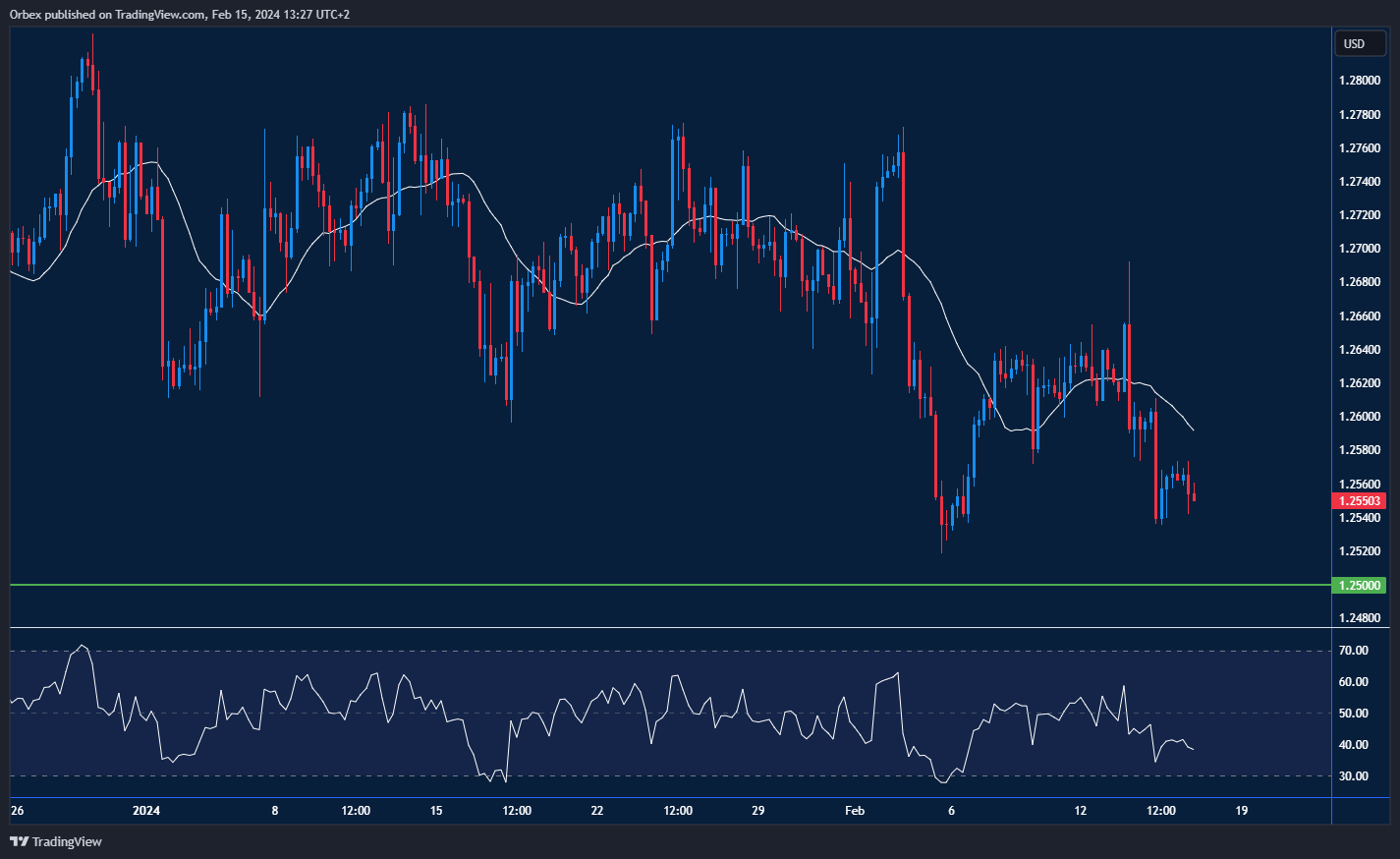

GBPUSD GDP contracts again

The British Pound held its breath after the UK economy slipped into technical recessions at the end of 2023. As the BoE kept interest rates firm, there was light at the end of the tunnel. Economists agree that growth will strengthen over the next few years, with wages rising and unemployment declining. Still, price action remains bearish for the near term, especially with a strengthened dollar halting any signs of a recovery back to 1.28. The recent drop opens 1.25 as a fresh psychological support, with a limit of 1.2660 being the previous swing high.

USDJPY technical recession drops Japan

Another economy that hit a technical recession was Japan. The Japanese Yen was already faltering before the news of a hard landing in the economy. Persistent high inflation and weak domestic demand continue to weigh on the currency as the country slips to the fourth largest in the world. All eyes will be on the BoJ’s next move as rates remain stagnant going into the first quarter. With 150.00 breached for the first time since November, this level becomes the next support as traders focus on last year’s high towards 152.00.

