The U.S. Treasury Department is expected to release its guidance on the battery sourcing requirements for EV tax credits contained in the Inflation Reduction Act of 2022 — and automakers are unlikely to be pleased.

According to a report by Reuters, car companies and other industry experts believe the guidance will result in fewer vehicles being eligible for the full or partial tax credit.

The Treasury Department delayed issuing the guidance even though the law went into effect Jan. 1. That delay allowed some EVs that were not likely to meet the eligibility requirements to continue to receive tax credits for the first quarter of 2023. However, Treasury and the automakers needed time to determine if their battery mineral sources met the credit mandates.

EVs that qualify for the revised tax credit must be assembled in America, and the battery components and minerals must meet a minimum U.S. or Allied nation sourcing requirement. Currently, a large share of the battery minerals produced worldwide are sourced in China, which does not qualify for the tax credit.

The goal of the Biden administration is to encourage automakers to build EVs in the United States or its free trade partner nations, and to develop alternate battery mineral sources in those allied nations to reduce dependency on China.

What are the rules?

As written in the Inflation Reduction Act, to qualify for the tax credit, an EV battery must have at least 50% of its components produced or assembled in North America to qualify for the first half of the potential $7,500 tax credit.

Then, 40% of the value of the minerals used in the battery must come from the United States or a free trade nation. Those content requirements rise by 10% each year for the next several years, further limiting the number of vehicles that qualify for a tax credit, unless the automaker sources minerals in a U.S.-approved nation.

Classifying all the minerals in a battery can be a challenge for automakers, which today source minerals from anywhere they can be obtained. The questions will be further complicated by a new agreement between the U.S. and Japan that should make more Japanese-made cars eligible for the tax credit.

The guidance due out on Friday is expected to precisely define decision factors in the processing, extraction, and recycling of minerals, and to define exactly which nations are including as free trade allies. This is all before applying the requirement that EVs must be assembled in North America to qualify for any part of the tax credit.

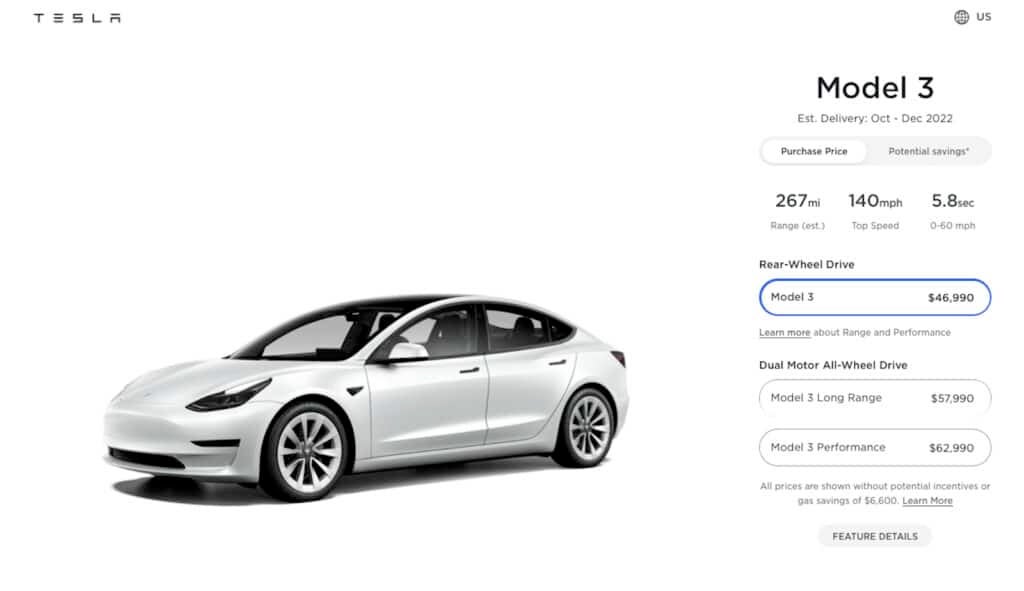

Tesla expects to lose credits

The popular Tesla Model 3 rear-wheel drive model is one vehicle that may be impacted by the new guidance. Tesla officials told Reuters that they expect the battery mineral sourcing requirement guidance may exclude the vehicle.

Until the actual guidance is released, it’s unclear which vehicles will remain eligible. The guidance will not affect vehicles purchased from Jan. 1 to March 31. Buyers who purchased otherwise eligible vehicles will get their tax credits.

In February, some preliminary statements from Treasury indicated that some vehicles by Tesla, Ford, and Volkswagen might gain tax credits in the guidance, but that still remains to be determined. West Virginia Senator Joe Manchinthreatened to sue if the Biden administration takes a generous view on credit eligibility. Manchin is a staunch proponent of the fossil fuel industry, as his home state’s economy is heavily reliant on coal production.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.thedetroitbureau.com/2023/03/treasury-dept-ruling-expected-to-cut-ev-tax-credits/