Posted March 16, 2024 at 11:18 am EST.

Almost a year-and-a-half ago, Solana was reeling from the collapse of FTX, with its token price plummeting nearly 70% to under $10. But as Solana reaches the fourth anniversary of its first block on March 16, it has ridden a wave of growth — and confidence — with 1.2 million daily active addresses, in part from the committed open source developers and the enduring appeal of memecoins, namely, Dogwifhat and Bonk.

SOL, the native token for the layer 1 blockchain, has risen to become the fifth-largest cryptocurrency, with its market capitalization reaching an all-time high of $87.4 billion on Saturday morning, according to CoinGecko. This milestone coincides with growing interest in Solana as a viable alternative to Ethereum, challenging the latter’s position as the leading smart contract-enabled blockchain.

“It’s fair to say the network is unkillable at this point, just based on everything that the community, network operators, and all the developers have been through over the last four years,” said Austin Federa, head of strategy for the Solana Foundation, in an interview with Unchained.

“Unkillable’ is entirely a function of community and the engineers working on the network. … There’s a massive community of open-source software developers that are committed to the long-term future of this network,” Federa added. “That is the reason that the [Solana] network has entered that status now. Same reason you can’t kill Bitcoin, you can’t kill Ethereum. These things are just part of the fabric of the internet now.”

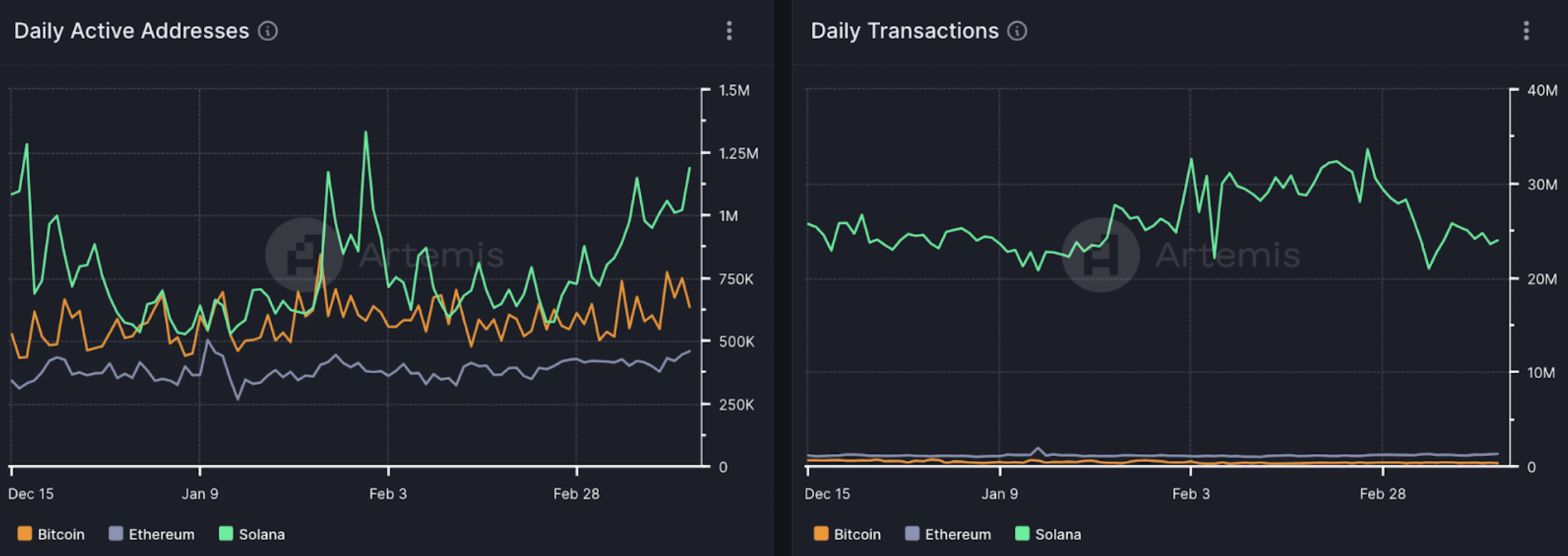

As of March 14, data from blockchain analytics firm Artemis shows that the number of daily active addresses on Solana is more than that of Bitcoin and Ethereum combined, with Solana also surpassing the networks together in number of daily transactions.

Crypto users transacted roughly 1.3 million times on Ethereum and 330,000 times on Bitcoin on Thursday, substantially less than Solana’s count of 24 million. Moreover, for the past six days, Solana has led all blockchain networks by stablecoin transfer volume, averaging $26.5 billion daily, per Artemis.

