The Bitcoin price has maintained a steep ascending trend since the start of the last quarter. Despite the volume remaining at decent levels, the volatility dropped, causing the price to trade within a narrow range. All attempts by the bulls to surpass the pivotal range at $44,500 are going to wane as they fall short of strength as the levels approach $44,000. In such trading conditions, miners are also seen adding to the selling pressure, which has been a matter of concern.

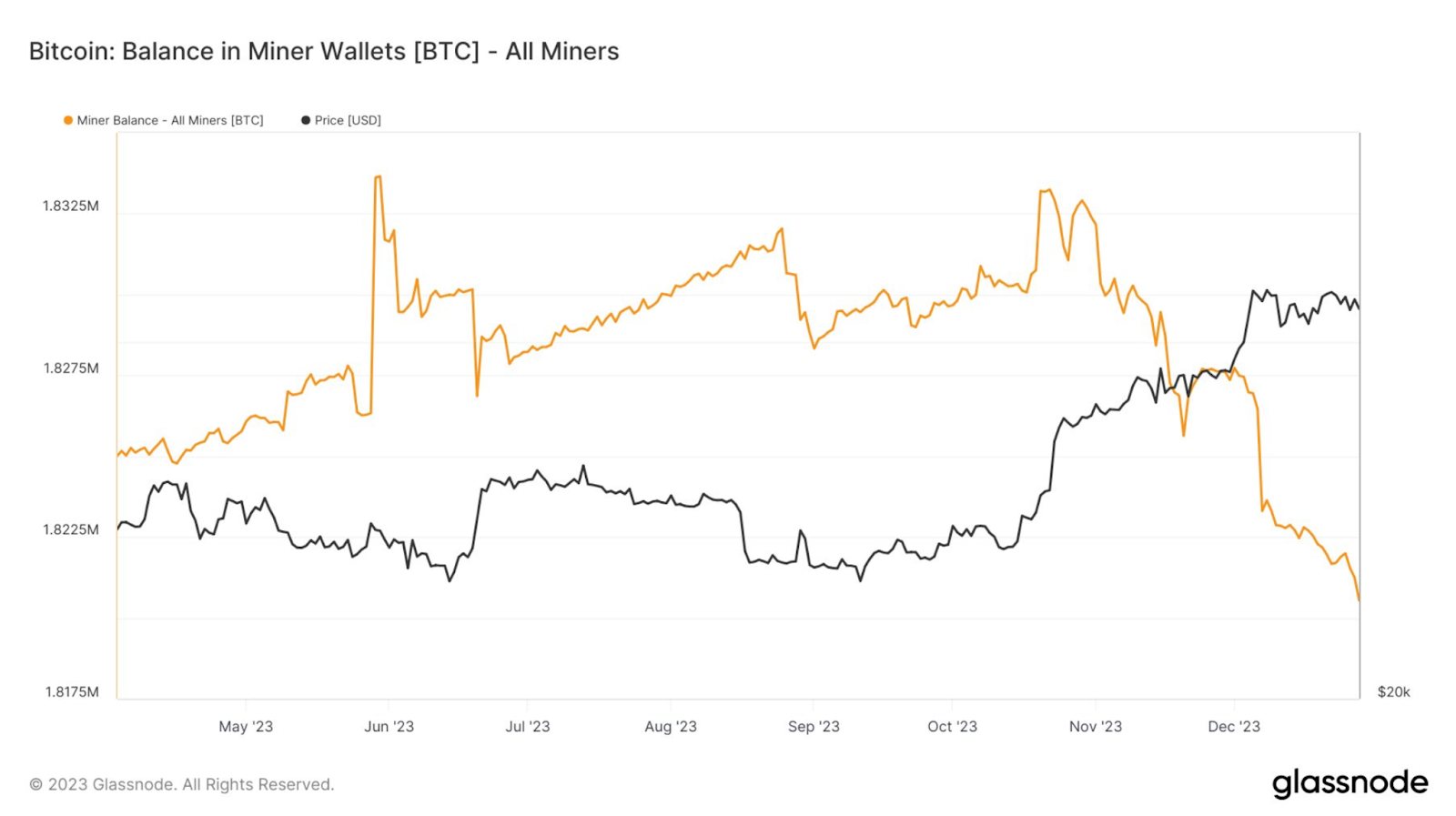

Bitcoin miners are those nodes within the network who validate the transactions, add them to the chain, and enjoy the rewards in the form of BTC. Some miners sell their rewards to the exchanges to compensate the exchanges, while others hold, expecting a fine rise ahead. As per the data from Glassnode, these miners have reduced their holdings by 12,700 since late October and nearly 700 BTC in the last 24 hours.

In times when the BTC price maintained a steep upswing from $30,000 to the yearly highs close to $45,000, miners continued to shed off their holdings. Alongside, a record 28,000 BTC worth $1.19 billion left exchanges in the past few days, making the largest single-day outflow since December 2022. Interestingly, Coinbase alone moved over 18,000 BTC, suggesting signs of institutional activity before January’s expected ETF launch.

Collectively, the Bitcoin price remains under bullish influence regardless of the short-term bearish pullback. It is worth noting that the selling pressure is mounting, which may cause a minor pullback in the BTC price. However, the upcoming Bitcoin spot ETF is expected to kick off a fine upswing, which may trigger a fresh rally towards new highs.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://coinpedia.org/price-analysis/this-could-be-why-bitcoin-btc-price-is-chopping-around-42500/