Over the past years, venture capital (VC) funding in Caucasus and Central Asia (CCA) has increased substantially, growing by more than fivefold between 2018 and 2023, a new report produced by RISE Research in cooperation with EA Group and BGlobal Ventures, as well as Crunchbase, the Ministry of Digital Development, Innovation and Aerospace Industry of Kazakhstan, and KPMG Caucasus and Central Asia, says. Across the region, fintech has risen to prominence, becoming one of CCA’s investors preferred investment targets.

The “Venture Capital in Central Asia and the Caucasus 2023” report, released in March 2024, provides an overview of the VC landscape across the CCA region, outlining emerging trends and favored sectors in 2023.

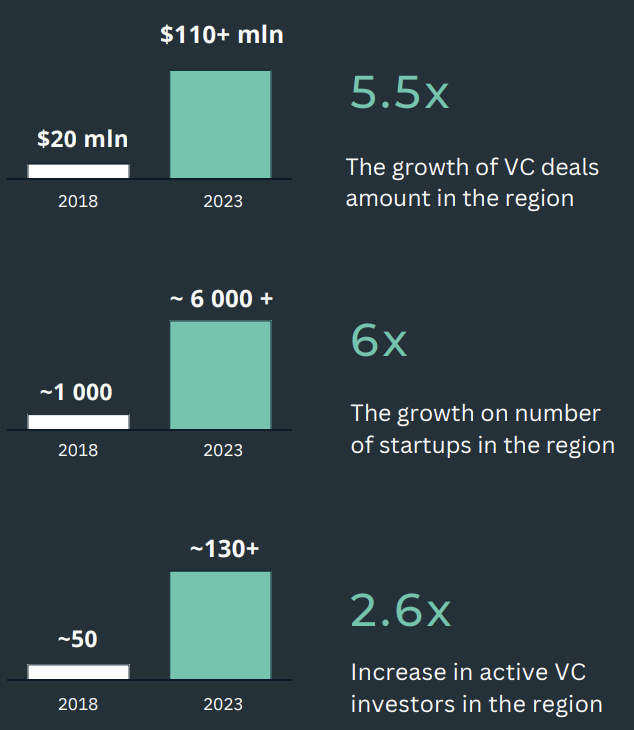

According to the report, VC funding in CCA reached US$110 million in 2023, up by 450% from a mere US$20 million in 2018. This growth has been driven by the region’s expanding startup ecosystem, which saw its number of tech startups grow sixfold while the number of active VC investors in the region increased by nearly threefold during the period, data from the report show.

The VC ecosystem in the CCA region over the past five years, Source: Venture Capital in Central Asia and the Caucasus 2023, Mar 2024

Fintech Kazakhstan on the Rise

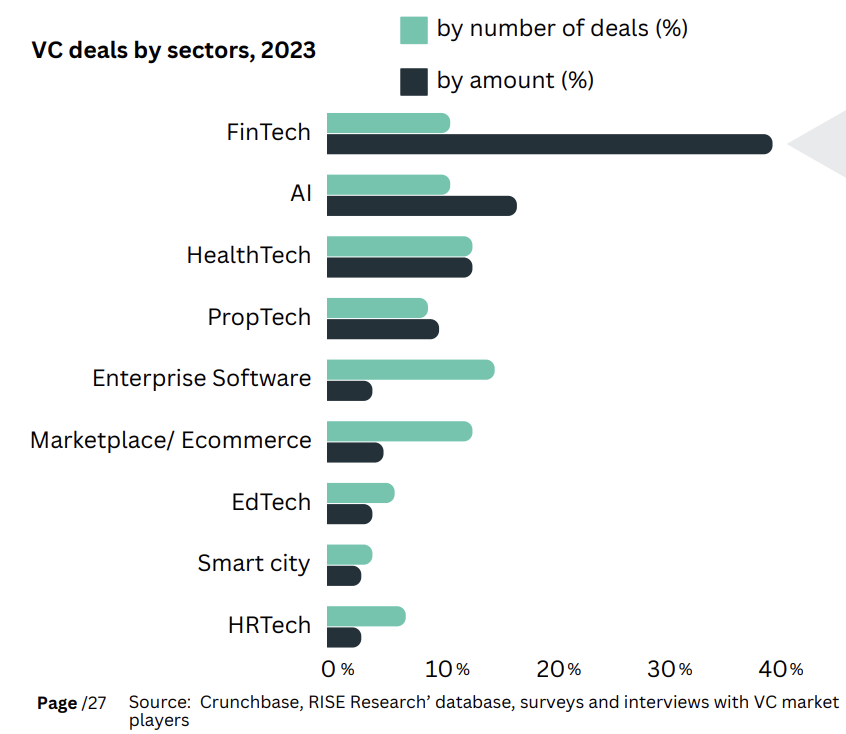

In 2023, fintech emerged as one of the most prominent sectors in the region. Though the report doesn’t share specific amounts, data show that fintech was the top startup sector in most of the countries across the region, and most particularly in Kazakhstan and Uzbekistan, two of CCA’s largest VC markets.

