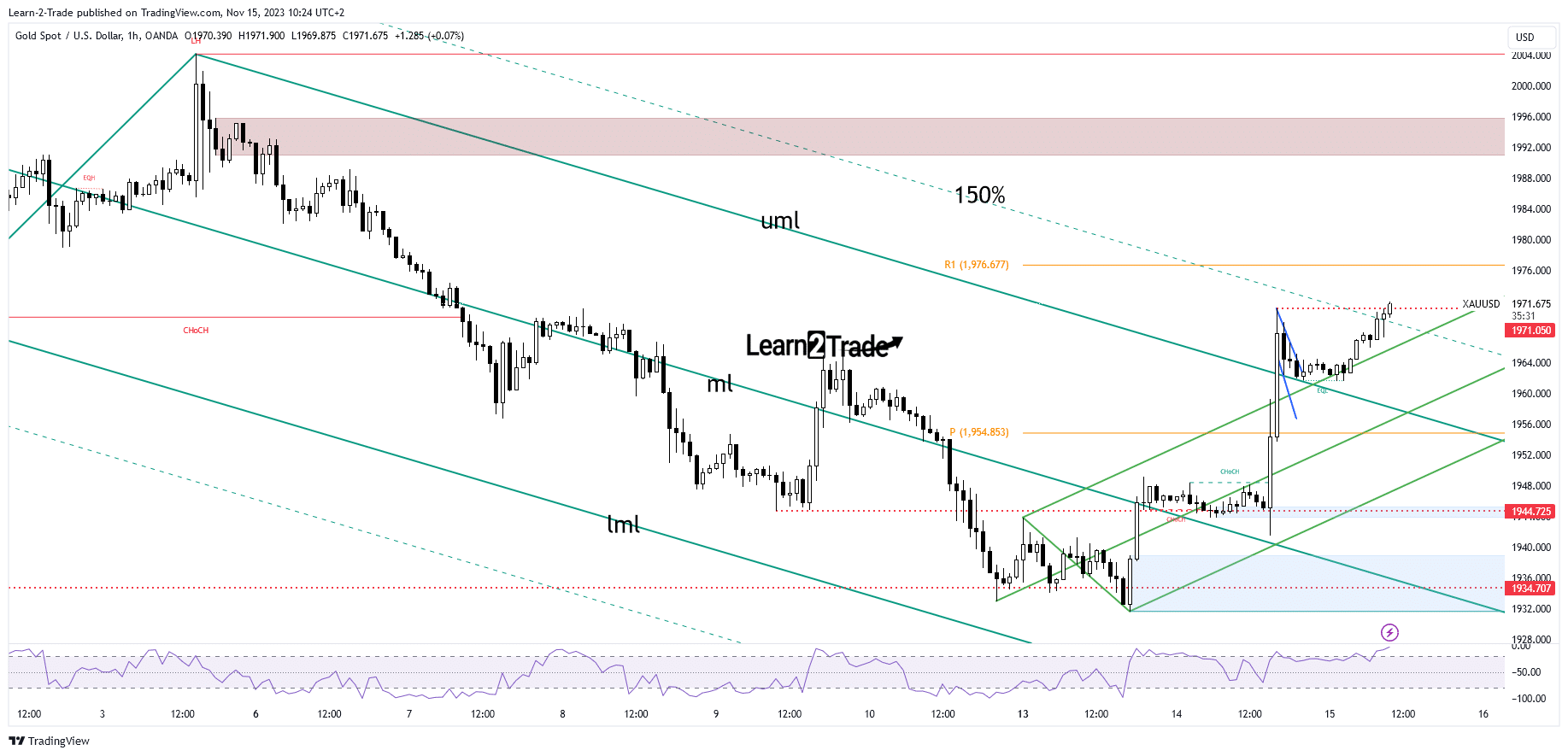

- The bias is bullish as long as it stays above the upper median line.

- The US economic data should bring high volatility today.

- Taking out the static resistance activates further growth.

Gold price increased in the recent trading session, hitting a new high of $1,971. It did dip a bit in the short term but quickly went back up to $1,971. This happened because of the recent U.S. inflation data, where the Consumer Price Index (CPI) showed lower inflation than expected.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

This made the Federal Reserve (FED) decide to keep the monetary policy unchanged in the upcoming meetings. As a result, the U.S. dollar weakened against other currencies, leading to the rise in gold prices.

Today, good news came in from China – the Industrial Production and Retail Sales were better than expected. In Australia, the Wage Price Index matched what was predicted. In the United Kingdom, the Consumer Price Index reported a 4.6% growth instead of the estimated 4.7%, and Core CPI rose by 5.7%, slightly less than the expected 5.8% growth.

Looking ahead, the U.S. is going to release some important data. Retail Sales may show a 0.3% drop, Core Retail Sales might announce a 0.1% drop, PPI is expected to register a 0.1% growth, and the Core PPI could report a 0.3% growth again. Keep an eye out for these numbers as they can have an impact on the market.

Gold price technical analysis: Testing resistance at $1,971

Technically, the XAU/USD is going up again after testing certain levels. It went above the 150% Fibonacci line and is now trying to break the 1,971 level, which is like a barrier. If it manages to go higher than this, it could keep growing, reaching at least the R1 level (1,976). The current trend looks positive, as long as it stays above a certain line.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gold-price-preserving-gains-after-downbeat-us-cpi-figures/