Reserve Bank of New Zealand consultation on DTI and LVR settings, will close on March 12.

In summary, Headlines via Reuters:

-

Launched consultation on activating debt to income (DTI) restrictions

and loosening loan to value ratios (LVRs) for residential lending - Propose to initially

setting DTI policy to allow banks to lend 20% of residential loans to

owner-occupiers with DTI greater than 6 - Proposing easing the

lvr settings at the same time as activating DTIs - Propose initially

setting the DTI policy to allow banks to lend 20% of residential

loans to investors with DTI greater than 7 - Propose easing LVRs

to allow 20% of owner-occupier lending to borrowers with LVR greater

than 80% - Propose easing LVRs

to allow 5% of investor lending to borrowers with an LVR greater than

70%

—

- Deputy Governor Christian Hawkesby says the financial stability risks of ‘boom and bust’ credit cycles are significant, so it’s important to ensure we have appropriate policies in place to manage them.

—

The full thing can be found from the Bank’s website, here:

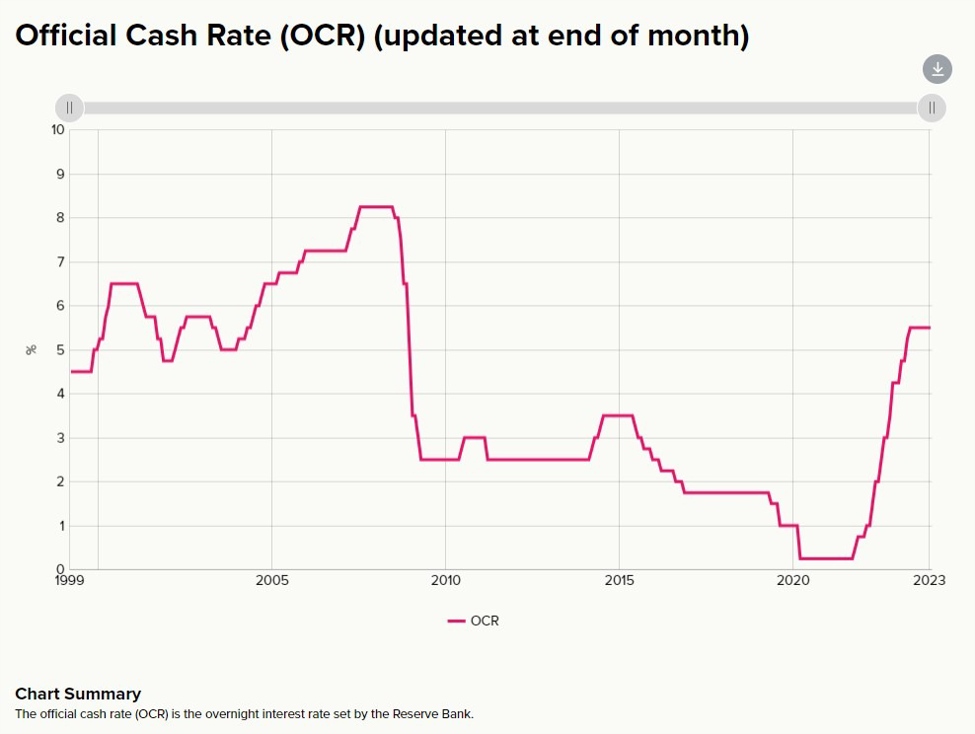

NZD/USD little changed. This is not a change in monetary policy settings. The Reserve Bank of New Zealand was one of the first DM central banks to begin its rate hike cycle and so far have held rates at their peak:

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexlive.com/centralbank/reserve-bank-of-new-zealand-to-consult-on-loosening-macroprudential-policy-20240122/