In 2023, Kazakhstan secured US$80 million in VC funding, accounting for nearly 73% of all VC funding in CCA. Of that amount, about 40% was raised by fintech startups, making the segment the favorite of investors in the country.

VC deals in Kazakhstan by sectors, 2023, Source: Venture Capital in Central Asia and the Caucasus 2023, Mar 2024

Fintech Among Investor’s Favourite in Central Asia

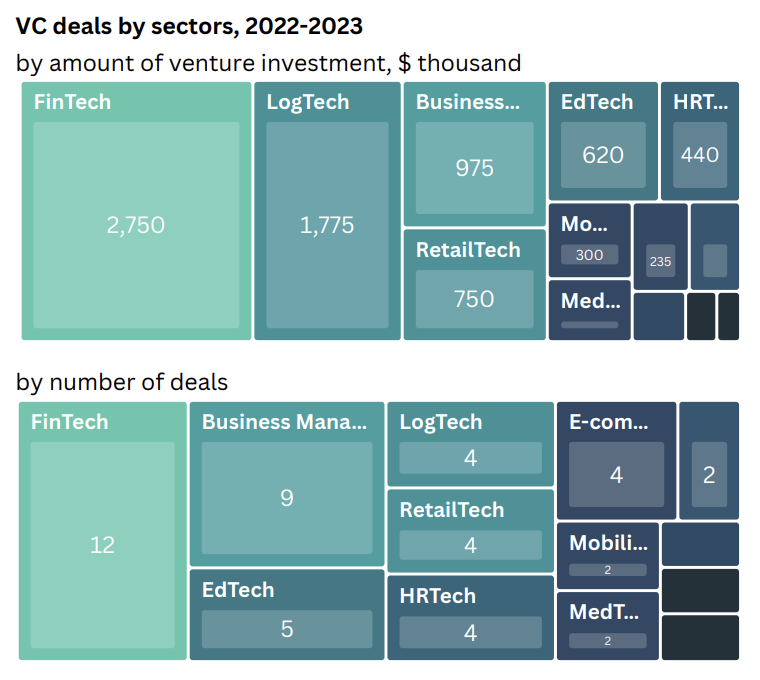

A similar trend was observed in Uzbekistan where fintech startups secured a total of US$2.75 million through 12 deals in 2022 and 2023, making fintech the most prevalent among sectors in the domestic startup scene.

Uzbek startups secured a total of US$6.3 million in VC funding in 2023, a sum that makes Uzbekistan the third biggest market in CCA in terms of VC funding.

Uzbek VC deals by sectors, 2022-2023, Source: Venture Capital in Central Asia and the Caucasus 2023, Mar 2024

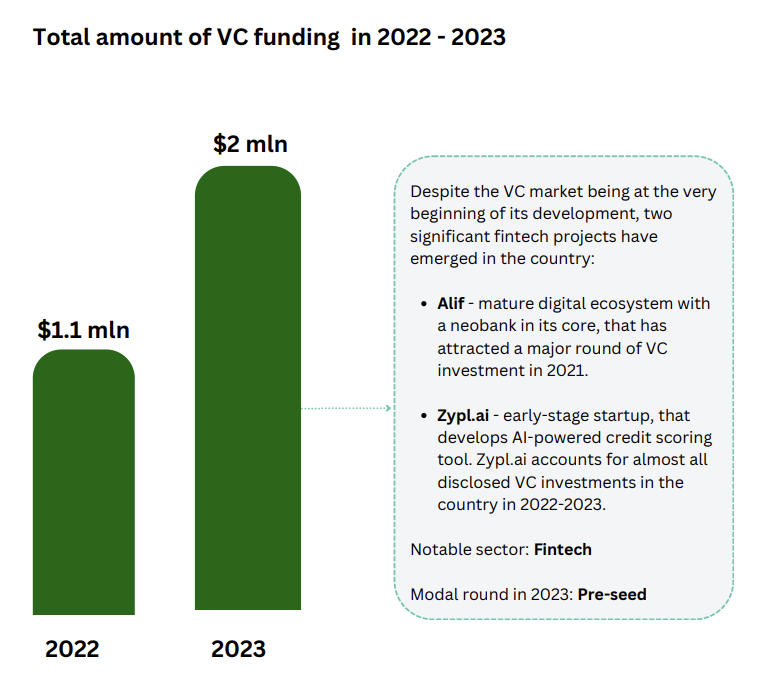

Fintech was also the preferred investment target in Tajikistan where the sector secured much of the US$3.1 million VC funding raised by the country’s tech startups in 2022 and 2023. Zypl.ai, an early-stage startup that develops a credit scoring tool powered by artificial intelligence, accounted for nearly all of disclosed VC investments in Tajikistan in 2022 and 2023, raising US$1.1 million in a pre-seed round in September 2022, and US$2 million in December 2023, the data show.

