Report | Nov 9, 2023

According to the latest CB Insights report Q3, global fintech funding saw a 3% decrease quarter-over-quarter, settling at $7.4 billion, with deal numbers dropping by 18%.

Despite this, the year-to-date figures remain robust, with $30.5 billion funded across 2,849 deals.

Global Fintech Funding and Investment Trends

- The global fintech funding for Q3 2023 was $7.4 billion, down 3% quarter-over-quarter (QoQ), with the number of deals falling by 18% QoQ.

- The total fintech funding reached $30.5 billion across 2,849 deals in 2023 year-to-date (YTD).

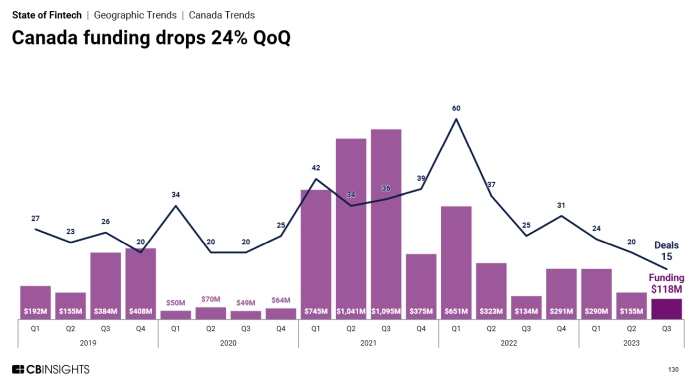

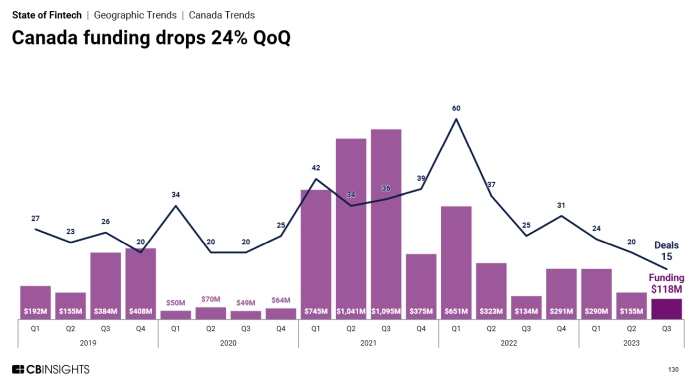

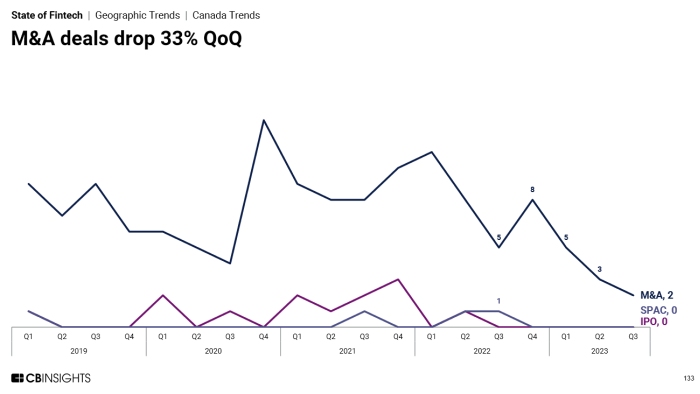

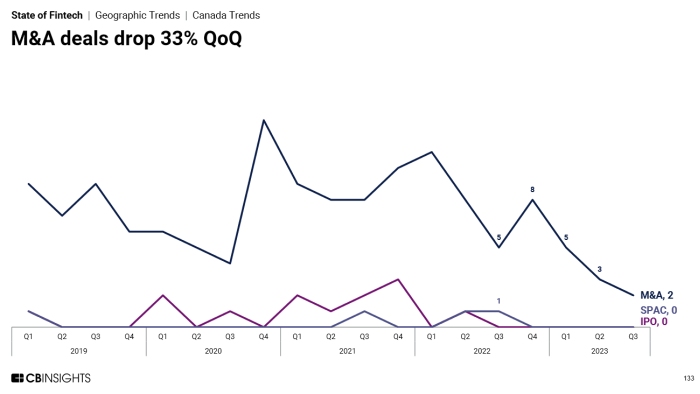

- The US leads in quarterly funding and deals in Q3 2023, with Canada’s fintech funding at $0.1 billion across 15 deals.

- The US accounted for nearly half (47%) of all quarterly fintech funding in Q3 2023, with Asia following at 27%.

- The median deal size globally has decreased in 2023 YTD, with LatAm being the only region to see growth in median deal size.

See: Discover the Future of Finance with Michael King’s “Fintech Explained”

- Digital lending leads in funding, while insurtech leads in deals in Q3 2023.

- There were three new fintech unicorns in Q3 2023, maintaining the same pace as the previous quarter and bringing the total fintech unicorn count to 312.

- Mega-round funding rose by 50% QoQ to hit $2.4 billion across 14 deals, although this was still the second-lowest quarter for mega-round funding since 2016.

- The report also notes a general decrease in the global average and median deal size in 2023 YTD, indicating a trend towards smaller, more strategic investments across the fintech landscape. Despite this, the fintech sector continues to attract significant investment, reflecting confidence in its long-term potential.

Global Sector Specific Updates

- Digital lending saw the largest funding jump in Q3 2023, indicating a strong investor interest in platforms that offer digital loans. This sector’s funding boost was driven in part by mega-rounds, which brought in more than half of the sector’s quarterly funding. For example, India-based data analytics solution Perfios raised the largest digital lending round with a $229 million Series D.

