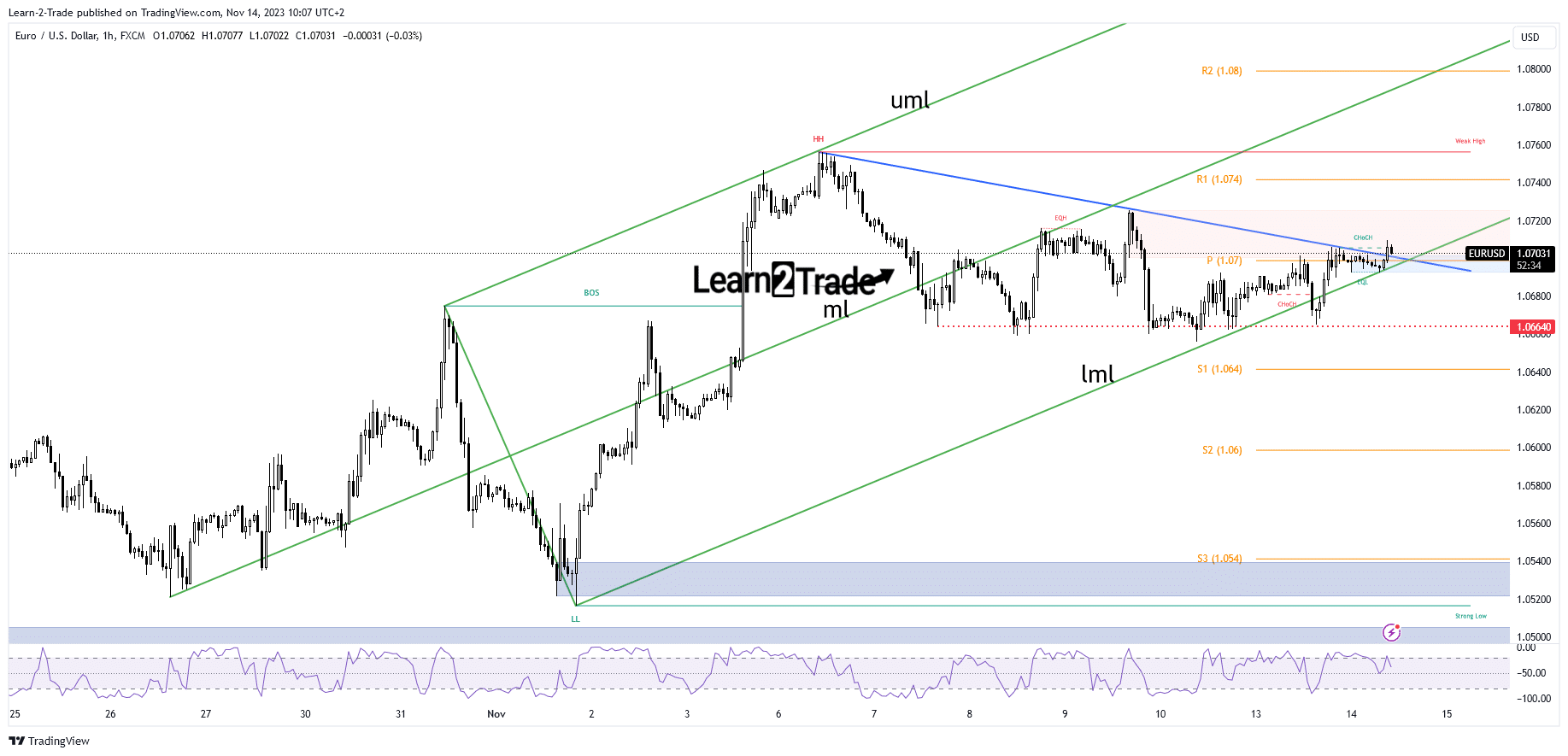

- The bias is bullish as long as it stays above the lower median line (lml).

- Taking out the former high activates further growth.

- The US CPI should bring sharp movements today.

The EUR/USD price gained in the late New York session as the US dollar slid again. Right now, things seem positive for Euro in the short term, even with small setbacks. Further pullbacks in the Greenback may stir a deeper correction.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

Yesterday, the US Federal Budget Balance was -66.6B, which was not as bad as the expected -70.5B. Before that, it was -171.0B. Today, we’re waiting for the Eurozone ZEW Economic Sentiment, expected at 6.1 points compared to the previous 2.3 points. German ZEW Economic Sentiment might be 4.9 in November, up from -1.1 in October. Also, the Eurozone Flash GDP might show a 0.1% drop, and Flash Employment Change might report a 0.2% growth.

The important stuff today is the US inflation figures. The CPI m/m might show a 0.1% growth, less than the 0.4% growth in September. The CPI y/y could announce a 3.3% growth, and Core CPI should show a 0.3% growth again in October. I think if inflation is lower, it might make the USD weaker.

EUR/USD price technical analysis: Wobbling in the supply area

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-price-mildly-gains-above-1-07-as-market-awaits-us-cpi/