XAUUSD falls as US dollar rises

Gold fell through the $2,000 barrier, which opened multi-month lows. Hotter than expected CPI data saw the yellow metal struggle. With inflation repeatedly beating the consensus, traders must think twice before concluding that the Fed will cut rates any time soon. The Fed’s next meeting a few weeks away gives plenty of time for more speculation on the next direction for gold. This could be amplified should more dovish comments come from the central bank. The price is attempting a rebound but will need to clear 2000 first, with 2030 being the next hurdle.

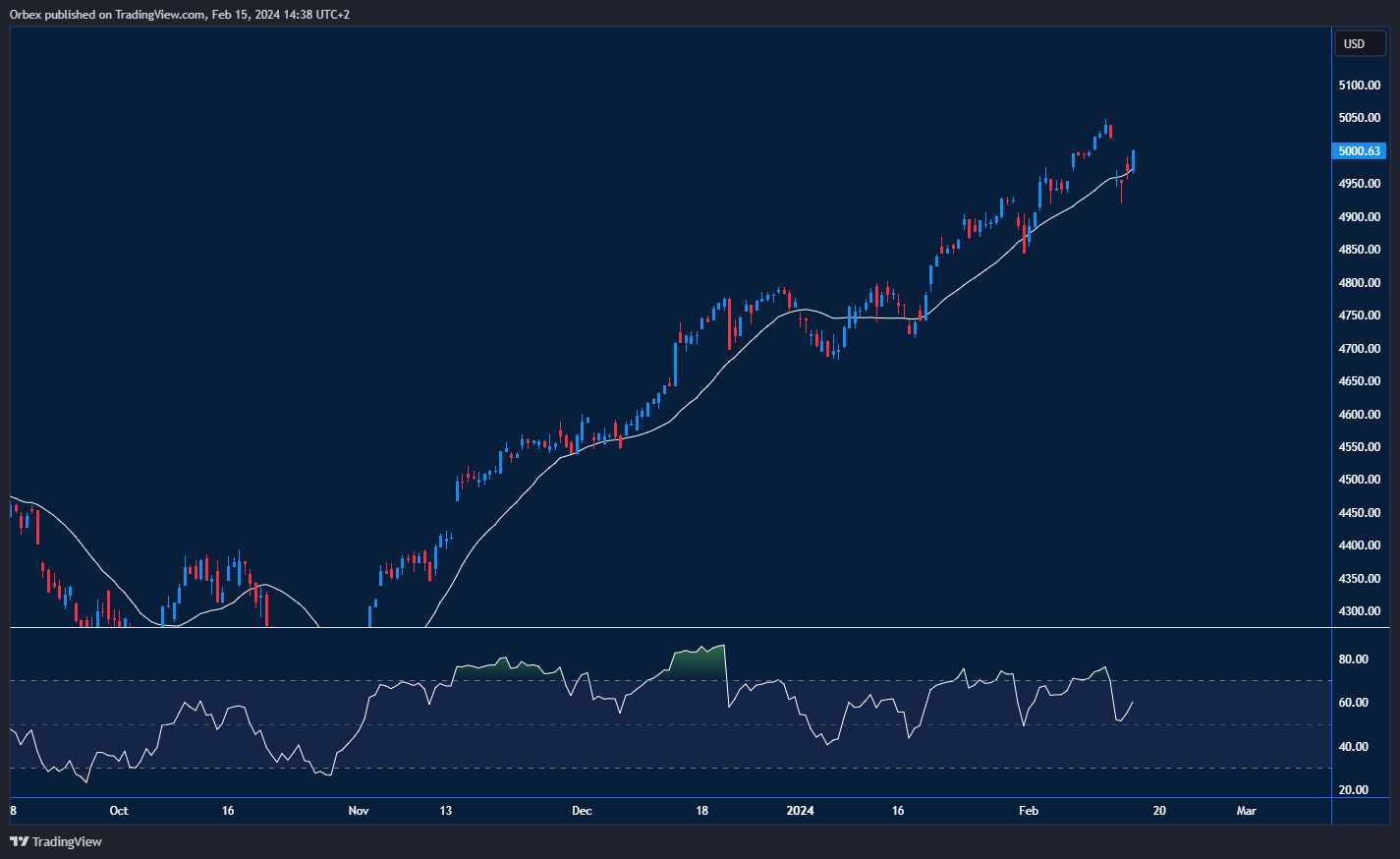

SPX 500 fills the gap

The S&P 500 took a brief dip as inflation fell. With the likelihood that the Fed will not add any further stimulus to the economy, stocks took a step back. The annual US inflation rate eased to 3.1% last month but not as fast as the market wanted to see. With all the talk on the Fed’s next move, those who expect a rate cut in the first half of the year will be disappointed. This could mean an upturn and another record high for the index as the 5000 level breaks again. The bright side is that prices have already covered the recent gap as it heads towards 5050 with 4950 as the first support.

Test your forex and CFD trading strategy with Orbex

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.orbex.com/blog/en/2024/02/the-week-ahead-more-recessions-confirmed