Aptos and Canto Enjoy Stellar Week

Crypto markets mostly traded lower on Thursday, with the exception of some smart contract platforms that continue to tack on gains.

Of the top 100 digital assets by market capitalization, MATIC, the native token of the Polygon blockchain, a popular scaling solution for Ethereum, has rallied 10% in the past 24 hours. Fantom’s FTM is up over 14%, according to The Defiant Terminal.

Meanwhile, Bitcoin and Ether fell 1.5% and 3%, respectively, on a day when US GDP numbers showed slowed but continued growth in 2022 with a 2.1% increase.

FTM Price + MATIC Price + ETH Price + BTC Price, Source: The Defiant Terminal

Real GDP grew by 5.9% in 2021, according to the US Bureau of Economic Analysis. The S&P 500 and Nasdaq ended the day up over 1% on the news.

Aptos Surges 120%

APT, the native token of the recently launched Aptos blockchain, is this week’s big winner, having more than doubled in the past week.

Despite the price action, many are skeptical that APT’s fully diluted value (FDV), the total market capitalization of a digital asset if all tokens are unlocked, is unrealistically high.

Quinten Francois, a popular investor on Twitter, noted that Aptos’ FDV is double that of Polygon’s. “Regardless of how promising Aptos is, this doesn’t justify such a valuation,” he wrote.

Canto Doubles

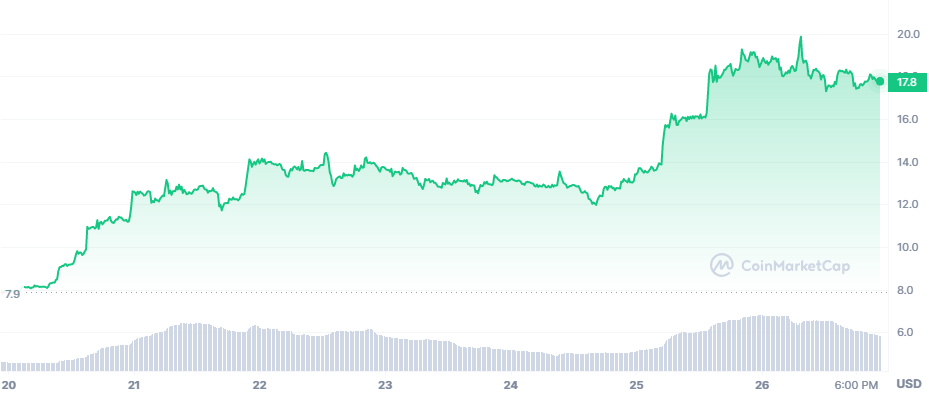

Canto, another emerging smart contract platform, saw its token continue to rally with a 100% gain on the week after picking up a public endorsement from venture fund Variant.

Canto Rallies After Variant Discloses Stake

Ethereum-compatible Layer 1 is the Fifth-Largest Blockchain on Cosmos

Pierino Ursone, head of options at Deribit, a derivatives platform which handles the majority of Bitcoin and Ether options, sees the market as entering a calmer phase.

‘Business as Usual’

“We can definitely see the ripple effects of FTX, but this now seems to be considered merely as a fact, and we are back to a kind of ‘business as usual,’” he told The Defiant.

Ursone also noted that Bitcoin, which underperformed the S&P 500 in the wake of the FTX crisis, has now returned to levels in line with the index. Indeed, BTC has dramatically outpaced the S&P 500 in 2023, having jumped 36% compared to the index’s 6% gain.

Ursone added that while the correlation between Bitcoin and the S&P 500 has returned, he doesn’t think that it will persist over the long term.

LDO, OP Down 10%

The biggest loser on the day is giving back some recent gains — LDO, the governance token for Lido, a liquid staking derivative (LSD) protocol, dropped 10% after being red hot of late.

Optimism, a Layer 2 network which hit an all-time high on Jan. 25, also ceded some ground with a 10% drop, according to The Defiant Terminal.

OP Price + LDO Price, Source: The Defiant Terminal

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://thedefiant.io/layer-1s-rally-as-markets-flounder/