The carbon market emerges as a cornerstone in the global agenda to support nature restoration, offering a nuanced approach through its bifurcation into compliance and voluntary sectors. This dichotomy not only serves to meet the regulatory mandates designed to curb carbon emissions but also provides a flexible platform for entities to contribute beyond the minimum requirements, facilitating a broader engagement in environmental action.

View from below of young tree seedlings growing in a forest.

View from below of young tree seedlings growing in a forest.

The compliance market: regulatory mandates for emission reduction

The compliance or regulatory carbon market is instituted by national or international policies, mandating certain industries and organisations to achieve specific emission reduction targets. This segment operates under schemes such as cap-and-trade or carbon taxes, where the total allowable emissions are capped. The cap is designed to decrease over time, tightening the emission limits and compelling entities to either reduce their emissions or purchase additional allowances from others who have surplus units from reducing their own emissions below the cap. This mechanism incentivises emission reductions and fosters a market-driven approach to achieve cost-effective environmental outcomes.

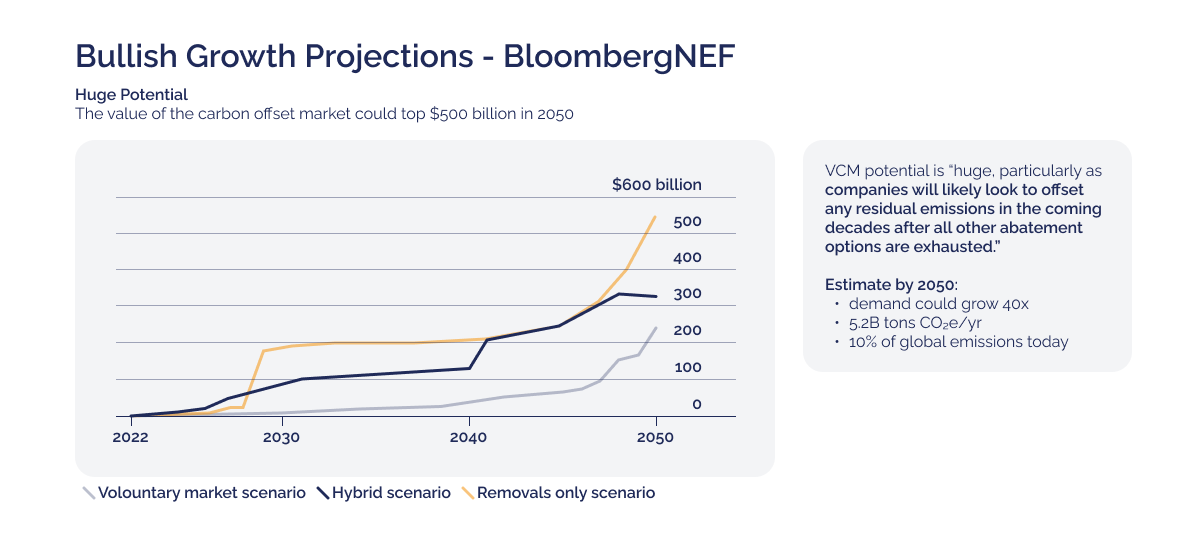

Bullish Growth Projections illustration.

Bullish Growth Projections illustration.

The verified carbon market (VCM): beyond compliance

In contrast, the verified carbon market (VCM), also known as the voluntary carbon market or project-linked carbon market, caters to entities—including businesses, governments, and individuals—that willingly commit to offset their carbon footprint. Participants in the VCM invest in carbon units (also known as carbon credits) by funding projects that either prevent the emission of carbon dioxide equivalent (CO2e) emissions or remove CO2e emissions from the atmosphere. These projects can range from energy-efficient cookstoves and forest conservation to habitat restoration and reforestation efforts. The VCM is not only about compensating for unabatable emissions but also about contributing to Sustainable Development Goals, such as enhancing biodiversity, supporting local communities, and promoting renewable energy adoption.