Tajikistani VC funding in 2022 and 2023, Source: Venture Capital in Central Asia and the Caucasus 2023, Mar 2024

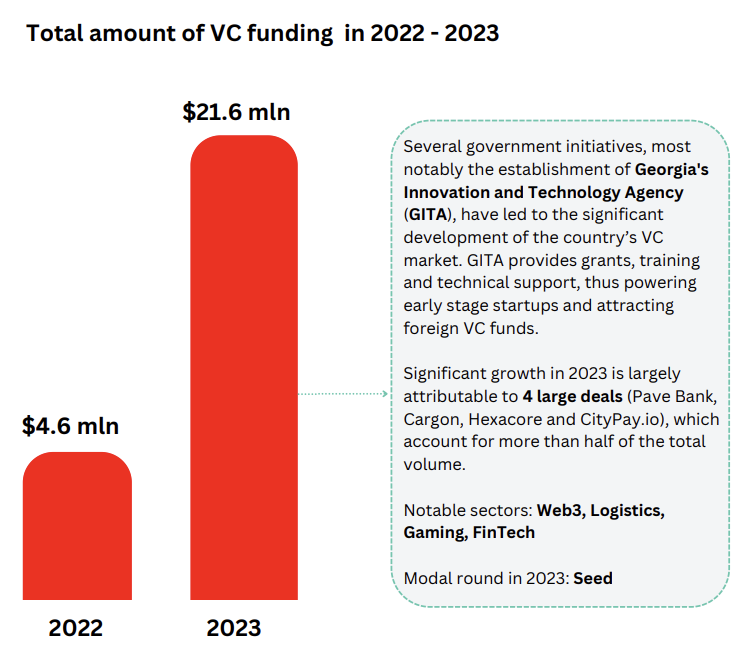

Georgia, the second largest VC market in CCA, also recorded strong interest in fintech last year, with some of the country’s biggest rounds being secured by companies in the sector. Pave Bank, a new digital bank, raised US$5.2 million in December 2023; Hexacore, a blockchain and Web 3.0 publisher, secured US$3.5 million in seed funding in August 2023; and CityPay.io, a digital currency payment solution, raised US$2 million in August 2023.

Together these four rounds secured US$10.7 million, representing nearly half of what was raised in Georgia last year.

Georgian VC funding in 2022 and 2023, Source: Venture Capital in Central Asia and the Caucasus 2023, Mar 2024

VC funding in Caucasus and Central Asia

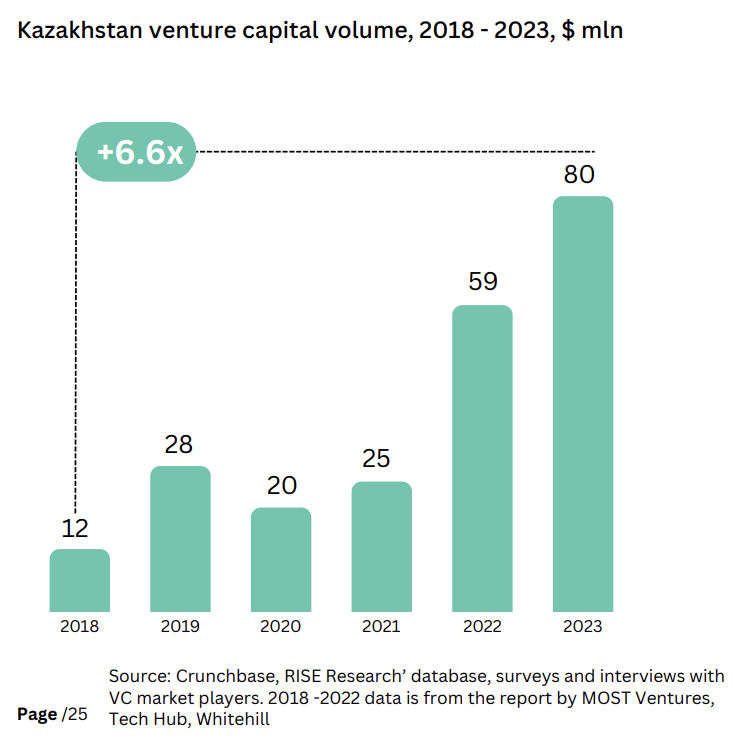

Data from the report reveal that Kazakhstan currently stands as the biggest market for VC funding in CCA and the most developed startup ecosystem. Since 2018, the country’s VC market has increased considerably, growing by 6.6 times to US$80 million in 2023. Meanwhile, average deal size grew 3.8 times to amount to US$1 million in 2023, an indication of the maturing of the Kazakh startup ecosystem.

