Bitcoin enthusiasts may need to temper their expectations for a rapid ascent to $70,000. On January 28, a crypto analyst thinks the world’s most valuable coin must fall back to $30,000, a critical support level, before resuming its uptrend.

Bitcoin Must Fall: Path To $30,000?

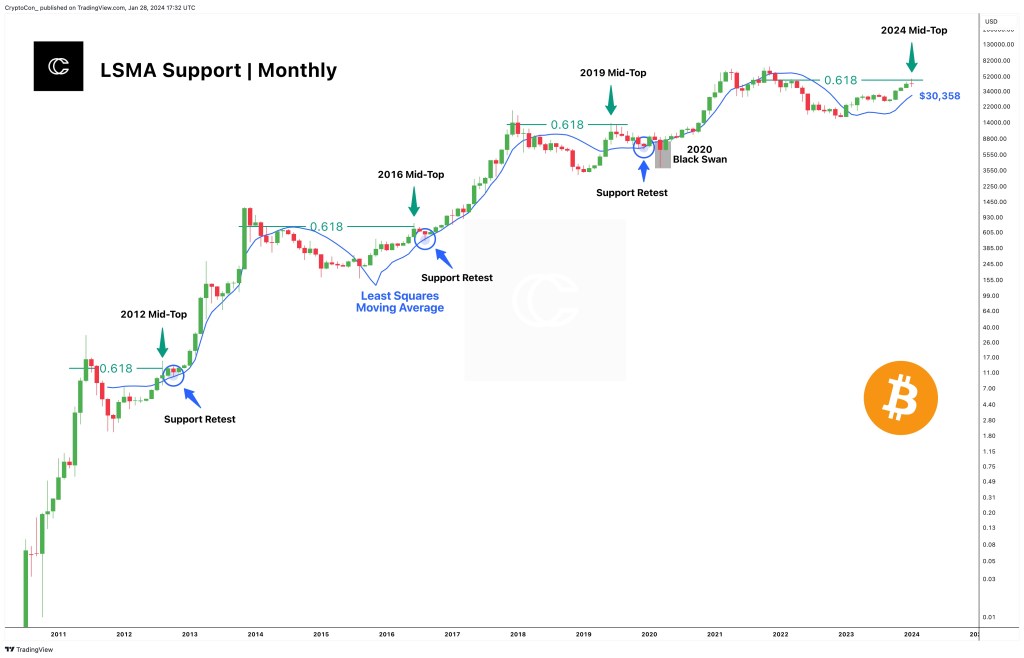

CryptoCon, a crypto analyst, cites historical price performance to support this assertion. Specifically, the argument is that no Bitcoin cycle has reached its recent high without first revisiting the monthly least square moving average (MA).

Currently, this MA is at $30,358. If past performance guides, CryptoCon believes Bitcoin could likely dip to this level before prices recover sharply.

The Bitcoin analyst notes that the MA has consistently acted as a floor for Bitcoin prices, even during periods of high volatility. CryptoCon asserts that the only outlier was the 2019 bear market, triggered by the Black Swan event of COVID-19.

The analyst further acknowledges that though some observers say Bitcoin has bottomed, further confirmations might be required. Based on CryptoCon’s analysis, insufficient data supports this claim. The analyst asserts that by how prices have behaved in the past, it is highly likely that the coin will drop to as low as $30,000 by February or March.

A Contrarian Position: Wall Street Accumulating BTC

This prediction may disappoint some Bitcoin holders eagerly anticipating a sharp recovery to $70,000 and beyond. This optimistic preview comes after the United States Securities and Exchange Commission (SEC) recently approved multiple spot Bitcoin Exchange-Traded Funds (ETFs).

Though prices fell, pinned to the massive liquidation of Grayscale Bitcoin Trust (GBTC) shares by, among other investors, FTX–the defunct exchange, prices recovered over the weekend. Spot Bitcoin ETF issuers, including Fidelity and BlackRock, have been buying BTC en-masse over the past weeks. Analysts have interpreted this as a net positive for prices. This development might lift sentiment and drive the coin to January 2023 highs soon.

However, looking at CryptoCon’s preview, it appears the analyst is taking a contrarian position, expecting prices to move against the general public. Whether this retracement will help anchor BTC and build a more sustainable long-term trend remains to be seen.

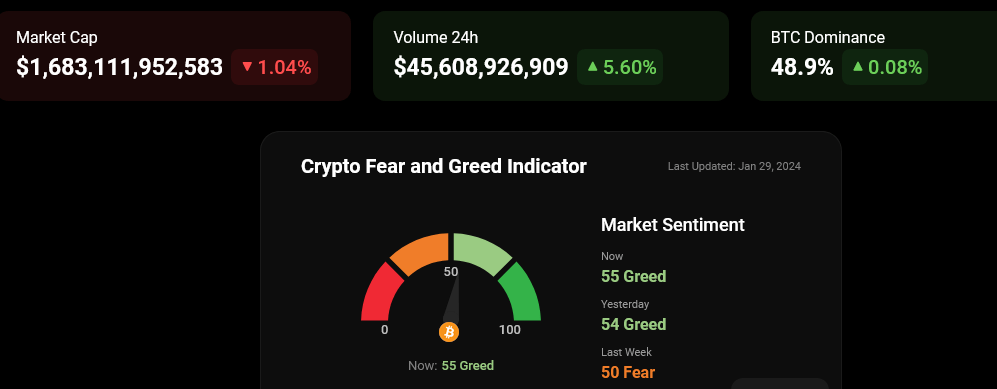

From the sentiment chart, Fear-and-Greed Index, bulls expect prices to increase in the sessions ahead. According to Coinstats, the index’s reading is 55, up from 50 last week.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.newsbtc.com/bitcoin-news/analyst-bitcoin-fall-to-key-support-level/