- Insurtech followed digital lending with a 22% increase in funding. This sector led in the number of deals, with 119 deals amounting to $1.1 billion in Q3 2023, showcasing the growing interest in technology-driven insurance services. See:

See: 2023 Canadian Insurtech: What You Need To Know

- The payments sector also remained a significant area of interest, with 73 deals totaling $1.1 billion. This demonstrates the ongoing demand for innovative payment solutions in a world that is increasingly moving towards cashless transactions.

- Wealth tech, which includes technology that assists with investment, personal finance, and wealth management, saw 33 deals with a total funding of $0.2 billion.

- The banking sector, encompassing digital banks and banking technology providers, had 20 deals and raised $0.3 billion.

- Capital markets sector, which includes technologies for trading, investments, and other capital market functions, had 24 deals with a total funding of $0.3 billion.

Canadian Fintech Spotlight

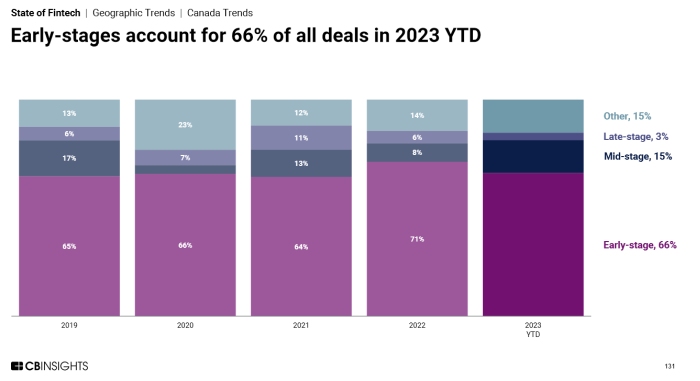

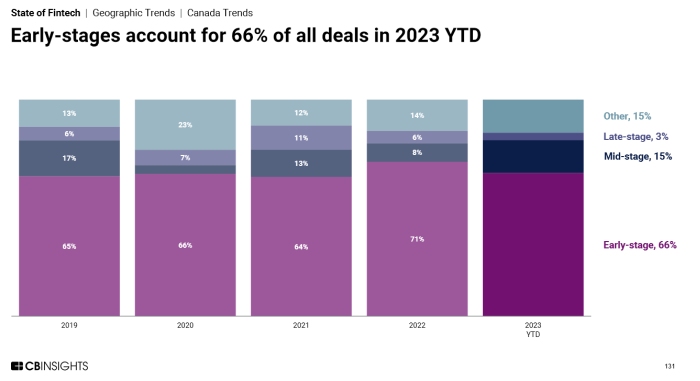

In Canada, fintech funding mirrored the global trend with a modest $0.1 billion across 15 deals in Q3 2023. Despite the global downturn, the Canadian fintech ecosystem has shown resilience. The median deal size in Canada, as in many other regions, has seen a decrease in 2023 YTD, reflecting a broader trend of smaller, more strategic investments.

See: KPMG Report H1 Canadian Fintech Funding: Echoes Early COVID-19 Days with Dramatic Investment Plunge

The Canadian fintech sector, while small in global comparison, is a hub of innovation. The country’s financial institutions and startups have been quick to adopt and integrate new technologies, from blockchain to AI, to improve customer experiences and operational efficiency.

Top Q3 Equity Deals in Canada

- Mindbridge: Secured a Growth Equity round of $60 million on July 25, 2023. The investors were not disclosed in the summary.

- Local Logic: Raised $13 million in a Series B round on August 2, 2023. The investors included Groundbreak Ventures, Investissement Quebec, Cycle Capital, Jones Boys Ventures, and Shadow Ventures.

- Foxquilt: Garnered $12 million in a Seed VC round on July 25, 2023. The specific investors for this deal were not mentioned in the summary.

- Radiant Capital: Obtained $10 million in a Series A round on July 20, 2023. The investors were not listed in the summary.

See: How AI is Shaping the Future of Financial Services in Canada

- Niricson: Raised $7 million in a Venture Capital round on August 2, 2023. Investors included MUUS Climate Partners, Sustainable Development Technology Canada, Bentley Systems, and Forward Venture Capital.

- FlipGive: Both on September 5 and August 31, 2023, FlipGive raised $4 million in a Series B round. The investors included BDC Capital and Framework Venture Partners.

- Bequest: Secured $3 million in a Seed VC round on July 4, 2023. The summary did not specify the investors.

- Octav: Also raised $3 million in a Seed VC round on September 12, 2023. The investors were not disclosed.

- Lexop: Raised $1 million in an undisclosed round on September 13, 2023. The investors were not mentioned.

- Peloton: Secured $1 million in a Convertible Note round on July 10, 2023. Specific investors were not listed.

- Trolley: Raised $1 million in a Seed VC round on July 24, 2023. Investors included Nyca Partners and Mark Cuban.

These deals reflect a diverse range of investment stages and sectors within the Canadian fintech landscape, indicating a healthy mix of early-stage innovation and growth-stage expansion.

Conclusion

In conclusion, while the global fintech funding has seen a slight contraction, the sector’s overall health remains strong.

See: OSC/EY Report: AI in Fintech Use Cases

The Canadian fintech ecosystem continues to grow, driven by a wave of innovation and strategic investment. The fintech industry’s adaptability and resilience are likely to continue, underpinning its critical role in the broader financial services landscape.

Download the full 191 page PDF report –> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/cb-insights-global-fintech-q3-2023-canada-spotlight/