Facing unprecedented demand surges and volatile price swings, the world’s lithium producers are revolutionizing the way the commodity is bought and sold. Miners are using auctions to secure higher prices than those assessed by price reporting agencies (PRAs) as demand for the battery metal increases amid the energy transition.

Traditionally, the lithium market relied on private contracts, but the surge in demand has led to the introduction of public trading platforms. PRAs now provide price assessments, and the London Metal Exchange and Guangzhou Futures Exchange have launched futures market.

However, with a 2024 lithium price slump affecting margins, producers turn to spot auctions that yield better prices than PRA reports.

A Valuable Tool for Lithium Price Discovery

According to S&P Global Commodity Insights, market experts and participants expect auctions to continue, as companies aim to achieve favorable prices despite market downturns.

Albemarle Corp., a major US lithium producer, stated that auctions help in responsible price discovery. This benefits both buyers and sellers and contributes to a more sustainable market.

For Przemek Koralewski, global head of market development at price reporting agency Fastmarkets Global Ltd., auctioning lithium prices serve two things:

“It allows miners to get the price of the day and it means that the contracts on which most material is sold are truly reflective of market dynamics.”

Unlike other commodities with a single benchmark price, lithium prices are typically determined using a range of PRA assessments, incorporating data from various market stakeholders.

In 2022, lithium companies leveraged auctions to secure higher prices despite slowing demand for electric vehicles and rising COVID-19 infections impacting market prices. Alice Yu, an analyst at Commodity Insights’ Metals and Mining Research team, stated that “auction prices provide an extra means of price discovery and add to market transparency.”

The use of auctions decreased as pandemic effects waned and prices surged amid the energy transition. However, a supply glut and global decline in EV sales have caused lithium prices to drop again.

