No less eminent a capitalist than Adam Smith—the father of economics—was skeptical of corporations. The separation of a business’s owners from its day-to-day managers would, he thought, lead inevitably to “negligence and profusion.” But modern businesses have some remedies for this “principal-agent” problem, and one of them is stock options.

The goal of compensating a key employee with stock options is to get his or her financial incentives aligned with those of the owners who aren’t running the business day to day. But even savvy individuals may not entirely grasp the nuances of option agreements, especially in the world of private equity (Private Equity Professionals | A Simple Model), where, unlike in the public markets, there is often no reliable secondary market for the optioned stock and the terms of the options are governed by bespoke, typically relatively complex contracts.

Fear not, in this post we’ll cover what you need to know about stock option agreements, how they work, and why, if you’re a relatively senior employee (N-2 or even N-3 at a larger company) or independent director of a business, you should do your best to negotiate them as part of your compensation package.

What Stock Options Are, And What They Aren’t

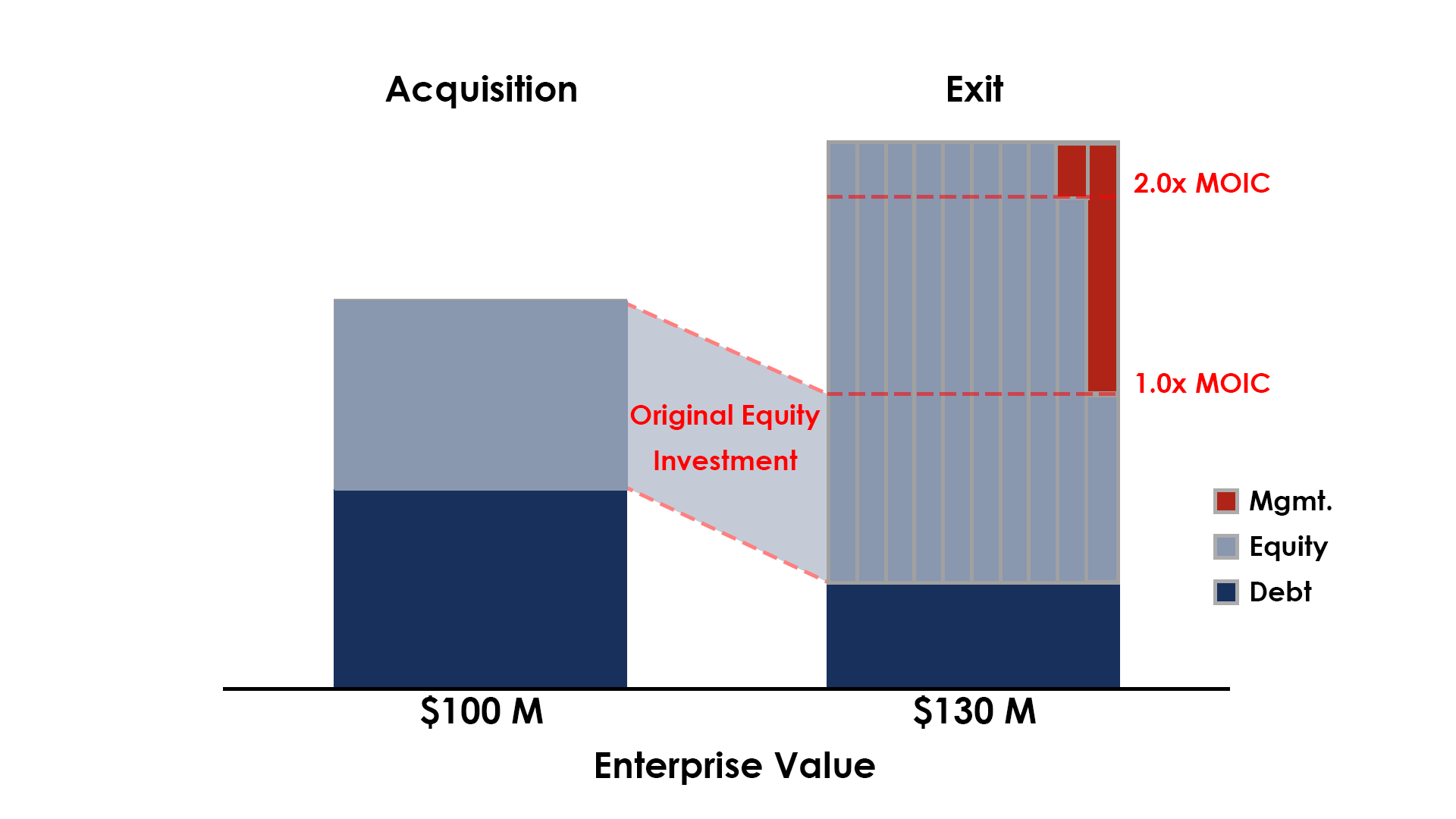

Stock options differ from forms of “sweat equity” such as Restricted Stock Units (RSUs), in which stock is simply given to an employee upon the fulfillment of certain objectives. Simply put, a stock option is a right (but not an obligation) to buy the company’s stock at a locked-in price—called the strike price—after a set period of time. If you are hired by a private company during or shortly after a merger or acquisition, any stock options offered would probably carry a strike price based on the share price being paid by the acquiring firm. Otherwise, options would likely carry a strike price based on the “mark-to-market” value from the most recent internal valuation. Regardless, the value of exercising an option will grow as the value of the stock (hopefully) rises above the strike price over time. This creates a powerful incentive for the holder of the option to help the firm succeed. But don’t forget, unlike with RSUs, you will still need access to cash in order to “exercise” (or pay out the strike price of) an option contract.

Now for some details. An option cannot be exercised unless it is vested, and a schedule for this vesting is included in all standard option agreements. For example, a schedule might allow for 20-30% of your options to vest each year, over a 3-to-5-year period. This incentivizes you to stay with the company at least until your options can be exercised. An accelerated schedule is worth negotiating for, especially if you are in an interim role, though as you might guess, most PE owners will want to tie vesting schedules to their own anticipated hold period (3-5 years or more) to retain key executives for that duration. It is worth noting, though, that most PE option agreements will allow for accelerated vesting of all options if and when there is a sale or “change of control” in the business, regardless of whether the sale occurs six days or sixteen years after the original date the agreement was put in force. Of course, if the options are not “in the money,” with a share price above the strike price, these vesting schedules will be primarily an academic exercise, since the options will be worthless even if they have vested.

