India’s central bank, the Reserve Bank of India (RBI), has announced that 50,000 users have adopted the nation’s central bank digital currency (CBDC), the digital rupee.

In a press conference on Wednesday, RBI’s Deputy Governor Rabi Sankar stated that this development represented the first milestone in its CBDC’s project testing phase. In addition to the 50,000 users, it was also revealed that 5,000 merchants across India currently accept the digital rupee as payment for goods and services.

The RBI launched the wholesale digital rupee pilot on November 1, 2022. Exactly a month later, India’s apex bank began the first retail digital rupee pilot starting with eight banks in four Indian cities, namely Mumbai, New Delhi, Bengaluru and Bhubaneswar.

Since then, a total of 770,000 digital rupee transactions have been recorded across all participating banks. According to Deputy Governor Sankar, five more banks and eight additional cities are set to join the pilot in a short time.

India To Cautiously Introduce The Digital Rupee

Sankar also expressed RBI’s readiness to carefully implement the digital rupee to avoid any severe financial fallout. He said, “We want the process to happen, but we want the process to happen gradually and slowly. We are in no hurry to make something happen so quickly”.

Currently, the digital rupee pilot program is full, with the RBI not accepting any new users for now. However, it is expected that there will be new slots available in the next few months.

India is just one of many countries exploring the introduction of a central bank digital currency (CBDC) to their economy following the emergence of blockchain technology in the last decade.

According to data from the Atlantic Council CBDC tracker, there are currently 114 countries involved in the discourse around CBDCs. Around 60 of these countries are in the advanced exploration stage, while 11 nations have successfully adopted a CDBC. Examples of countries using a CBDC include China (Digital Yuan), Jamaica (Jam-DEX), Nigeria (eNaira), etc.

India’s Central Bank Still Not Convinced About Cryptocurrencies

While the Reserve Bank of India shows much receptiveness towards the idea of CBDC, the Indian apex bank maintains its negative stance on the use of cryptocurrencies. Shaktikanta Das, RBI Governor, has continuously recommended the complete ban of cryptocurrency over time.

Last month, he reemphasized this position at a banking summit in Mumbai, stating that crypto assets had no underlying value. He also added that adopting cryptocurrency will weaken the RBI’s authority and lead to the “dollarization of the economy”.

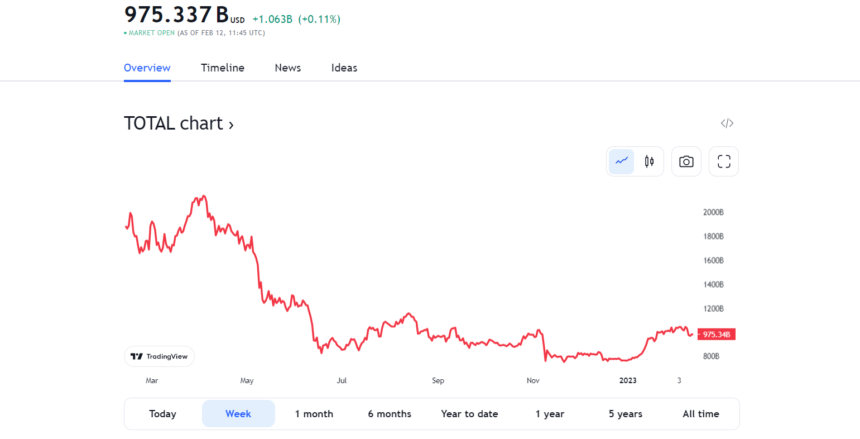

In other news, the crypto market is experiencing a general bearish trend, with many assets recording losses over the last few days. According to data by CoinMarketCap, BTC is down by 6.69% in the last week, while ETH is having it worse, losing 8.12% of its market value over the same period.

Current Total Crypto Market Cap Valued At $975.337 Billion | Source: TOTAL Chart on TradingView.com.

During this time, other major cryptocurrencies such as XRP, DOGE, and ADA have also experienced losses to the tune of 7.08%, 14.99%, and 8.43%, respectively. For now, it remains unknown how long the crypto market will keep sliding. However, the current bearish market state has been interpreted by many as merely a price correction, with another breakout set to occur in the coming weeks.

Featured Image: Hindustan Times, Chart from TradingView.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.newsbtc.com/news/digital-rupee-attracts-50000-users-says-indias-central-bank/