The advancement of generative artificial intelligence (gen AI) has opened up new commercial, social, and technological opportunities. However the development of generative AI in Singapore is double-edged a new whitepaper by a consortium comprising the Monetary Authority of Singapore (MAS), financial institutions, tech firms and consultancies, says.

The document, released in May 2024, outlines challenges associated with gen AI and shares a comprehensive gen AI risk framework to guide financial institutions in using the technology in a responsible manner.

The Risks of Generative AI for Singapore

One of the primary concerns highlighted in the whitepaper is the presence of biases in generative AI models. Temporal or historical bias, for example, can lead these models to favor perspectives from specific time periods, resulting in outputs that reflect outdated views.

Political bias is another concern, where AI systems might emphasize certain political ideologies over others due to skewed training data. This can result in content that leans towards specific political stances, excluding other valid viewpoints. Moreover, generative AI can perpetuate stereotypes and produce biased information, unfairly disadvantaging certain demographics.

The risk of generating harmful, offensive, or malicious content, known as toxicity, is also significant with gen AI, particularly if the AI learns inappropriate language or behaviors from its training data. Toxic outputs from gen AI can cause significant harm, including spreading misinformation or offensive content.

Another ethical concern outlined in the report is the potential of gen AI to produce convincing deepfake content, which can lead to misinformation.

Furthermore, gen AI relies on using publicly available data for training, often developed by third parties. This introduces several legal and regulatory risks, including copyright or intellectual property issues, as well as privacy concerns. Privacy challenges are further amplified when personal data, such as that from social media, is used in gen AI.

Gen AI also heightens security risks such as data poisoning, model manipulation, and prompt injection. This may be attributed to the large amount of data it requires for training, the reliance on third-party suppliers for model and data, and the free-format input accepted and output generated. Furthermore, gen AI may be used for malicious purposes, and may amplify the scale, speed and sophistication of cyberattacks and scams.