Furthermore, Solana, more than surviving crypto winter, has seen the price of its native token climb relative to the two largest cryptocurrencies by market cap, BTC and ETH.

The conversion rate from SOL to ETH has increased nearly 300% since March 2023, while the SOL to BTC conversion rate has jumped more than 213%, data from TradingView shows. Conversion rate measures how much one token can buy of another, and the positive rate shows the value of SOL is strengthening relative to the values of BTC and ETH.

Solana’s Memes

The price of Solana, known for its cheap gas fees and quick transaction time, has surged in recent months along with the popularity of the meme coins it supports. Notably, BONK, which was airdropped to those who purchased a Solana Saga Android phone, has grown its market cap to $2.1 billion from $36.7 million on Nov. 1, 2023, surpassing Aave, the largest decentralized lending protocol, and layer 2 blockchain network Starknet.

Dogwifhat, a meme coin represented by a Shiba Inu puppy wearing a beanie, now has a market cap of over $3 billion, which exceeds Arbitrum’s ARB token, Lido’s LDO token, and Celestia’s TIA token. Solana enthusiasts are attempting to place the Dogwifhat meme onto the world’s largest spherical structure, the Las Vegas Sphere, raising nearly $700,000 already.

In a Franklin Templeton report released this past week, Solana was cited as a prime example of the strong relationship between meme coins and their native networks. “During Q4 of 2023, the Solana network captured a large percent of activity of all the active addresses during the same time that BONK saw a price surge, alluding further to the connection between meme coins and their native networks,” according to the report, “The Value of Meme Coins and Their Native Networks.”

The meme coins on Solana have also started merging with politics. Inspired by the incorrect spelling of the names of political figures, Solana-based meme coins such as Jeo Boden (BODEN) and Doland Tremp (TREMP) have surged in trading volume and market cap in recent weeks. The two tokens have a combined market cap of $138 million, according to blockchain analytics tool DEX Screener.

“Memes are people having fun with blockchain again,” Federa said. But he cautions that while silly meme coins may grab the public’s attention, they should not obscure the substantive work that occurs on the Solana network.

“Meme coin activity and meme coin excitement does not diminish serious DeFi builders on Solana,” Federa noted. “It doesn’t diminish the work that institutional finance is doing to start building products onchain. These things can coexist the same way you can have social media applications and banking applications coexist on the internet.”

Growing Pains

Solana’s journey has been marked by challenges, as its ascent to the fifth largest cryptocurrency hasn’t been without growing pains. After reaching an all-time high of nearly $260 in November 2021, SOL’s price plummeted to under $10 by the end of 2022, following the collapse of the crypto exchange FTX.

Former FTX CEO Sam Bankman-Fried, a significant figure in the Solana ecosystem, revealed in testimony in his October 2023 criminal trial how he invested in SOL when it was priced at just 20 cents.

“Sam owned roughly 10 percent of all the Solana in the world,” wrote Michael Lewis in his book Going Infinite. The downfall of FTX and its founder Bankman-Fried hurt Solana, and its reputation, deeply.

Read more:

But the perception of Solana has shifted dramatically within the last 15 months. Crypto asset manager Pantera Capital has been raising funds to acquire upwards of $250 million worth of discounted SOL from the FTX estate, which holds about 41.1 million SOL tokens worth approximately $7.5 billion, according to a recent report from Bloomberg.

Solana has also gotten a handle on the frequent outages that plagued the network in 2022, although it did suffer an outage for the first time in more than a year last month.

ARVE Error: src mismatch

provider: youtube

url: https://www.youtube.com/watch?v=xwFBD2hzChk&t=1124s

src in org: https://www.youtube-nocookie.com/embed/xwFBD2hzChk?start=1124&feature=oembed

src in mod: https://www.youtube-nocookie.com/embed/xwFBD2hzChk?start=1124

src gen org: https://www.youtube-nocookie.com/embed/xwFBD2hzChk

Community members of Solana also expect to see the network improve in performance with the implementation of the Firedancer software, slated to be rolled out in the fourth quarter of 2024. Firedancer, a new validator software client developed by Jump Crypto, aims to enhance the scalability and resiliency of Solana.

“Solana today is nowhere near finished,” said Federa. “There’s whole pieces of the entire stack that are horribly unoptimized, and there’s a lot of work left to be done to get the network to a place where it could support a billion concurrent users.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://unchainedcrypto.com/solana-at-4-memecoins-help-drive-network-to-all-time-high-in-market-cap-post-ftx-collapse/