However, the Kazakh tech startup ecosystem remains nascent with the bulk of 2023’s VC deals being pre-Seed (52%) and Seed (38%) rounds. Series A and B rounds accounted for 10% of the total number of deals in 2023 and Series C rounds were non-existent.

Kazakhstan VC volume, 2018 – 2023, US$ million, Source: Venture Capital in Central Asia and the Caucasus 2023, Mar 2024

The relatively low levels of investments in CCA imply that plenty opportunities still exist for investors alike.

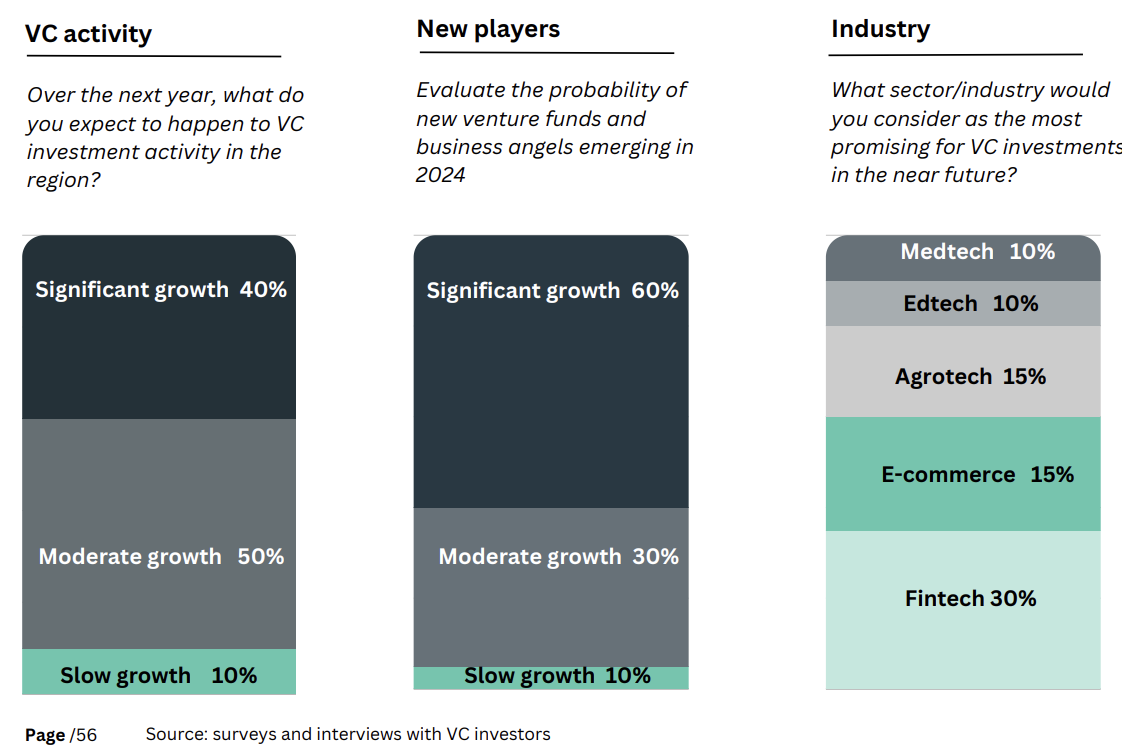

A survey of more than 100 startups in the region and insights drawn from interviews with over 30 markets leaders reveal that industry participants are bullish on the growth prospect of VC funding in CCA.

40% of the investors polled expect significant growth in VC investment in 2024. This growth will be driven by the launch of new venture funds and the emergence of new business angels, with 60% of respondents expecting the investor pool in the region to grow significantly in 2024.

Investors cited fintech as the most promising sector for VC investments in CCA in the near future (30%), followed by e-commerce (15%), agrotech (15%) and medtech (10%).

Results of the CCA survey, Source: Venture Capital in Central Asia and the Caucasus 2023, Mar 2024

Featured image credit: Edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/93901/funding/fintech-central-asia-kazakhstan-uzbekistan/