- Investors scaled back their expectations for rate cuts in the US.

- The US retail sales figure was much lower than expected, showing poor consumer spending.

- Wholesale inflation in the US beat forecasts.

The USD/CAD weekly forecast paints a bullish picture, fueled by a decreasing probability of early Fed rate cuts, thanks to unwavering US inflation.

Ups and downs of USD/CAD

The pair fluctuated throughout the week, ending slightly higher. When the week began, the US released its consumer inflation report, which beat forecasts. As a result, investors scaled back their expectations for rate cuts in the US. Moreover, the likelihood of the first cut in June went up. Consequently, the dollar soared, pushing the pair higher.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

However, on Thursday, the US retail sales figure was much lower than expected, showing poor consumer spending. A slowdown in the economy supports rate-cut bets. Still, as the week ended, there was another surge in the dollar as wholesale inflation in the US beat forecasts. Persistent inflation will likely encourage the Fed to hold high-interest rates.

Next week’s key events for USD/CAD

The US will release the FOMC meeting minutes, likely containing clues on the timing for Fed rate cuts. Meanwhile, Canada will release major reports on inflation and retail sales. Like most major central banks, the Bank of Canada has pushed back market expectations of looming rate cuts, stating that inflation is still high.

Therefore, next week’s inflation report will significantly impact the outlook for the bank’s policy. A higher-than-expected figure will likely mean a delay in rate cuts, boosting the Canadian dollar. Meanwhile, a drop in inflation would increase rate-cut bets, weighing on the Canadian dollar.

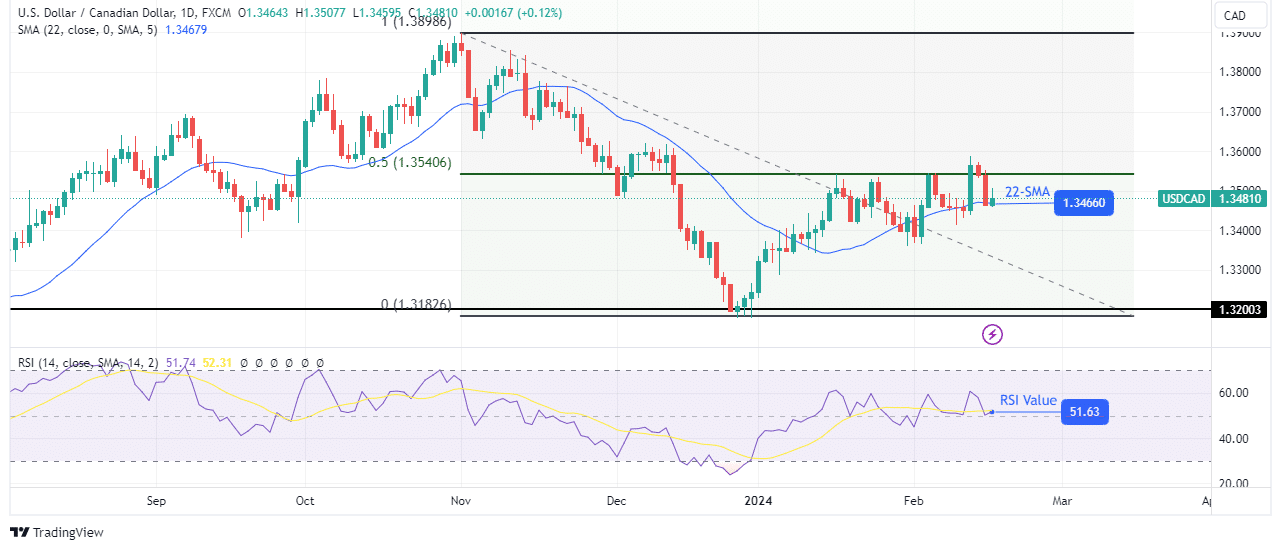

USD/CAD weekly technical forecast: Bulls under pressure at 50% retracement

On the technical side, USD/CAD is bullish, with the price slightly above the 22-SMA and the RSI slightly above 50. The bullish move started when the price sharply reversed at the 1.3200 support level. However, bulls weakened after the price retraced 50% of the previous move.

–Are you interested to learn more about forex signals? Check our detailed guide-

Notably, the price started consolidating, sticking close to the 22-SMA. Consequently, it is trapped between the Fib level and the SMA. Bulls are struggling to push above the 0.5 Fib retracement level. If they fail, the price will likely break below the SMA to continue the previous bearish move. However, if bulls regain momentum, the price will break above the Fib level to retrace 100% of the previous move.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/02/17/usd-cad-weekly-forecast-hot-us-cpi-dims-early-rate-cut-bets/