While many options are time-based, vesting strictly by the calendar, others are performance-based. They don’t vest unless you, your team, and/or your company hit agreed-upon targets. These are usually, but not necessarily, in the form of financial targets (for sales, EBITDA, etc.), and are intended to incentivize you to help the owners achieve the best possible financial outcome during the time you remain with the company. If the targets are not hit within the stated period, these options will not vest, even if the company is otherwise doing well or there is a successful exit event such as a sale of the company.

And speaking of exit events, what happens if you decide to leave the company for an opportunity elsewhere? Any unvested options will likely vanish as if they had never existed. As for vested options, some agreements may allow you a window of time (often 1-3 months) after leaving to exercise them, though you will typically need to pay in the aggregate strike price to do so as a departing employee or director (which often requires a significant cash outlay). And if the firm has not gone public, there may also be constraints on when and if you can sell the shares acquired through buying into your vested options. Some agreements will address this, specifying, for instance, whether private secondary markets can be used, and whether the company itself has a right of first refusal in purchasing the shares.

The Bottom Line

Overall, stock options are a daunting form of compensation that involve a certain amount of uncertainty (particularly vis a vis straight up cash payments), but are they still worth pursuing in your compensation negotiations? Absolutely. PE firms often prefer this kind of long-term, incentive-based compensation over guaranteed salary or even commissions, and are happy to offer deals that could prove very sweet if things go well.

For key employees, options are a way to create significant personal wealth while working for a PE-backed company; for example, I know of multiple executives who have made 5x+ their annual salary on options payouts in successful PE exits (learn more: Incentive Equity Compensation). As with many things, though, the devil is in the details, so make sure you fully understand any options-based compensation you are offered. Consulting a lawyer or trusted advisor who is familiar with such agreements is always a good move. But be sure to read (and more importantly, try to understand) the fine print for yourself as well, and happy negotiating!

Related: Incentive Equity Compensation (click on the image below to learn more).

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.asimplemodel.com/insights/private-equity-stock-options-primer