Canalys’ recent global wearable band market analysis forecasts a 2% rise in 2023, totaling to 186 million units. This growth is primarily driven by a significant 22% surge in basic watch shipments in emerging markets, notably India.

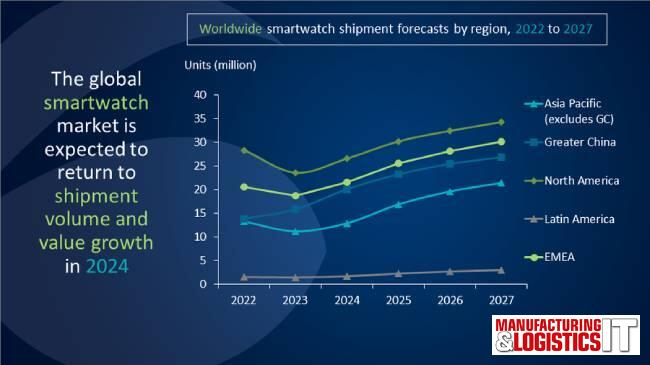

This increase effectively counterbalances a 9% decrease in smartwatch sales and a 10% reduction in basic band shipments. Looking ahead, the wearable band market is poised for a more substantial uplift, with Canalys anticipating a 10% growth in 2024. This positive trend is fueled by an expected resurgence of interest in smartwatches worldwide, with expectations of a 17% increase in their shipments.

“Basic watches emerged as the standout trend in 2023, with the category expected to form more than 40% share of wearable band shipments this year,” said Jack Leathem, Research Analyst at Canalys. “The success of basic watches can be attributed to a perfect blend of affordable pricing, appealing product designs and a consequent soaring demand in emerging markets. These devices, which balance style and tech at a wallet-friendly price, have emerged as a practical, short-term alternative to more expensive smartwatches, also leading to a decline in the popularity of the less functional basic bands. Canalys expects this shift away from basic bands to persist, with shipments projected to fall to 12% by 2027, especially as basic band market leaders such as Xiaomi and Google (Fitbit) increasingly shift their focus to higher mark-up, wristwatch form factors.”

“The smartwatch sector, however, is poised for a rebound in 2024 with an anticipated shipment of 83 million units. Initially attracted to basic or affordable smartwatches, users are now seeking enhanced functionality, especially those who purchased devices during the COVID-19 pandemic,” stated Leathem. “Vendors aim to boost shipment revenues by promoting advanced smartwatches with upcoming hardware improvements, including significant battery life enhancements and the potential arrival of micro-LED screens on premium devices. These enhancements also encompass novel fitness and health capabilities like blood pressure monitoring and sleep apnea detection, which are expected to become new industry standards when introduced by Apple in the next 10th-anniversary line of Apple watches. With regards to its recent ban by the US’s International Trade Commission (ITC), prior generation devices are expected to account for the majority of lost shipments in the US market.”

“The global shift to advanced smartwatches will be most evident in emerging regions, with the Middle East and Central and Eastern Europe expected to see a remarkable 27% and 22% respective increase in smartwatch shipments in 2024. Users in these regions are poised to upgrade from basic watches to smartwatches for the first time,” noted Cynthia Chen, Research Manager at Canalys.

Canalys also anticipates the rise of cloud-based services, especially generative AI, gaining momentum in 2024 after commitments from Zepp Health and Google in 2023. The increasing adoption of compelling AI features by smartwatch vendors signals growth prospects. “This trend of integrating advanced AI features into smartwatches is anticipated to open new avenues for market growth,” observed Chen. “The industry is increasingly pivoting toward offering more sophisticated, AI-driven services. These include customized recommendations, personalized fitness regimes and comprehensive performance analytics, all powered by AI that mimics human interaction. Manufacturers are optimistic that such innovations will not only encourage consumers to upgrade their devices but also boost service revenue, enhance brand loyalty and provide insightful data on user behavior.”

Chen, however, cautions about the challenges that come with the adoption of generative AI. “As this technology evolves, it is essential to address issues related to data privacy and the accuracy of AI-generated content, commonly referred to as AI hallucinations.”

“We expect these hardware and service upgrades to make a significant impact on consumer demand for smartwatches,” added Chen, highlighting the broader market impact. “Growth is forecasted to continue into 2025 with the share of the smartwatch category rising from 38% in 2024 to 44% in 2025. Concurrently, as more high-end, premium smartwatches enter the market, Canalys anticipates a substantial boost in the overall value of shipments.”

|

Worldwide wearable band shipment (forecast and annual growth) |

|||||

|

Category |

2022 |

2023 |

2024 |

Annual |

Annual |

|

Basic band |

40.0 |

35.8 |

33.0 |

-10% |

-8% |

|

Basic watch |

65.4 |

79.7 |

88.5 |

+22% |

+11% |

|

Smartwatch |

77.5 |

70.7 |

82.7 |

-9% |

+17% |

|

Total |

182.8 |

186.1 |

204.2 |

+2% |

+10% |

|

Note: percentages may not add up to 100% due to rounding |

|

||||

|

Worldwide wearable band shipment (category share) |

|||||

|

Category |

2022 shipments |

2023 shipments |

2024 shipments |

||

|

Basic band |

22% |

19% |

16% |

||

|

Basic watch |

36% |

43% |

43% |

||

|

Smartwatch |

42% |

38% |

40% |

||

|

Total |

100% |

100% |

100% |

|

|

|

Note: percentages may not add up to 100% due to rounding |

|

||||

Wearable band category definitions:

Basic bands: wristband with a screen size of less than 1.6”². The device has no operating system and app support.

Basic watch: wristwatch with a screen size greater than 1.6”². The device is equipped with a real-time operating system and built-in app support.

Smartwatch: wristwatch with a screen size greater than 0.6”². The device is equipped with an advanced operating system that provides third-party app support.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.logisticsit.com/articles/2024/01/09/smartwatches-forecasted-to-rebound-in-2024-with-17-growth