A recent study by researchers from the University of Michigan and Cornell University, published by the International Energy Forum, highlights a critical challenge in the transition to renewable energy in the United States: the insufficient availability of copper to meet the demands of renewable energy infrastructure and electric vehicles (EVs).

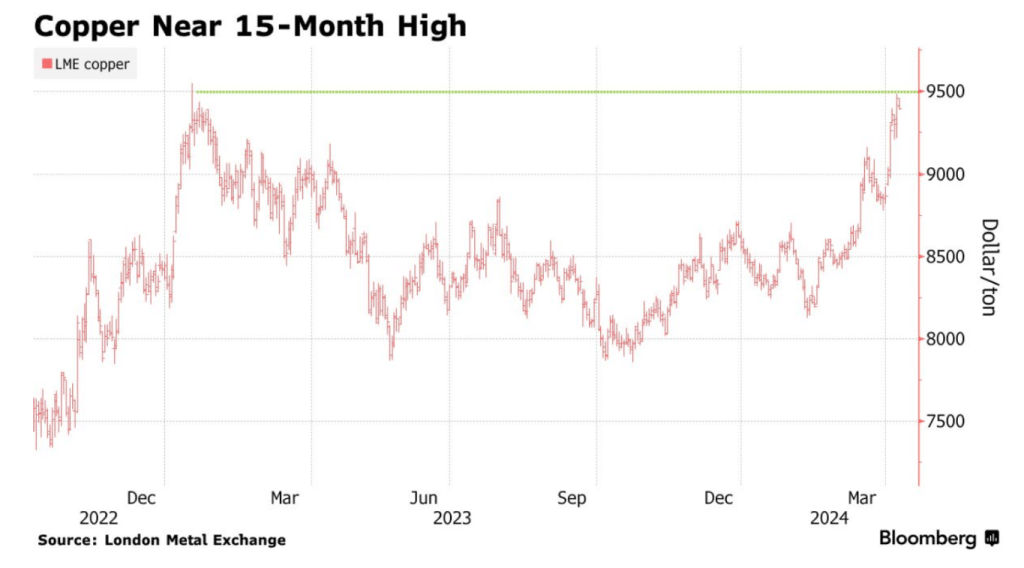

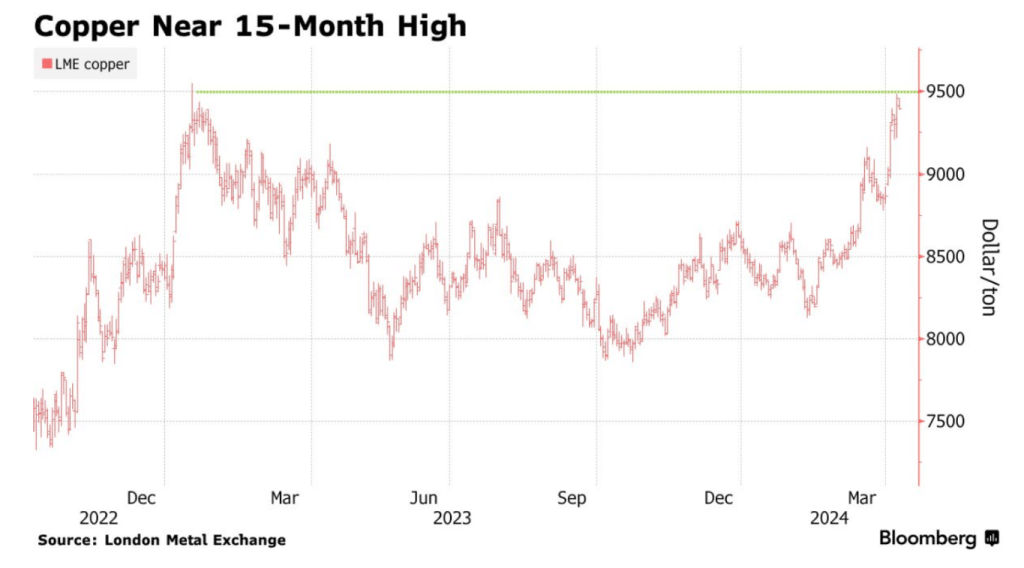

Recent copper price trends show a near 15-month high, which analysts attribute to speculative buying and genuine supply constraints.

Amid this surging copper prices is an alarming revelation by the researchers from the two universities mentioned.

