- The EUR/USD pair seems determined to hit new lows as the dollar gains ahead of FOMC.

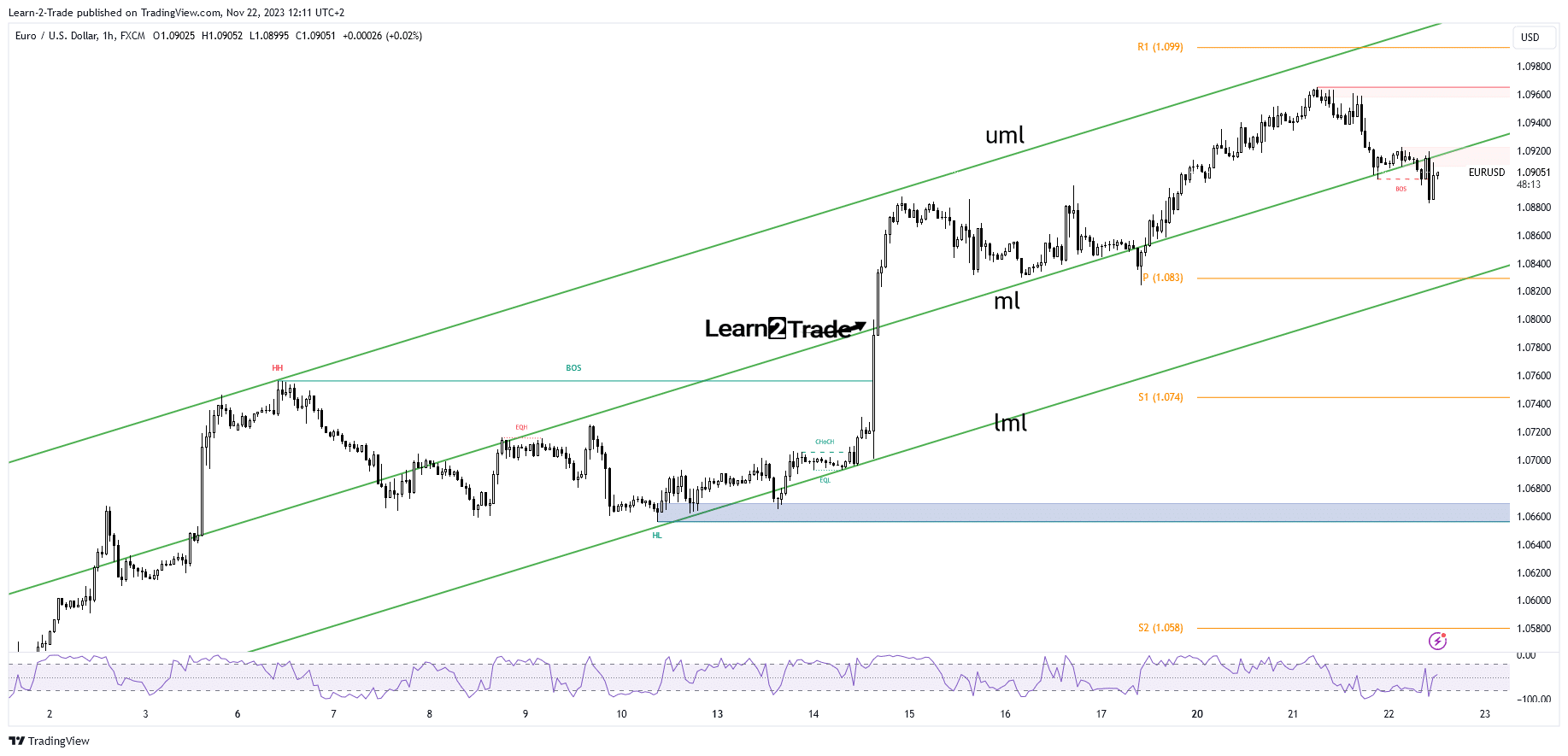

- The lower median line is seen as a potential target.

- The US data could have an impact later today.

The EUR/USD price went down, trading at 1.0899 at press time, way lower than yesterday’s highest point of 1.0963. The downtick move is attributed to the stronger US dollar.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The Greenback got stronger after Canada’s inflation numbers came out. The CPI and Core CPI showed higher inflation than last month’s reading. Even though US Existing Home Sales were not as good as expected, the US dollar is still strong in the wake of FOMC Meeting Minutes. The FED said they’re keeping the same monetary policy and won’t change the interest rates.

Today, US data could drive the market. The Unemployment Claims may drop from 231K to 226K last week. Also, Revised UoM Consumer Sentiment could go up from 60.4 to 61.1 points. Also, Durable Goods Orders might show a 3.2% drop after growing by 4.6% last time. Core Durable Goods Orders might show a 0.2% growth.

On the other hand, the Eurozone will release the Consumer Confidence indicator, which might stay at -18 points.

EUR/USD Price Technical Analysis: Down Leg

The currency pair failed to retest the ascending pitchfork’s upper median line (uml), signaling exhausted buyers. The pair has now dropped below the median line (ml), representing dynamic support.

–Are you interested to learn more about crypto signals? Check our detailed guide-

After its sell-off, the price could retest the median line (ml) before extending its sell-off. The downside obstacle turned into an upside obstacle, so false breakouts may result in a downside continuation. The lower median line (lml) and the weekly pivot point of 1.0830 represent key targets if the rate continues to drop.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-price-slips-below-1-09-as-market-awaits-fomc/