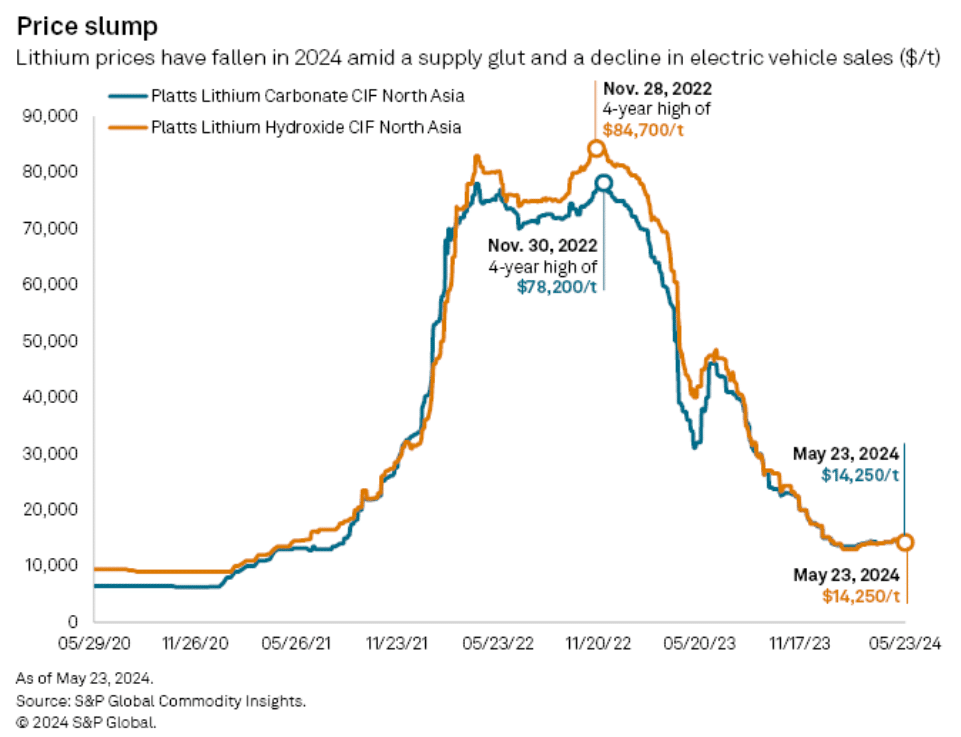

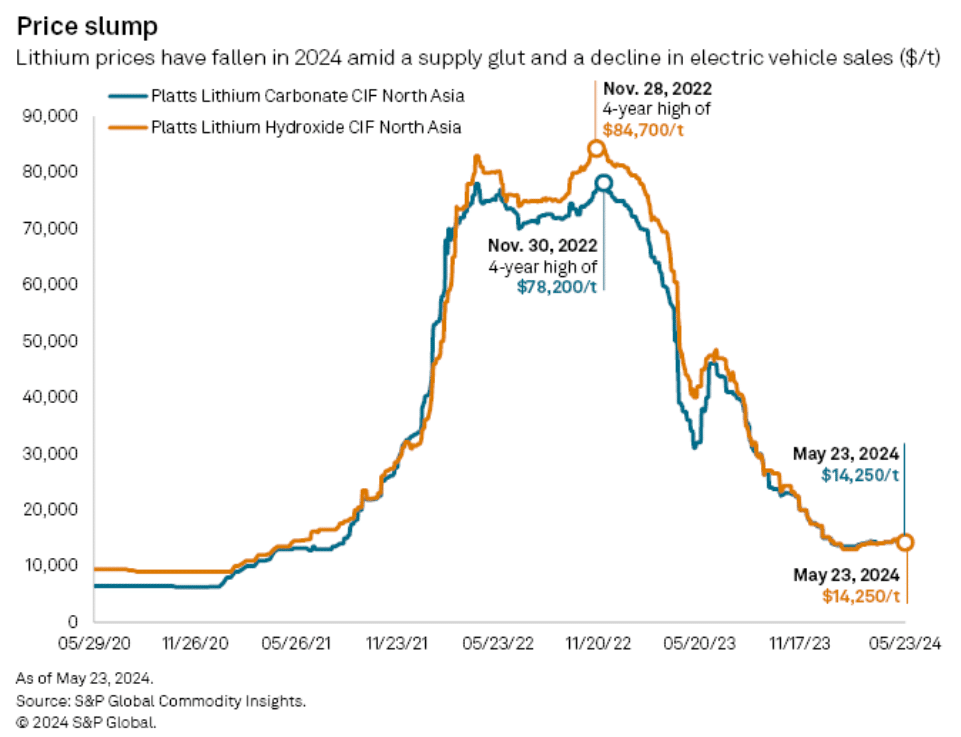

On May 23, Platts reported the lithium carbonate CIF North Asia price at $14,250 per metric ton, down 81.8% from the four-year high of $78,200/t on Nov. 30, 2022. The lithium hydroxide CIF North Asia price also fell 83.2% to $14,250/t from a peak of $84,700/t on Nov. 28, 2022.

Embracing Lithium Auctions for Better Pricing

Several lithium companies are now revisiting auctions, believing that price reporting agencies have overstated the price decline. Auctions have indeed yielded higher prices.

For instance, Albemarle’s two lithium spodumene auctions on March 26 and April 24 increased the spot spodumene price by about 10% each time. Encouraged by these results, Albemarle plans to continue with auctions.

In late March, Australia-based Mineral Resources Ltd. sold lithium spodumene concentrate at $1,300/t through digital auctions. This was 13%-20.4% higher than the Platts lithium spodumene 6% FOB Australia price of $1,080/t to $1,150/t during that period. The company aims to continue using auctions for price transparency.

Joshua Thurlow, CEO of Mineral Resources, highlighted the market’s recognition of future lithium demand for the global energy transition, noting delays or failures in long-awaited supply projects.

Similarly, Brazil-headquartered Sigma Lithium Corp. reported achieving higher prices through an “auction-price discovery process” compared to the traditional PRA approach.

