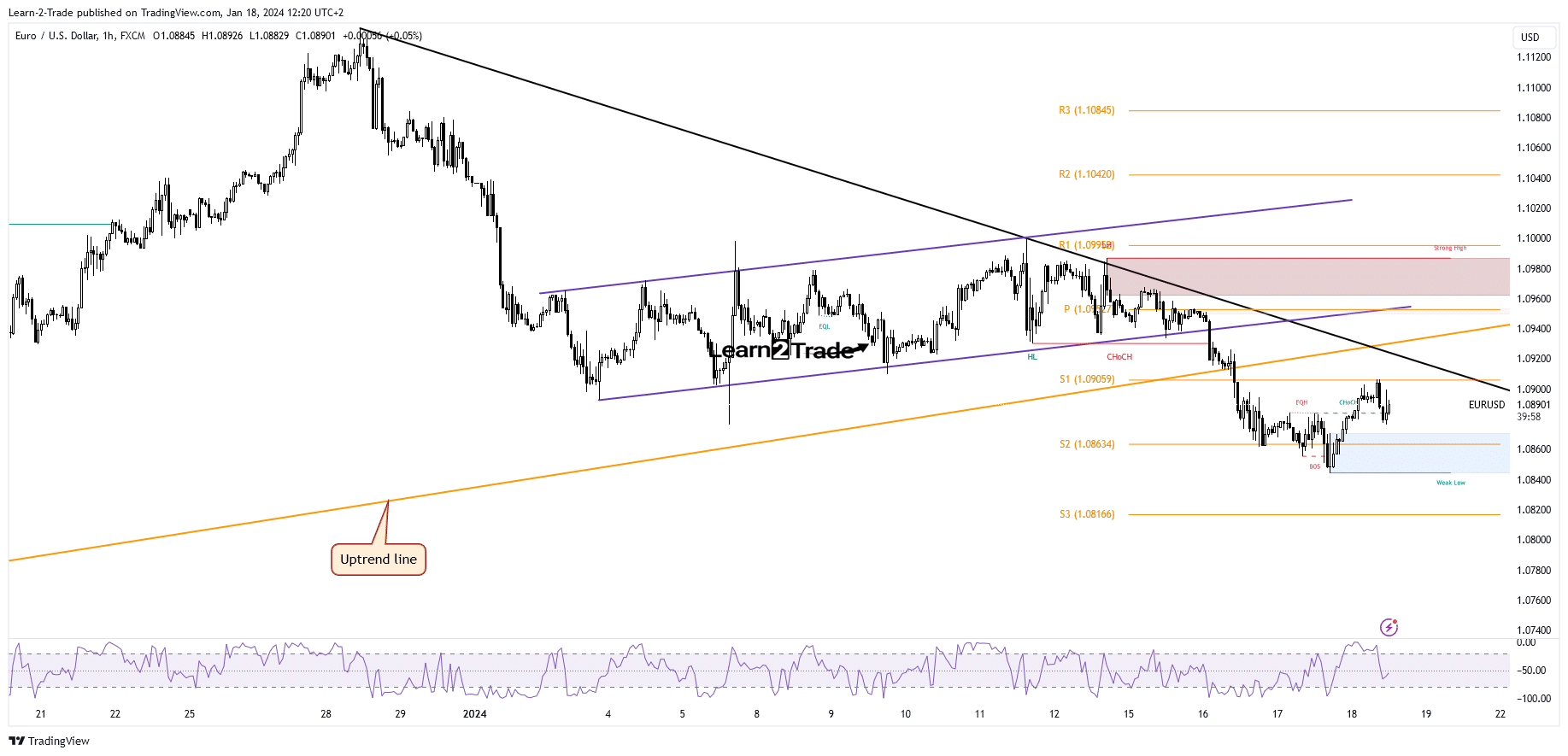

- The EUR/USD maintains a bearish bias if it stays below the downtrend line.

- A new lower low activates more declines.

- The US economic figures should bring more action today.

The EUR/USD price bounced back within the broad bearish trend. The US dollar’s minor correction weakened the greenback in the short term.

The pair is trading at 1.0889 at the time of writing, far above yesterday’s low of 1.0844. After the last sell-off, a minor rebound was expected before extending its downward movement.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Fundamentally, the US Retail Sales, Core Retail Sales, Import Prices, and Industrial Production came in better than expected in the last trading session. Only the Capacity Utilization Rate came in worse than expected.

Today, the Eurozone Current Account was reported at 24.6B compared to the 30.9B expected versus the 32.3B in the previous reporting period. The US session should bring some volatility as the US is to release important economic data.

The Unemployment Claims is expected at 206K above 202K in the previous reporting period, Building Permits could remain steady at 1.47M, the Philly Fed Manufacturing Index may jump to -6.6 points from -10.5 points, while the Housing Starts indicator could drop to 1.43M.

EUR/USD Price Technical Analysis: Downtrend

Technically, the EUR/USD price extended its downward movement after escaping from the minor up channel. This represented a downside continuation formation.

–Are you interested to learn about forex robots? Check our detailed guide-

The pair has also taken out the uptrend line, activating more declines. It has failed to stay below the weekly S2 of 1.0863, signaling exhausted sellers.

The bias remains bearish as long as it stays below the downtrend line. As you can see on the hourly chart, the rebound was stopped by the weekly S1 of 1.0905 before dropping again. Still, only a new lower low activates more declines.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/18/eur-usd-price-rejected-by-1-09-level-amid-risk-off/