Credit Markets | Dec 21, 2023

Image: IMF and Bloomberg Opinion

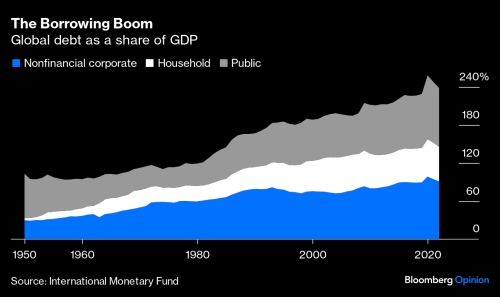

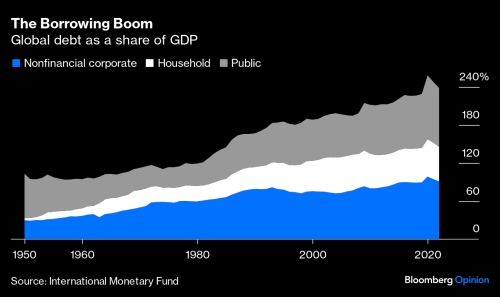

Image: IMF and Bloomberg OpinionThe global economy has witnessed a staggering increase in both public and private debt

Bloomberg’s “Points of Return” newsletter reports that public debt now accounts for 92% of the world’s GDP, a threefold increase since the mid-1970s. Similarly, private debt has surged to 146% of GDP. This unprecedented rise in global debt underscores the need for investors to be vigilant about the potential risks and opportunities in the credit market.

Dimos Andronoudis, a Fathom Consulting economist, reveals through Altman-score analysis that a mere 10% of US-listed companies demonstrate robust financial health, marking an all-time low. The situation appears more dire than during the 2007-09 credit crisis, with an unprecedented 36% of these companies nearing bankruptcy by the last financial year’s end.

Shift From Banks to Credit Markets

A shift has occurred from bank-centric lending to a broader reliance on credit markets. This transition offers advantages like improved pricing efficiency and reduced systemic risks. However, it also raises concerns about the quality of lending decisions and the potential for misallocation of credit. Additionally, the prolonged period of low interest rates has facilitated easier debt repayment and more speculative lending practices.

See: SG Launches First Digital Green Bond on Ethereum

There is a notable discrepancy between the caution exercised by bankers, evident in tighter lending standards, and the seemingly less cautious approach of the credit markets. This divergence highlights the importance of a balanced and well-informed investment strategy that considers both market trends and fundamental credit analysis.

Although a crisis akin to 2008 seems unlikely, an increase in defaults appears inevitable, particularly in the context of rising interest rates and the end of a benign credit cycle. Despite the challenges, the current credit market scenario presents unique opportunities for astute investors. The potential for higher interest rates and rising defaults could reveal areas where capital has been inefficiently allocated, thereby opening new avenues for investment. Credit investors who conduct thorough research and analysis may find lucrative opportunities in this environment.

Impact on Fintechs

The surge in global debt, both public and private, opens new avenues for fintech innovation. Fintechs have the opportunity to develop novel solutions for debt management, credit analysis, and risk assessment. By leveraging advanced technologies like AI and machine learning, fintechs can offer more sophisticated tools for both consumers and businesses to manage their debt and credit profiles more effectively.

See: Fintech Fridays EP60: Revolutionizing Small Business Lending and Empowering Entrepreneurs

The transition from traditional bank lending to credit markets can be a double-edged sword for fintechs. On one hand, it creates a competitive landscape where fintechs can offer alternative lending solutions and democratize access to credit. On the other hand, fintechs must ensure they maintain high standards of credit assessment to avoid the pitfalls of poor lending decisions that have plagued traditional markets.

For fintechs in the investment sector, the evolving credit market scenario offers opportunities to create platforms and tools that help investors identify and capitalize on emerging opportunities, especially in the face of higher interest rates and market shifts.

Conclusion

The changes in the global credit market pose both challenges and opportunities for fintechs. By innovating in areas like credit analysis, risk management, and debt restructuring, and by offering new solutions for investment and lending, fintechs will continue to shape the future of finance.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/fintech-opportunities-as-global-debt-surges/