Fintech equity funding activity in Singapore declined in 2022, with investment value dipping by 8% and deal count declining by nearly 26%, a new report produced by DealStreetAsia and Enterprise Singapore, shows.

These findings are consistent with global trends observed last year during which fintech funding worldwide slumped by 35% from a record 2021 amid market instability, geopolitical turmoil, and looming fears of a recession.

The Singapore Venture Funding Landscape 2022 report, released on March 01, 2023, examines the venture capital (VC) market activity in the city-state, sharing key data and growth metrics for Singapore and other prominent Southeast Asian markets.

According to the report, fintech equity funding totaled US$3.5 billion in 2022, down 8% from 2021’s US$3.81 billion. The number of fintech deals were down as well, declining from 216 in 2021 to 160 last year.

Top verticals under the Smart Nation and Digital Economy themes in Singapore in 2021 and 2022, Source: Singapore Venture Funding Landscape 2022, Enterprise Singapore, DealStreetAsia, March 2023

Despite the slump, fintech remained the favored startup segment for investors in Singapore, accounting for more than 31% of all equity funding raised in 2022.

Much of the fintech equity funding activity last year was driven by large mega-rounds of US$100 million and up, data show. These deals were not only among the largest ones recorded in Singapore but also the biggest ones in the broader Southeast Asian region.

Top 20 2022 equity funding deals in Southeast Asia, Source: Singapore Venture Funding Landscape 2022, Enterprise Singapore, DealStreetAsia, March 2023

These deals included Coda Payments’ US$690 million Series C, Amber Group’s US$500 million Series B+ and C, Oona Insurance’s US$350 million equity round, and Bolttech’s US$300 million Series B.

Coda Payments provides cross-border monetization solutions for digital products and services, and digital publishers. Founded in 2011, the company is valued at US$2.5 billion and said it would use the proceeds from the fundraise to expand into more territories.

Amber Group is a digital asset firm operating a full range of services spanning investing, financing, and trading. The company, which is valued at US$3 billion, secured a US$200 million and a US$300 million round last year.

Oona Insurance is a pan-Southeast Asian digital general insurance platform. The company, which strives to become the region’s pre-eminent digital-first and retail-focused general insurance platform, plans to introduce new products such as travel and health, and said it would use the proceeds to build a new tech stack to enhance customer experience.

And Bolttech is a leading embedded insurance provider that operates in more than 30 markets throughout Asia and Europe as well as the US. The company, which is valued at US$1.5 billion, said it would use the capital raised in its Series B to fuel its continued global growth.

Equity funding remains strong

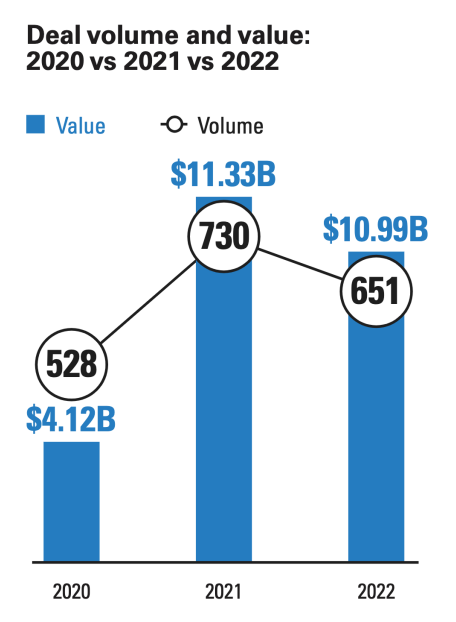

After a bumper year 2021, VC funding activity in Singapore weakened in 2022, declining 11% in annual deal volume and by 3% in total deal value.

Deal volume and value in Singapore in 2020, 2021 and 2022, Source: Singapore Venture Funding Landscape 2022, Enterprise Singapore, DealStreetAsia, March 2023