A Century of Data Reveals a Looming Shortfall

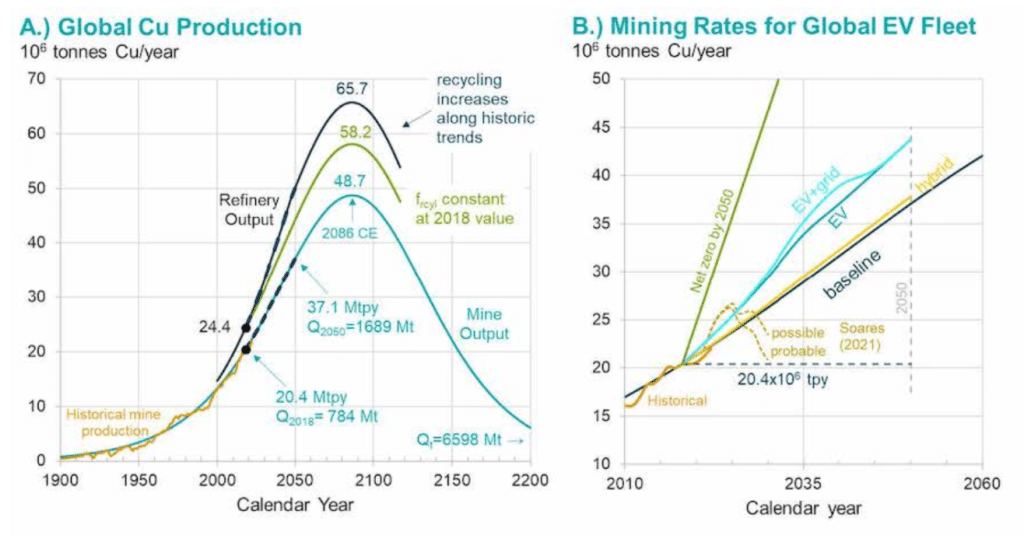

The study examines 120 years of global copper mining data, revealing that current copper production rates cannot keep pace with the copper requirements outlined in US policy guidelines for transitioning to renewable energy.

Particularly concerning is the Inflation Reduction Act’s mandate for 100% electric vehicle production by 2035. EVs require significantly more copper than traditional internal combustion engine vehicles, along with additional copper needed for grid upgrades.

According to Adam Simon, co-author of the study, the disparity is stark, saying that:

“A normal Honda Accord needs about 40 pounds of copper. The same battery electric Honda Accord needs almost 200 pounds of copper. Onshore wind turbines require about 10 tons of copper, and in offshore wind turbines, that amount can more than double.”

The paper shows that the required copper is significantly impossible for miners to generate.

One key factor contributing to the shortfall is the lengthy permitting process for mining companies. It averages about 20 years from discovery to mine construction approval.

With over 100 companies mining copper across six continents, the study’s modeling suggests that global copper production may fall short of future demand. This poses significant challenges to achieving renewable energy goals in the US and beyond.

The 115% Increase Dilemma

The research underscores the immense challenge of meeting future copper demands, particularly in the context of the global energy transition. To illustrate, the study indicates that between 2018 and 2050, humanity will need to mine 115% more copper than has been mined throughout history until 2018 just to sustain current needs and support developing regions, excluding green energy efforts.

