Amid the altcoin market bounce back, the world’s second-largest crypto Ethereum has rallied 4% with the ETH price moving past $2,000 again.

Ethereum Whale Accumulation Continues

On-chain data provider Santiment said that as the Ethereum network growth shoots, the largest wallet addresses have accumulated more than 30% of the total ETH supply over the last year.

<!–

adClient.showBannerAd({

adUnitId: “34683725-0f88-4d49-ac24-81fc2fb7de8b”,

containerId: “my-banner-ad”

});

–>

In a recent development in the Ethereum space, the top 200 Ethereum wallets collectively possess 62.76 million ETH, valued at approximately $124.1 billion. Notably, these wallets have accrued 30.3% more coins since November 21, 2022. Furthermore, a surge in Ethereum wallet activity was observed, with a remarkable 94.7 thousand new ETH wallets created yesterday—the most substantial increase since July.

On the other hand, the demand for Ethereum derivatives is also on the rise. Maarten Regterschot, an analyst contributing to CryptoQuant, has highlighted a noteworthy trend in the Ethereum (ETH) market. His analysis points to a pattern of “systemic buying” in Ethereum futures, characterized by a substantial rise in open interest. Notably, Ethereum futures have experienced an influx of $700 million, suggesting a deliberate accumulation of assets over a specific timeframe.

Someone(s) are TWAP-buying on Ethereum futures

Recommended Articles

This linear growth in open interest indicates systematic buying over a certain period. There is $700 million added so far. pic.twitter.com/GCXK8u5yLL

— Maartunn (@JA_Maartun) November 22, 2023

ETH Exchange Supply Declines

Santiment data reveals that the supply of ETH tokens on exchanges has decreased by nearly 20% over the last six months. This decline in ETH supply on exchanges is at its lowest point in half a year, indicating a positive outlook for potential price increases in the altcoin. The reduced selling pressure on ETH suggests favorable conditions for upward movements.

<!– Before_Last_2_Para_desk_728x90 [async]

if (!window.AdButler){(function(){var s = document.createElement(“script”); s.async = true; s.type = “text/javascript”;s.src = ‘https://servedbyadbutler.com/app.js’;var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n);}());}

var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || [];

var abkw = window.abkw || ”;

var plc653687 = window.plc653687 || 0;

document.write(”);

AdButler.ads.push({handler: function(opt){ AdButler.register(180936, 653687, [728,90], ‘placement_653687_’+opt.place, opt); }, opt: { place: plc653687++, keywords: abkw, domain: ‘servedbyadbutler.com’, click:’CLICK_MACRO_PLACEHOLDER’ }});

–>

Concurrently, there is an uptick in activity from ETH wallets, a metric that gauges the demand for Ethereum among market participants and overall network engagement. Increased activity and the creation of new wallets during a price uptrend are often viewed as bullish indicators for the asset.

ETH Price to $3,000?