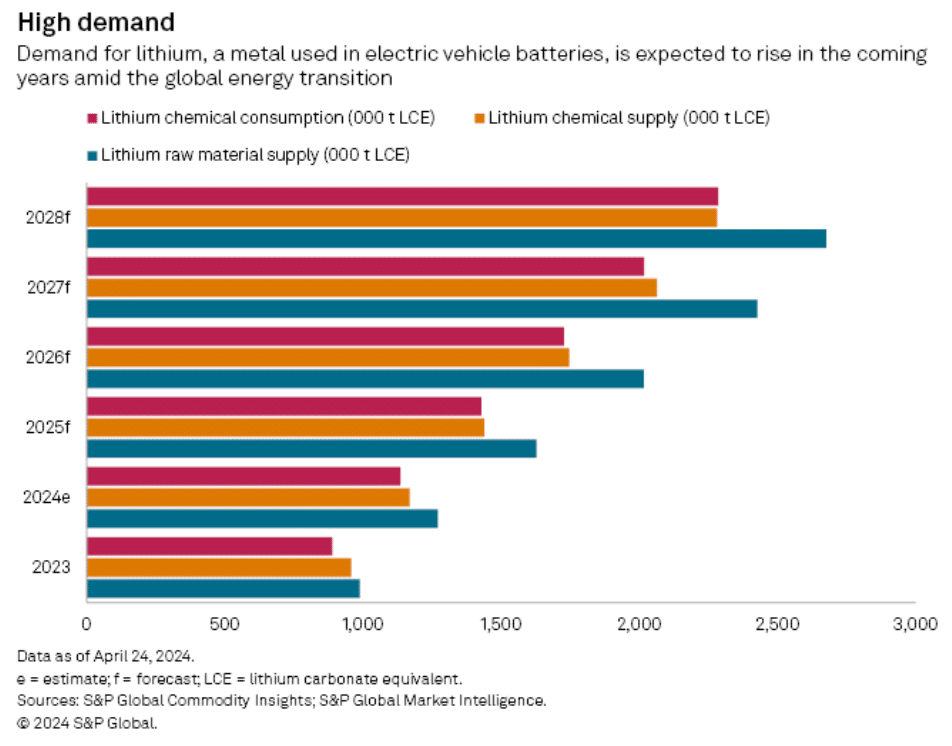

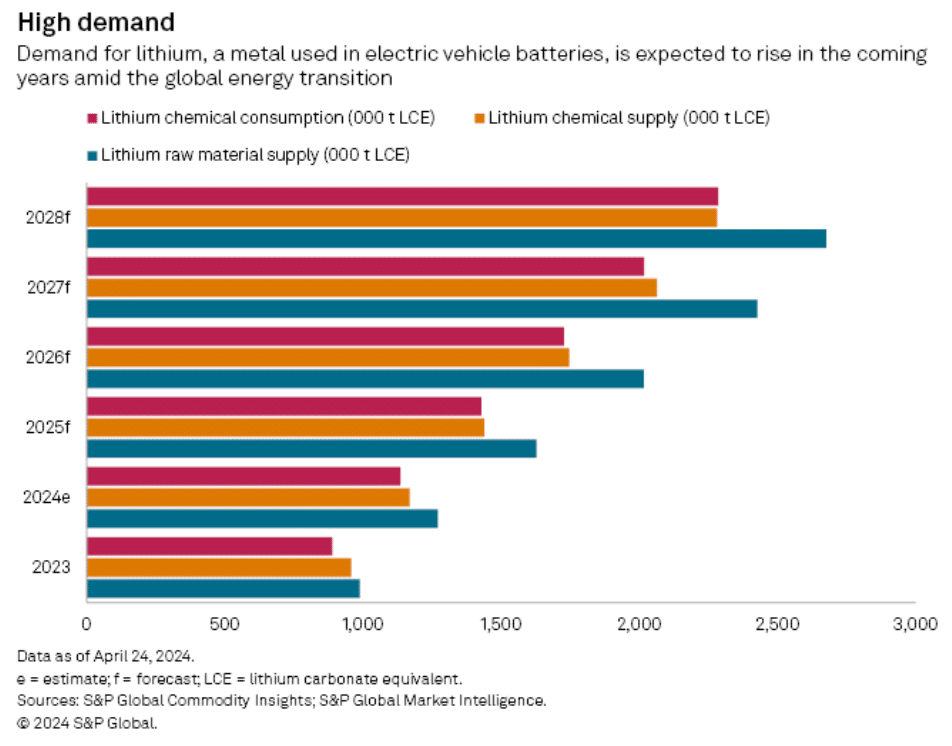

These developments indicate that auctions are becoming a valuable tool for lithium producers to secure favorable prices and enhance market transparency. This is particularly crucial as demand for lithium, a critical element of EV batteries, will rise again amid the energy transition.

A Dynamic Pricing Approach for A Resilient Lithium Market

Lithium prices have experienced a dramatic fall and the market is still adjusting to inflated inventories from the boom period. There’s also a growing divergence between different lithium products as the supply chain matures.

Historically, long-term contracts have been linked to the downstream chemicals market rather than the raw material, spodumene, which has become significant only in the past decade. This has led to a disconnect between the prices of these two materials.

Ana Cabral, CEO of Sigma Lithium Corp., noted that lithium producers are gaining more control over pricing previously influenced by lithium chemicals. She emphasized the need for a risk-reward system aligned with the pricing mechanism, highlighting that those producing the raw concentrate bear most of the risk.

Lithium producers face not only explosive demand growth but also geopolitical and regulatory changes that could create regional market divisions. The West aims to reduce dependence on supply chains involving China, with increasing attention to the carbon footprints of various sources.

Chris Berry, president of House Mountain Partners LLC, likened the current lithium market evolution to that of the iron ore market. He noted that auctions and increasing liquidity in lithium futures are positive developments.

Regular, open spot pricing through bids and offers enables market participants to react swiftly to supply and demand changes, ensuring more efficient market clearing during both boom periods and downturns. This dynamic approach allows the market to adapt more effectively to fluctuating conditions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/lithium-miners-revolutionize-pricing-with-auctions-spot-price/