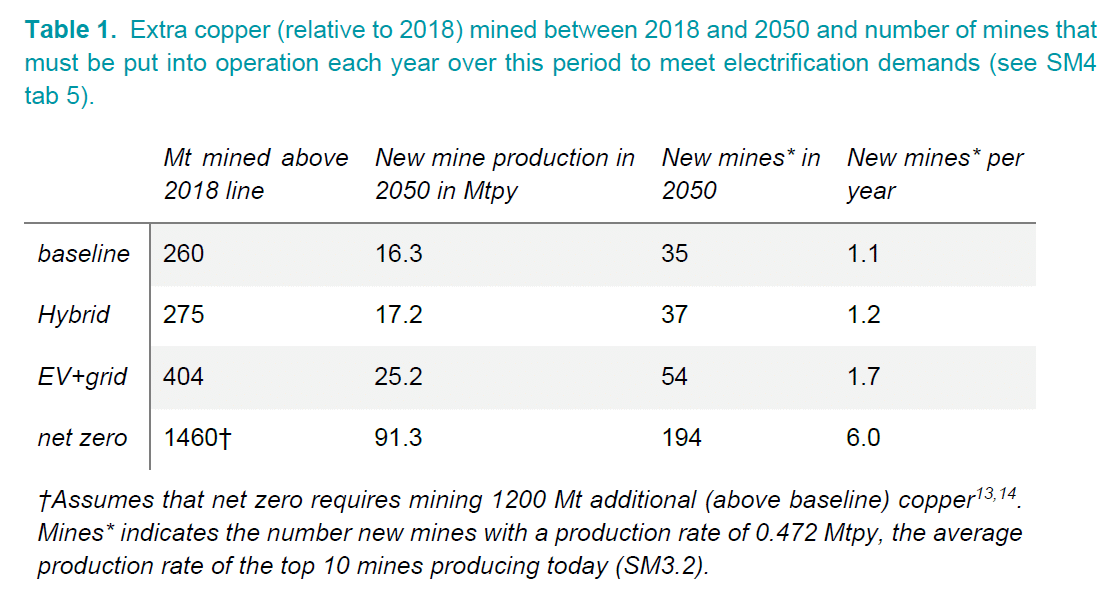

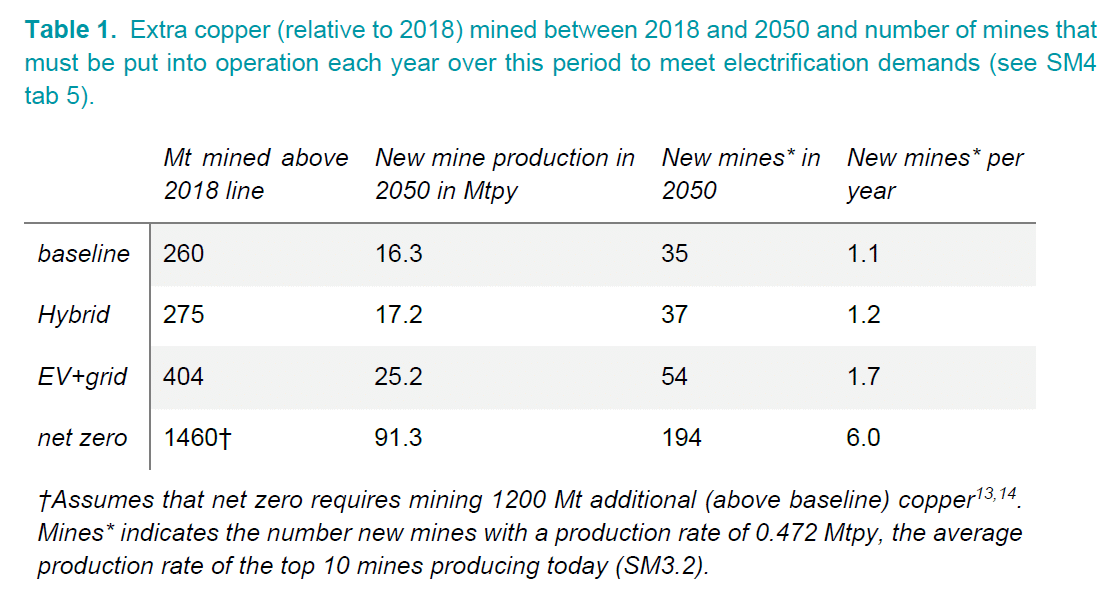

The table below provided details of the masses of copper to be supplied by new mines, the corresponding production rates necessary in 2050, and the estimated number of new mines required.

For instance, to fulfill the demand for 260 million tons of mined copper under a business-as-usual scenario, an average mine output of 8.13 million tons per year (Mtpy) over 32 years is required. Consequently, new mines would need to produce 16.3 Mtpy by 2050.

The study suggests that mines with an average production rate of 0.472 Mtpy, akin to the top 10 existing mines, would need to be operational by 2050. This necessitates the discovery, permitting, and establishment of a significant number of new mines annually between 2018 and 2050.

The analysis underscores that the bulk of new copper supply will come from large-scale mines due to their substantial production capacity. It highlights the need for the establishment of between 35 and 194 large new mines over the next three decades. That’s equal to an annual rate of 1.1 to 6 new mines to sustain the green transition and meet exploding demand.

Balancing Act: Electrification vs. Essential Infrastructure

For the global vehicle fleet to electrify successfully, the study suggests the need to establish up to 6 new large copper mines annually over the coming decades. Moreover, around 40% of the output from these mines will be crucial for electric vehicle-related grid enhancements.