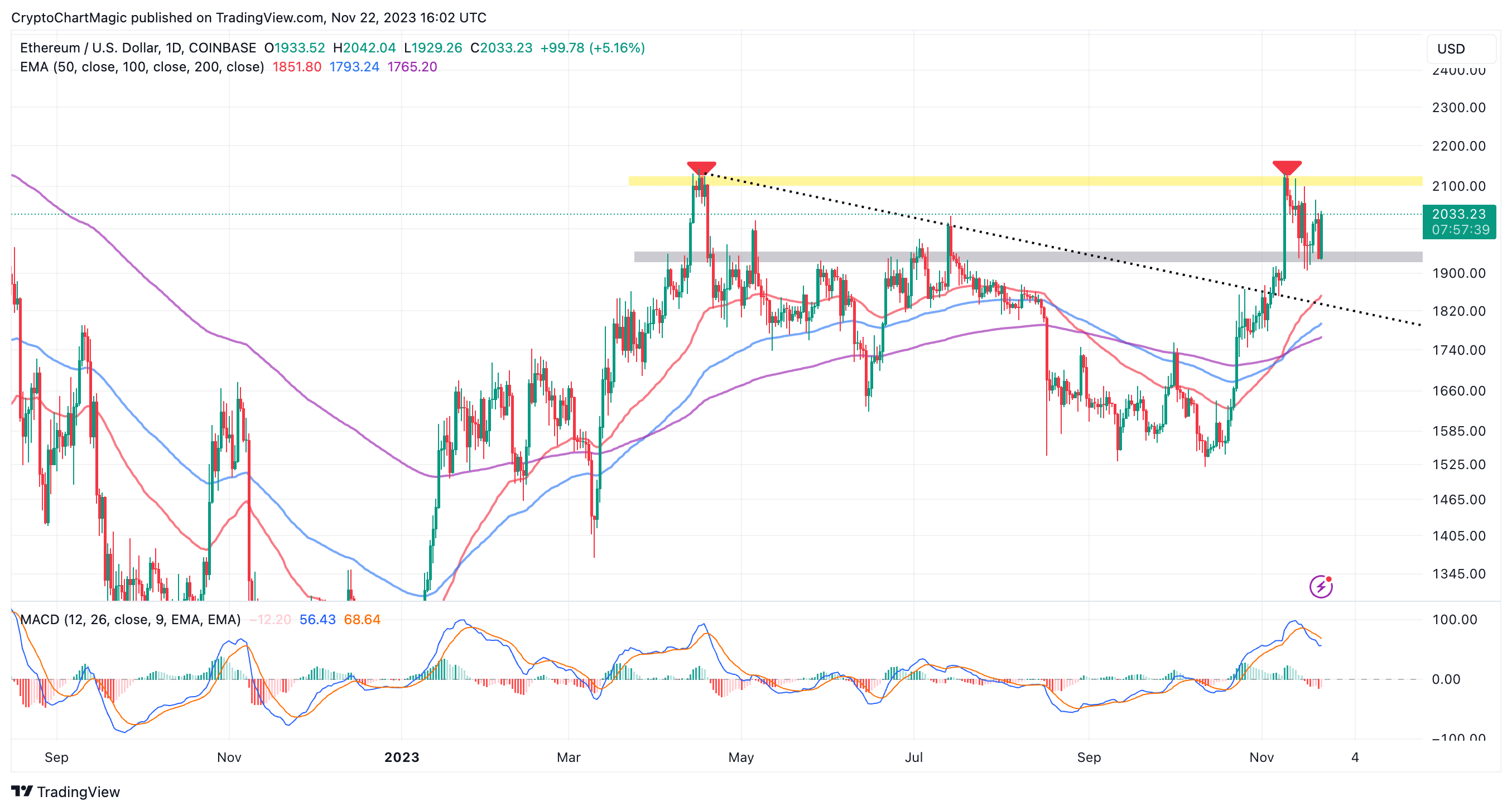

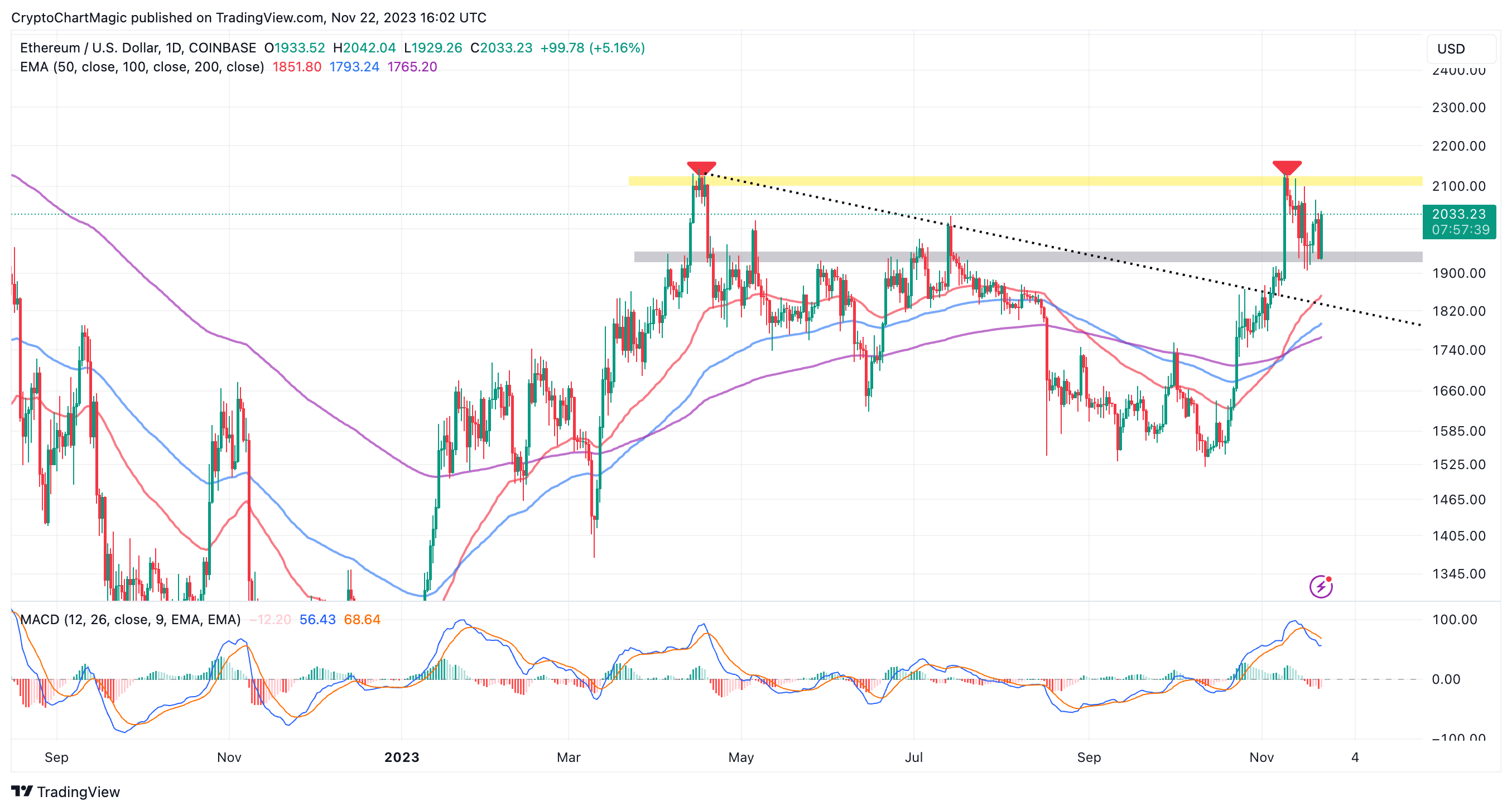

Ethereum’s price has gained momentum, surpassing the $2,000 support level and instilling confidence in traders with a bullish outlook. The recent rise from $1,930 signals a positive trajectory, hinting at a potential breakout towards the coveted $3,000 mark.

Supporting the optimistic sentiment are golden cross patterns, with the 50-day Exponential Moving Average (EMA) crossing above both the 100-day EMA and the 200-EMA around two weeks ago. To sustain the uptrend, Ethereum’s price faces crucial challenges at $2,130, where weakening resistance needs to be overcome, and $2,000, which must hold as a robust support level.

The successful breach of the $2,130 hurdle is pivotal for signaling increasing momentum and ensuring the continuation of the upward trend. Such a move could also negate the sell signal indicated by the Moving Average Convergence Divergence (MACD) indicator, potentially leading to another bullish breakout.

<!–

–>

<!–

–>

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://coingape.com/ethereum-eth-price-back-above-2000-amid-whale-accumulation/