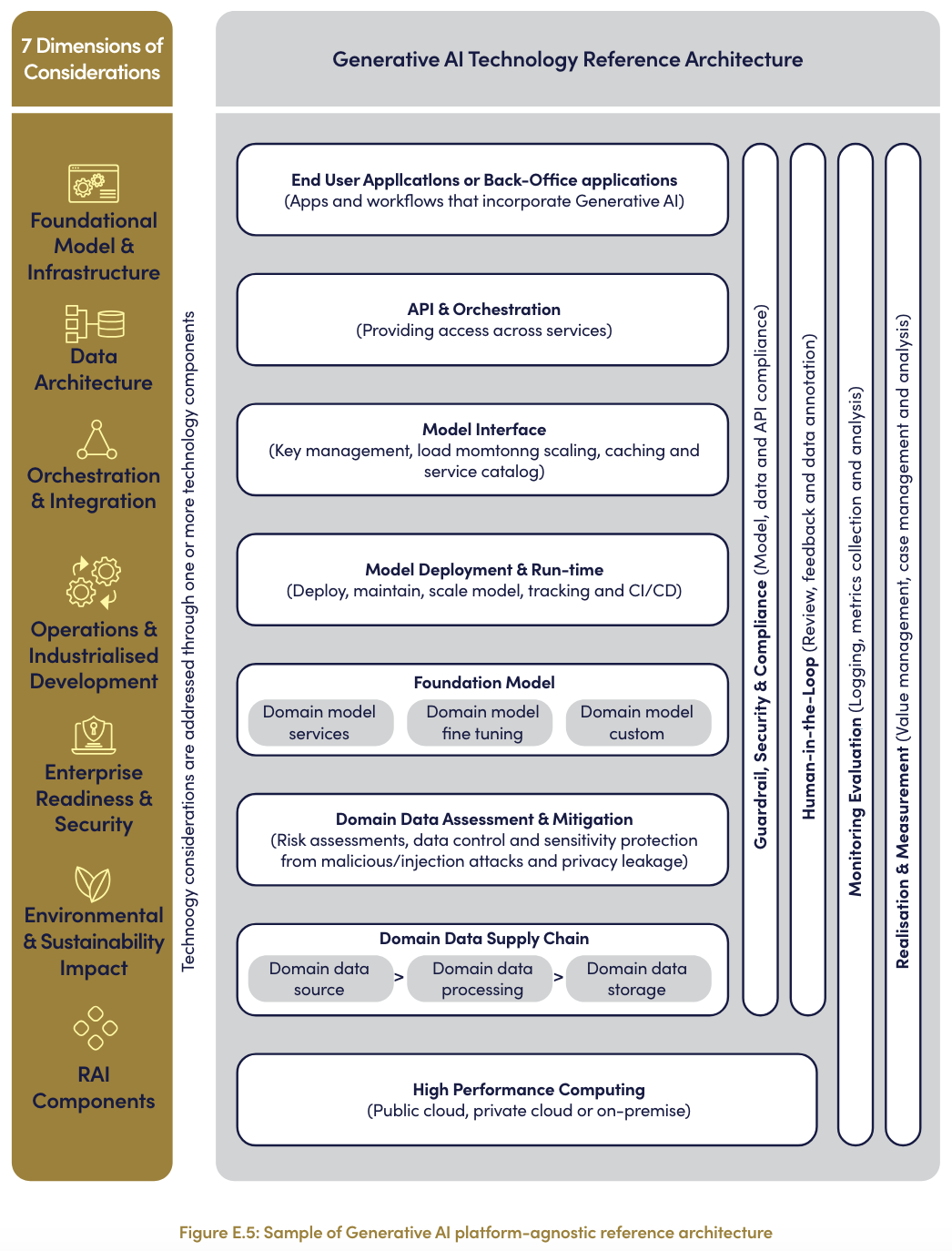

The report also shares a platform-agnostic gen AI reference architecture, providing a list of the building blocks and components that organizations can use to create robust enterprise-level gen AI technology capabilities. This architecture is intended to serve as a sample framework instead of norms to comply to, helping organizations quickly start the pilot phase or plan the implementation process as they adopt the technology, from initial use cases to full-scale enterprise deployment.

Sample of Generative AI platform-agnostic reference architecture, Source: Project MindForge, via the Monetary Authority of Singapore, May 2024

Adoption of Generative AI in Singapore’s Banking Sector Still at Its Infancy

The whitepaper, titled “Emerging Risks and Opportunities of Generative AI for Bank”, was produced by MindForge, a consortium formed in 2023 to understand the risks and opportunities of gen AI technology specifically for the financial services industry.

The consortium comprises MAS, Citi, DBS, HSBC, OCBC, Standard Chartered, The Association of Banks in Singapore (ABS) and UOB, and technology partners Accenture, Google and Microsoft.

Phase 1 of Project MindForge, which concluded on November 15, 2023, sought to develop a risk framework for gen AI. In the next phase, the consortium will expand its scope to involve financial institutions from the insurance and asset management industries, extend its gen AI risk framework to the entire financial industry, and develop an AI governance handbook for the industry.

Gen AI are AI systems designed to autonomously generate new, original content. These systems have expanded rapidly over the past years, driven by the excitement following the introduction of OpenAI’s ChatGPT in late 2022 and opportunities to automate routine tasks, improve efficiencies, and enhance recommendation engines and customer experiences. In the banking sector, McKinsey estimates that gen AI could deliver an annual potential of US$200 billion to US$340 billion (equivalent to 9 to 15% of operating profits).

In Singapore, the MindForge report notes that financial institutions are still in the early stages of implementing gen AI capabilities, with early use cases focusing principally on internal productivity, risk reduction, improving insights, and emerging use cases exploring revenue generation and improving customer interaction.

In October 2023, UOB became the first bank in Singapore to pilot Microsoft’s Copilot, a AI-powered assistant, to improve productivity, accessibility, and collaboration. In November, OCBC Bank followed suit, launching a gen AI chatbot for its 30,000 employees globally to assist them with writing, research and ideation.

Singapore was among the world’s first jurisdictions to articulate AI governance principles through the publication of the Model AI Governance Framework (MGF) back in 2019. The document, updated in 2020, promotes the responsible use of traditional AI.

In response to the rise of gen AI and its associated risks, the AI Verify Foundation and Singapore’s Infocomm Media Development Authority proposed an extended framework in January 2024. The MGF-Gen AI aims to address gen AI concerns while fostering innovation, and calls for collaboration among policymakers, industry, researchers, and the public.

Featured image credit: edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/97226/ai/generative-ai-singapore/