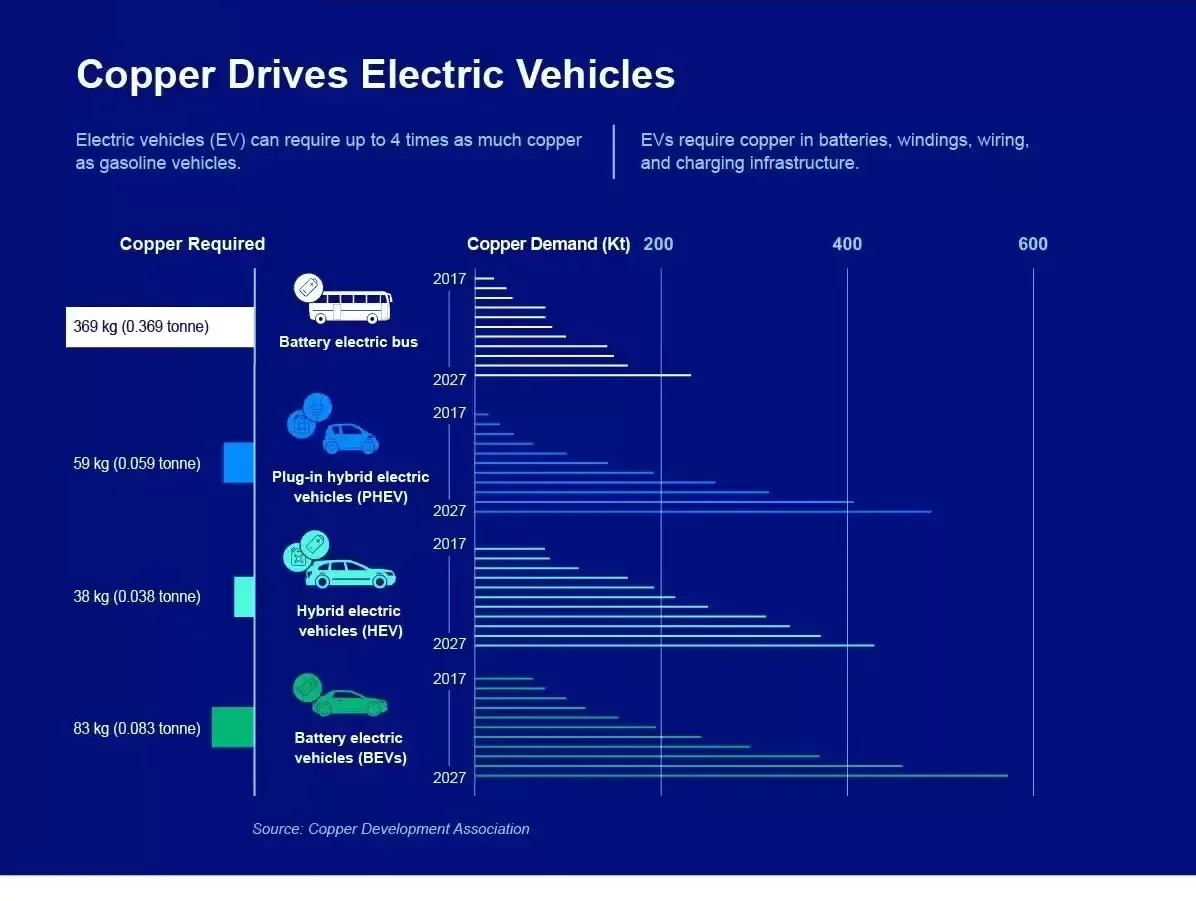

In another estimates by the Copper Development Association, below is what the EV industry requires for copper.

Adam Simon emphasizes the importance of adopting pragmatic approaches to the energy transition. Rather than solely focusing on fully electrifying vehicle fleets, he proposes exploring hybrid vehicle manufacturing as a more feasible alternative.

Adam Simon emphasizes the importance of adopting pragmatic approaches to the energy transition. Rather than solely focusing on fully electrifying vehicle fleets, he proposes exploring hybrid vehicle manufacturing as a more feasible alternative.

Furthermore, Simon emphasizes the indispensable role of copper in developing countries for critical infrastructure projects like electrification, clean water facilities, and sanitation systems. Balancing these diverse needs highlights the complexity of the copper allocation dilemma amidst the global energy transition.

“Our study highlights that significant progress can be made to reduce emissions in the United States. However, the current — almost singular — emphasis on downstream manufacture of renewable energy technologies cannot be met by upstream mine production of copper and other metals without a complete mindset change about mining among environmental groups and policymakers.”

Ultimately, the study urges a nuanced approach that acknowledges the critical role of copper in enabling sustainable development.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/the-world-needs-6-new-large-copper-mines-a-year-to-reach-net-zero-energy-transition/