With the urgent need to mitigate climate change, the role of fossil fuel giants in exacerbating this crisis cannot be overstated. Concrete actions must be taken to address the environmental and social impacts caused by these entities. One such measure gaining traction is imposing taxes on fossil fuel companies.

This month, a groundbreaking report, titled “Climate Damages Tax” revealed a proposed tax on fossil fuel extraction capable of mobilizing nearly $720 billion by 2030. This tax offers a substantial financial boost to the world’s most vulnerable nations facing severe climate crisis.

Let’s deep dive into this new taxation rule and its impact on fossil fuel giants and the economy at large.

David Hillman, director of Stamp Out Poverty and co-author of the report, emphasized the report’s call to action.

“The richest, most economically powerful countries, with the greatest historical responsibility for climate change, need look no further than their fossil fuel industries to collect tens of billions a year in extra income”.

He elaborated that this robust approach could significantly augment the funds for the recently established “Loss and Damage Fund”, a key outcome of the COP28 summit in Dubai.

Stamp Out Poverty: Advocating for Global Finance Solutions

Stamp Out Poverty, founded in 2006, advocates for new finance sources to combat poverty and climate change globally. It established the Make Polluters Pay coalition in 2021, collaborating with international partners to secure an agreement for setting up a Loss and Damage Fund at COP27.

Emergence of the Loss and Damage Fund

The Loss and Damage Fund emerged from pressure from low-income countries seeking assistance in mitigating climate threats. Many developing nations lacking resources to address climate challenges or boost renewable energy capacities also supported this move.

The fund’s purpose is to aid countries globally in combating climate change. Representatives from 24 nations now need to determine the fund’s structure, contributor countries, and allocation criteria.

Abu Dhabi hosted the first board meeting of the Global Climate Fund for Loss and Damage on May 9, 2024.

The meeting focused on financing innovative solutions from COP28, held in Dubai’s Expo City in late 2023, and the agreements outlined in the “UAE Consensus.”

Abdullah Balalaa, Assistant Minister of Foreign Affairs for Energy and Sustainability emphasized the board’s crucial role in ambitiously implementing this commitment, reflecting the UAE’s resolute to creating a sustainable future for all.

Stamp Out Poverty’s new Climate Damages Tax report

The Climate Damages Tax (CDT) is a fee on the extraction of each tonne of coal, a barrel of oil, or cubic meter of gas, calculated at a consistent rate based on how much CO2e is embedded within the fossil fuel.

Thus, the tax report proposes

- Taxing major fossil fuel companies based in some of the world’s wealthiest countries could raise billions of dollars to address climate change.

- It would further promote renewable energy projects in low-income nations worldwide.

Furthermore, The Paris Agreement assigns greater responsibility to wealthier nations for addressing climate change due to record high carbon emissions. Rich countries made commitments at COP summits but took limited action afterward.

Media reports state that they haven’t raised enough funds or started new projects to aid low-income nations in fighting climate change. Introducing a tax on oil and gas producers in affluent countries such as the U.S., the U.K., Japan, Spain, and Canada could finance developing nations and attract more investment to the Fund.

Revenue Potential

- As already mentioned, the wealthiest Organisation for Economic Co-operation and Development (OECD) countries could yield up to $720 billion in climate funding by 2030.

- A rate of $5 per tonne of CO2 starting this year in OECD countries and increasing by $5 a tonne each year would provide $900 billion in funding by 2030.

In an optimist’s opinion, taxing fossil fuel giants could boost climate finance by $900 billion by the end of the decade. The authors of the report propose allocating $720 billion of this to the Loss and Damage Fund, aiding countries most affected by climate change. The remaining funds could support the rich nations transitioning to the green revolution.

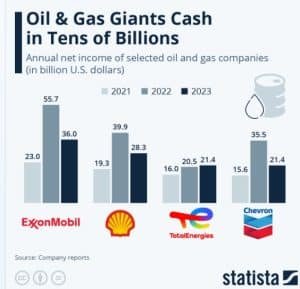

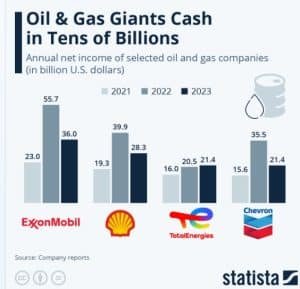

Several media reports say that recent profit levels for companies like ExxonMobil, Chevron, BP, and Shell have seen exponential growth. The industry, with its substantial resources, can afford higher taxation. Given the companies’ historical responsibility and financial capacity, imposing greater taxes on the fossil fuel sector should be a priority.

Investment Opportunities

The funds generated from taxing fossil fuel companies could be allocated strategically to address the most pressing climate-related challenges. Priority areas for investment include:

Infrastructure Resilience

Building infrastructure to withstand the impacts of extreme weather events such as floods, hurricanes, and wildfires is crucial. Investments in resilient infrastructure can help communities bounce back quicker from climate-related disasters.

Natural Resource Management

Protecting and restoring ecosystems such as forests, wetlands, and coastal areas sequesters carbon and enhances resilience to climate change. Funds can be directed towards conservation efforts and sustainable land management practices.

Community Resilience

Vulnerable communities disproportionately bear the brunt of climate change impacts. Thus, investing in community-based adaptation projects, such as early warning systems, heatwave preparedness, and social safety nets, can enhance resilience and reduce vulnerability.

Research and Innovation

Continued research and innovation are essential for developing cutting-edge technologies and solutions to address climate challenges. Funding research initiatives focused on renewable energy, CCS, and climate-smart agriculture can accelerate the transition to a low-carbon future.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/climate-damages-tax-to-raise-720b-from-fossil-fuel-giants/