The head of wealth management at a mid-sized bank in a place like Hong Kong – say a managing director – might be fairly relaxed about the sudden arrival of would-be competitors.

Virtual banks and digital wealthtechs – mere robo-advisors, the managing director might sniff, as if describing a lowly servant – are no match for the incumbent bank, with its roster of product and its big captive client base of depositors.

If anything, the experience of Robo 1.0 merely confirmed that these upstarts are not serious. A raft of consumer-facing wealth apps rushed into the region’s markets, all thinking they were going to be the next WealthFront.

They were felled by two costs. One was customer acquisition: burning VC money on advertizing. The other was lack of product. Although leading manufacturers – the fund management companies – might take a punt on a new potential distribution channel, they take time to woo and then onboard.

A few wealthtechs squeaked through, however. Bothersome to our managing director. A few in Singapore seem to have done it: StashAway, Syfe, Endowus. Each has a business proposition that runs around traditional wealth and brokerage offers.

Endowus, for example, hooked its claws into the Central Provident Fund, Singapore’s state pension system, and was able to offer people a compelling story around putting their retirement savings to work. Clever, concedes the managing director. But it took that lot three years to finally build a range of products from about 50 third-party fund managers.

Successful or not, this is a mere annoyance, an insect bite on the managing director’s fleshy arm. Behold, the bank’s toiling depositors! Look how they cower among their prodigious cash balances! See how they pay a 5 percent front-end load merely to buy a global equities fund off the bank’s shelf!

And what are these…these robo-advisors? These virtual banks? One-trick ponies. A fintech like Endowus cannot replicate its luck or its CPF gimmick anywhere else. If they try to enter another market where the managing director holds sway, they will be crushed. It will take them years to build up a meaningful product set, something that could compete with the bank’s sweep.

But what is this? Endowus entered the Hong Kong market in 2022. It only went live this spring. And…and they have more than 50 fund managers on their Hong Kong platform! Do the managing director’s eyes deceive? What trickery is this?

A shortcut has been found. Steffanie Yuen, head of Endowus’s Hong Kong arm, reveals the fintech has partnered with Allfunds, a Spain-based tech company. Another bloody fintech! Is there no end to this pestilence?

Along with other vendors such as Calastone and DLTFunds, Allfunds processes transactions among wealth managers and asset managers. For example, when a consumer purchases a fund from a bank, someone must work out all the details with the manager of that fund – confirm who bought or sold what units for what amount of money.

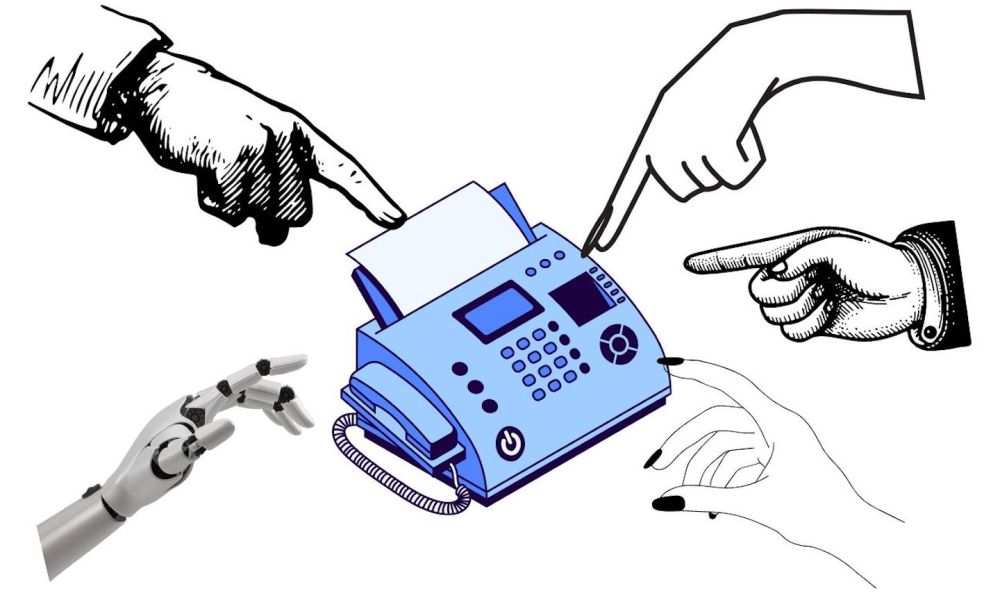

This is a murky area of asset-management back offices. Every bank has its own system. ‘System’ being a byword for an Excel spreadsheet, with orders communicated by email, or phone or… The managing director looks around and spies the fax machine in the corner. Yes, by fax.

Companies such as Allfunds absorb this pain and scale it globally, and sell this back as a service to wealth managers. Ideally they encourage fund houses to sign up to Allfunds’ service in the middle electronically, with APIs managing end-to-end communications. In fact, Allfunds has 1,300 fund houses that are fully automated.

This doesn’t mean Endowus automatically imports 1,300 managers into its Hong Kong business, no more than it can import the managers on its Singapore platform. Each market has its own licensing and due-diligence requirements. But the technology enables the fintech to run through this process quickly. What took the Singapore headquarters three years to build, the Hong Kong team replicated in three months.

Because the deal with Allfunds is company-wide, this means if Endowus chooses to enter another market, it will have the funds-processing capability already in place.

The managing director surveys the bank. The depositors are still there. They trust the bank’s brand. They know the bank won’t lose their money.

Won’t lose it, but maybe won’t make them richer, either. The depositors have new alternatives. Suddenly there is a new wealthtech with a full-fledged product set swanning about Hong Kong like it’s some kind of…player.

If it’s just this one, just this one – let’s face it, says the managing director, one very lucky little startup – then, well, the bank will manage as it always has. Bite away, little gnat, for we are a giant!

But Sebastien Chaker, Allfunds’ head of Hong Kong, says of the 20 clients the vendor has signed up in the city over the past 12 months, half are digital wealth techs or virtual banks.

The managing director can’t believe it. There are ten of these things in this market now? All plugging into a ready network of global asset management companies? The same ones whose products fill the bank’s shelf? How is our mighty bank supposed to distinguish itself? One gnat is nothing, but a cloud of them cannot be defeated.

The managing director messages the head of operations. “About that fax machine…”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.digfingroup.com/endowus-allfunds/