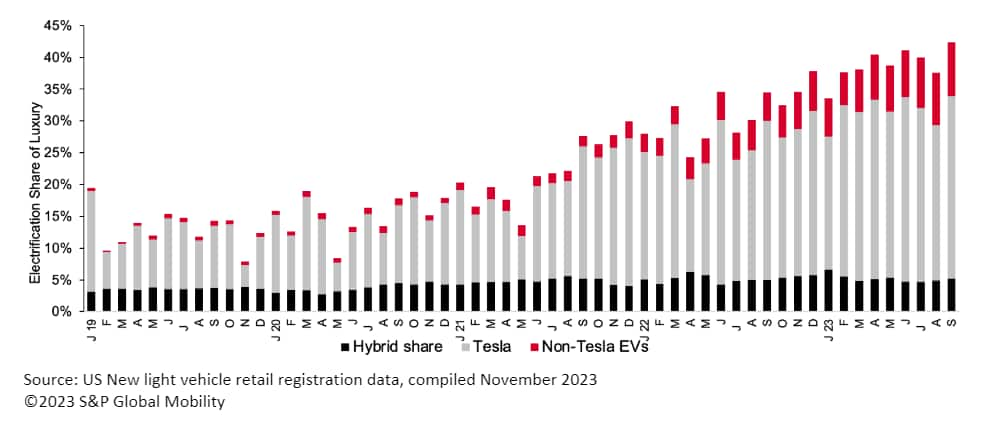

On the surface, it would appear luxury

consumers have embraced the electrification of the automobile. As a

percentage of luxury vehicle retail registrations, electrified

vehicles have climbed steadily through the pandemic to a record

42.4% in September 2023, according to S&P Global Mobility

analysis of US retail registration data.

This is up from 15% in September 2019 - with

“electrified” registrations including battery-electric vehicles,

plug-in hybrids, and gas-electric hybrid vehicles.

However, if Tesla is removed from the equation,

the remaining brands account for a mere 14% of luxury vehicle

retail registrations in September – with a split of 9% for BEVs and

5% for hybrids. But luxury BEVs have been growing, while hybrid and

PHEV share of luxury vehicle registrations have been stable at

roughly 4% to 6% for several years.

Electrified share of luxury vehicle

registrations

On a year-over-year percentage growth basis,

BEV growth among non-Tesla brands might appear impressive. And

those brands are indeed taking bites out of Tesla’s share among

electric vehicle registrations. But the BEV unit counts remain

small compared to a legacy OEM luxury portfolio that remains

dominated by internal combustion powertrains.

Tesla has benefitted from being the first mover

for many years. In January 2019, Tesla owned the nascent luxury EV

segment (a meager 326,000 units from a 17 million total US vehicle

market). The only luxury electrified competition at the time was

the BMW i3, Jaguar i-Pace, and Audi e-tron.

In subsequent years, even as more competing

luxury EVs came to market, Tesla market share continued to grow.

Tesla’s share of total luxury vehicle registrations was 29% as of

September 2023, a 19 percentage-point increase over the four-year

time span.

Prior to that, the non-Tesla luxury EV market

barely made a mark at 1% to 2% share of luxury vehicle

registrations. However, starting in 2022, that share started to

grow with each successive quarter. Current market share for

non-Tesla luxury EVs is 9% in September 2023 – impressive growth,

but still far from crossing the chasm.

Legacy luxury brands have brought offerings

like the Porsche Taycan; BMW i4 and iX; Mercedes-Benz EQS, EQE, and

EQB; the expansion of the Audi e-tron lineup, and Volvo’s Recharge

line. The new-arrival disruptor brands – Polestar, Lucid, Fisker,

and mostly Rivian – have also made an impact among non-Tesla

brands. As more products come to market, the share split between

Tesla and non-Tesla brands will continue to shift, according to

S&P Global Mobility analysis.

But in looking at overall EV adoption,

specifically at luxury EV households, roughly 90-95% of them also

have an internal combustion vehicle in the garage. This can be a

traditional gas engine, hybrid powertrain, or diesel. So while

there is EV growth, the vast majority of luxury households have not

converted to a purely electric fleet. Rivian households – not Tesla

ones – are most likely to have another EV in the garage. Yet about

80% of Rivian garages also have an ICE vehicle, according to

S&P Global Mobility Garage Mates data.

One electrified area lacking growth is luxury

hybrids and PHEVs – an intriguing development as mainstream-brand hybrid

sales have been outpacing BEVs Back in 2019, Acura, Infiniti,

Lexus, and Lincoln had hybrid models for sale; today only Lexus

sells any meaningful volume of hybrid vehicles while the others

have been discontinued. BMW, Porsche, and Volvo have created a

presence in the PHEV market but have seen little growth as they

have prioritized their BEV lineups.

And while Tesla continues to dominate the BEV

market, S&P Global Mobility forecast last year

that Tesla share would erode as more legacy and disruptor brands

entered the market, even if Tesla volumes were to increase. As

non-Tesla luxury brands’ commitment to electrification grows, it

appears that trend is coming to pass – albeit slowly.

MORE ON AUTOMOTIVE PLANNING AND

FORECASTING

CONTACT OUR ELECTRIC VEHICLE

CONSULTANTS

TRACK AUTOMOTIVE INDUSTRY

DEVELOPMENTS AROUND THE GLOBE

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/tesla-fuels-electrification-of-us-luxury-vehicles-segment-shar.html