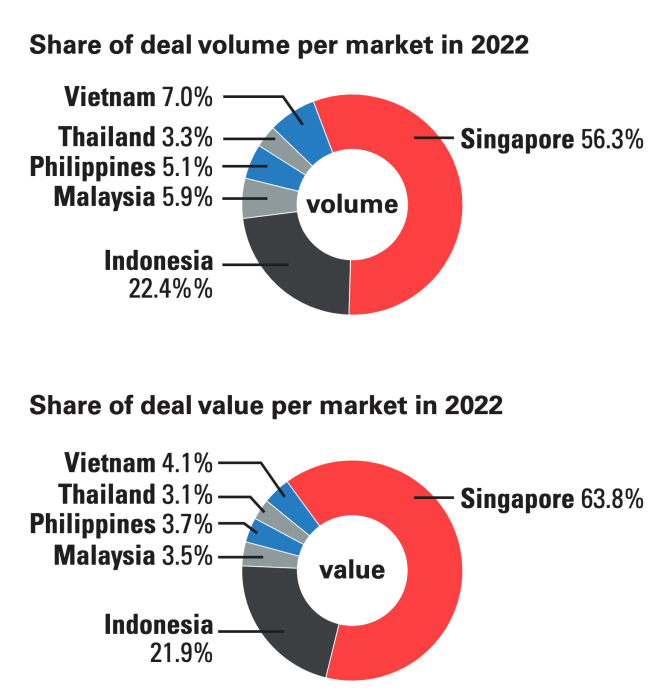

Despite the pullback, 2022 was the second-best year for Singapore and the nation maintained its lead as the top destination for VC investment in Southeast Asia by accounting for 56% of total deal volume recorded in six of the largest economies in the region and for 64% of the total deal value.

Overall, the decline observed in Singapore was much lighter than in Indonesia, Malaysia, the Philippines, Thailand and Vietnam, where funding plunged by 42% year-on-year (YoY), data show. This indicates that obtaining capital was much easier in the city-state compared with other locations in the region.

Share of deal volume and value per market in 2022, Source: Singapore Venture Funding Landscape 2022, Enterprise Singapore, DealStreetAsia, March 2023

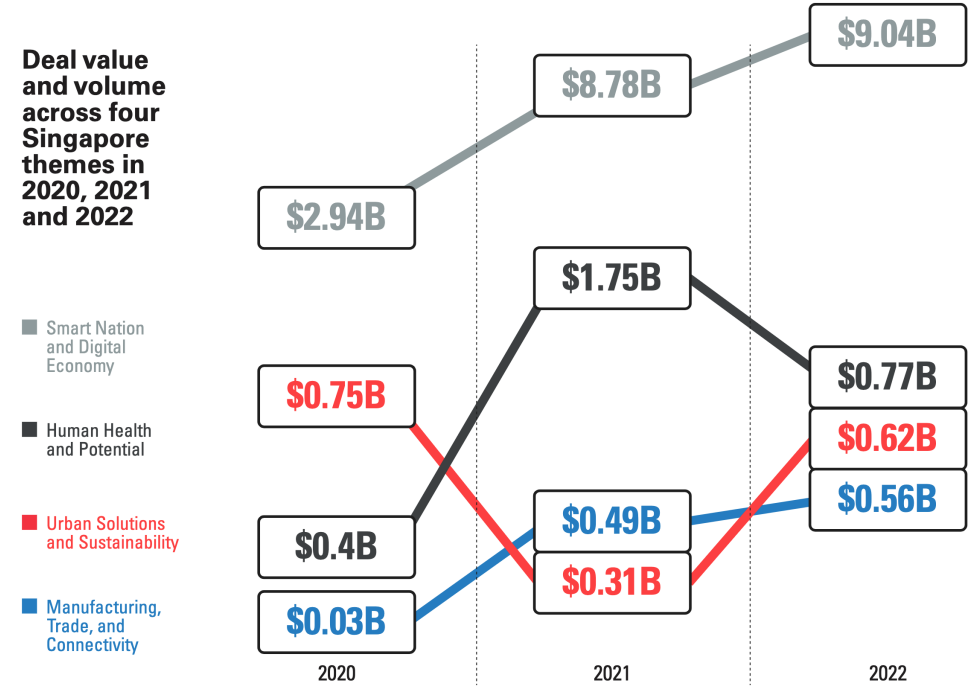

The study, which looks at four strategic domains, notes that dealmaking activity remained strong in the Smart Nation and Digital Economy category. In 2022, the sector continued its growth trajectory with total deal value increasing by 3% YoY.

Smart Nation and Digital Economy refers to capabilities intended to prepare both consumers and enterprises for opportunities in the digital space. It includes sectors such as fintech, gaming, e-commerce, software and IT, cybersecurity and data analytics.

Urban Solutions and Sustainability is another domain that recorded growth in funding last year with total deal value doubling from US$310 million in 2021 to US$620 million in 2022.

Venture funding in Singapore by themes, Source: Singapore Venture Funding Landscape 2022, Enterprise Singapore, DealStreetAsia, March 2023

Finally, another trend highlighted in the report is the rise of Singapore’s deep tech sector. Although the space witnessed a decline in deal volume (-36%) and value (-23.5%), deep tech startups managed to attain higher levels of maturity by securing later stage VC funding, the report says.

For example, Biofourmis and MiRXES, two biomedical technology companies, secured a US$320 million Series D and a US$87 million Series C, respectively, it notes. Additionally, at least seven startups completed Series B rounds last year.

With rising investors’ interest, continued support from the government, and Singapore’s robust infrastructure, deep tech startups in the city state are primed to grow this year. These are expected to emerge as an even more vital pillar in the local tech ecosystem, the report concludes.

Featured image credit: edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://fintechnews.sg/71124/funding/fintech-equity-funding-in-singapore-sees-slight-decline/