Report | March 20, 2024

Image: Coingecko 2024 RAW Report

Image: Coingecko 2024 RAW ReportTokenized Real World Assets Surge as Crypto Investments Attract Investors

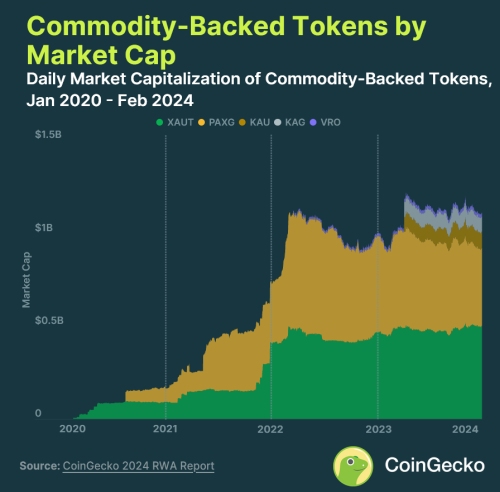

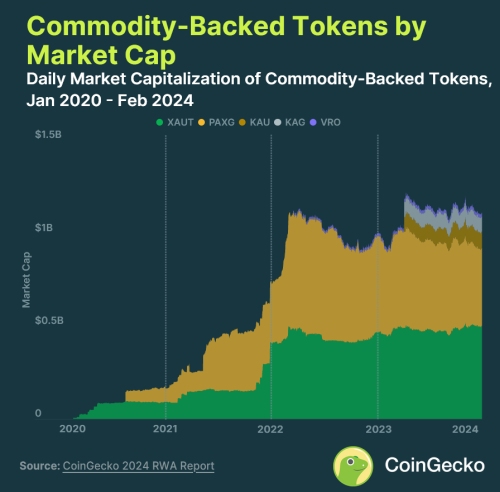

Coingecko has published a 2024 report on Real World Assets (RWAs), showing significant growth and diversification beyond fiat-backed stablecoins. With USD-pegged assets dominating the stablecoin market, the report also reveals a substantial rise in commodity-backed tokens (particularly gold), tokenized treasury products and demand for private credit by bridging traditional financial assets with the digital economy, offering enhanced liquidity, accessibility, and efficiency in asset management and investment.

See: Citi’s PoC Success in Private Market Tokenization

Real World Assets (RWAs) refer to tangible or intangible assets that exist in the physical world and have intrinsic value, such as real estate, commodities, art, and financial securities. In the context of blockchain and cryptocurrency, RWA tokenization involves converting the ownership rights of these assets into digital tokens on a blockchain, facilitating their trade, ownership, and management in a secure, transparent, and efficient manner. Tokenized RWAs are curating the landscape of crypto investments, offering a promising outlook for both retail and institutional investors.

- In 2024, USD-pegged assets continue to dominate the fiat-backed stablecoin sector, accounting for 99% of all stablecoins. Tether (USDT) remains the market leader with a staggering market capitalization, highlighting the growing trust and reliance on stable assets within the crypto ecosystem.

- The market cap for commodity-backed tokens has reached $1.1 billion, with gold-backed tokens like Tether Gold (XAUT) and PAX Gold (PAXG) making up 83% of this segment. This indicates a strong investor interest in tangible, value-storing assets within the digital domain. See Canadian project: Investors Launch Argo Digital Gold to Tokenize Gold

- The tokenized treasury market witnessed a 641% growth in 2023, showcasing the increasing appetite for safer, yield-generating crypto assets. Franklin Templeton emerged as a significant player, issuing a substantial amount of tokenized US treasuries and capturing a notable market share.

See: BoE Speech: 4 Areas at the Intersection of Payment Innovation, Tokenization, and Money

- The demand for private credit within the crypto space has seen a notable concentration in the automotive sector. Out of the total $470.3 million in loans extended by private credit platforms, car loans account for 42%, amounting to $196.0 million. In contrast, the fintech and real estate sectors represent a smaller portion of the debt, comprising 19% and 9% of the outstanding loans, respectively.

- Innovation continues: Lithuania-licensed crypto bank, Meld, in partnership with DeFi platform Swarm, plans to introduce lending and borrowing against tokenized RWAs, potentially revolutionizing retail investment strategies.

Outlook

As the crypto sector matures, the tokenization of real-world-assets is only a matter of time as the global investment paradigm democratizes assets to a broader range of assets for investors worldwide to create a more inclusive, efficient, and resilient financial ecosystem.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/coingecko-2024-report-investing-in-tokenized-rwas/