The spot gold price (XAU/USD) achieved an exceptional performance in the first quarter of the year, surpassing the previous record and breaching the $2,200 per ounce mark. This rise was primarily driven by expectations of lower US interest rates and the metal’s appeal as a safe-haven asset.

This article provides an in-depth look at gold price expectations for the coming days and the second quarter of 2024, examining important market topics and key drivers that could play a pivotal role in shaping the path of the precious metal.

The price of gold is at a new record high after new US data stimulated expectations about lowering interest rates

As economic growth and inflation moderate, investors expect the Federal Reserve and other major central banks to begin easing restrictions in the coming months, following significant interest rate hikes in 2022 and 2023 in much of the developed world.

Bullion valuation has already taken into account much of the expected shift to looser monetary policy, so future upside potential may be limited. This is especially true in light of the 17% increase in gold prices over the past six months. The Fed will need to take a more dovish stance for gold prices to make significant gains through 2024, but this seems unlikely given recent guidance and rising inflation threats.

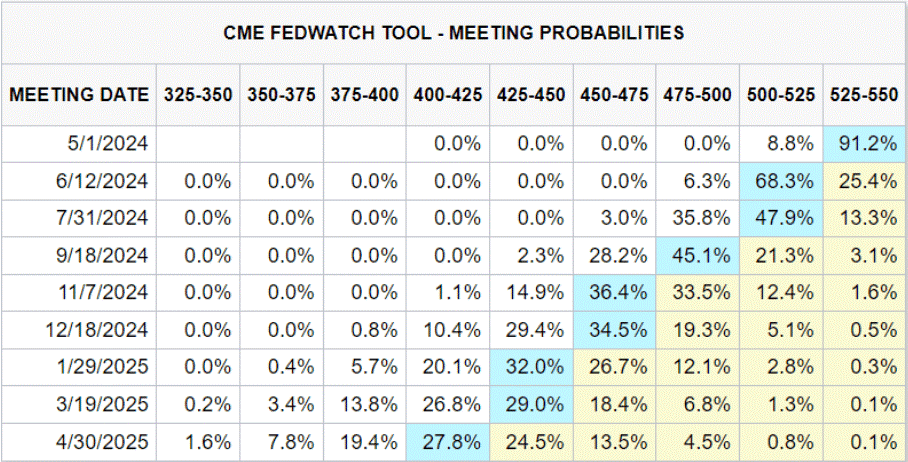

According to the Fed’s CME monitoring tool , investors expect about 75 basis points of quantitative easing from the FOMC in 2024. Gold prices could rise significantly in the second quarter if the FOMC decides to postpone action due to ongoing price pressure and expectations about… Its monetary policy roadmap. And become more stringent. Lower Treasury yields and a lower US dollar, often linked to the Fed’s reduction in borrowing costs, generally help the gold market.

The image below shows the current interest rate prospects for the next nine meetings of the Federal Open Market Committee (FOMC) .

FOMC meeting probabilities – Source: CME Group

Beyond the Fed: geopolitics, central bank purchases, China, charts

There are several factors other than global interest rates that could affect the development of gold prices in the coming quarters. If geopolitical tensions worsen in the next quarter, most notably those linked to the Russia-Ukraine war – which have already contributed to the precious metal’s rise in recent months – they could once again emerge as a more important source of support.

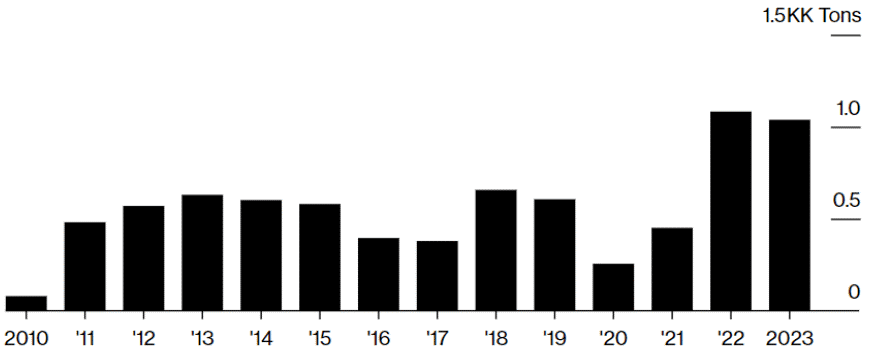

Large central bank purchases of gold may be another factor supporting the market’s prosperity. For background, the People’s Bank of China and the Central Bank of Turkey were active buyers of gold during the historic years that set the pace for growth in 2022 and 2023, when central banks purchased more than 1,000 tons of gold annually.

Given gold’s reputation as a reliable store of value, its ability to act as a safe haven during turbulent times, and its value in diversifying an investment portfolio, central banks have been buying it at a record rate. Central banks have been carefully reallocating their reserves, moving away from a strong reliance on the US dollar, which has historically made up the bulk of their holdings, as global power dynamics change and US dominance becomes less certain.

World Gold Council forecasts of central bank purchases of 39 tons in January and forecasts for the coming quarters suggest that demand could be strong over the entire year. This can limit potential losses in a downward correction by acting as a buffer in a potential bearish gold price reversal.

Central Banks’ gold buying – Source: World Gold Council

Meanwhile, in China, private investors were attracted to gold due to the poor performance of the real estate sector. China’s overall economy remained weak, and the stock and currency markets did not perform well.

The XAU/USD technical profile shows a consistent pattern of tops and bottoms that supports gold’s bullish outlook and price outlook, but caution should be exercised as technical indicators point to overbought conditions. Even if they prove to be short or relatively minor, corrective pullbacks often occur when markets become excessively bullish in a short period of time.

Gold Weekly – Source: CAPEX WebTrader

Gold price forecast: neutral and under observation

After significant gains in the first few months of the year, gold prices may enter a consolidation phase during the second quarter. In light of this, prices seem unlikely to rise sharply in either direction unless there is a sudden change in global inflation dynamics and interest rate expectations.

Investors should carefully monitor global geopolitical developments, central bank purchases, the US presidential election, and economic data. These elements will provide key hints regarding the precious metal’s path in the coming months.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: Plato Data Intelligence.