Read more: The interconnected world of carbon: exploring key carbon market concepts

Bridging regulatory goals and voluntary initiatives

The dual structure of the carbon market offers a comprehensive approach to tackling environmental crises. The compliance market ensures that industries with significant emissions face a regulatory imperative to transition towards lower carbon operations, laying the groundwork for achieving national and international emission reduction targets.

The VCM complements regulatory frameworks by filling gaps where official policies may not reach and by offering additional incentives for emission reductions. While compliance markets enforce caps on emissions for certain sectors, VCMs allow for a wider participation, including sectors and geographies not covered by regulations. This complementary relationship enhances the overall effectiveness of environmental policies, driving investment into sustainable projects worldwide. VCMs also serve as testing grounds for carbon reduction technologies and methodologies that could be integrated into compliance markets in the future. Furthermore, by setting high standards for project verification and carbon unit quality, VCMs help raise the bar for environmental integrity across all markets, influencing regulatory frameworks to adopt more rigorous standards.

Read more: The importance of carbon offsetting in achieving net zero

This dual market structure enables a dynamic and multifaceted response to environmental emergencies, accommodating the diverse capacities and ambitions of global actors. It allows for the harnessing of market forces to drive innovation and investment in low-carbon solutions, facilitating a transition towards a sustainable economy. By operating in tandem, these markets play critical roles in steering the global community towards achieving its collective environmental goals.

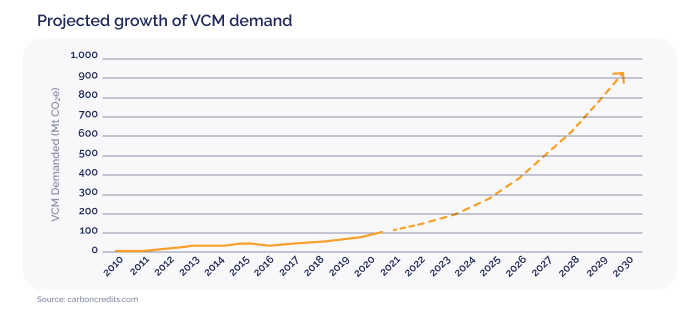

Growing interest in verified carbon markets

The demand for VCM solutions has seen a significant uptick, driven by a confluence of factors. Corporations, in response to pressure from consumers, investors, and stakeholders, are increasingly committing to net-zero targets, necessitating the procurement of carbon reduction units to compensate for emissions they cannot eliminate through direct reductions. This surge in corporate commitment is paralleled by a growing societal emphasis on sustainability, where both individuals and institutions seek actionable pathways to contribute to environmental goals. Additionally, the recognition of carbon offsets by international agreements and compliance markets, such as CORSIA for aviation, underscores the expanding role of the VCM in the broader environmental action landscape. The demand is further bolstered by the desire to support projects with co-benefits, such as biodiversity conservation, water purification, and community development, highlighting an evolution in market motivations towards holistic environmental and social impacts.

Expanding upon the ascendance of VCMs, we delve deeper into the dynamics that underscore this burgeoning interest, leveraging the pivotal facts and figures provided to illustrate the market’s growth and its role in the broader environmental action framework.

The VCM has experienced exponential growth, underpinned by a surge in corporate and individual commitment towards achieving net-zero emissions. This growth is not just a reflection of heightened environmental awareness but also an acknowledgement of the VCM’s critical role in facilitating a broader, more inclusive approach to carbon reduction. The VCM’s flexibility and its capacity to complement regulatory efforts make it a cornerstone in the global pursuit of sustainability.

Organisations who have offset emissions in January 2024, illustration.

Organisations who have offset emissions in January 2024, illustration.

A testament to the VCM’s rising prominence is its projected expansion to a market value between $10 billion and $40 billion by 2030. This forecasted growth is indicative of the market’s response to an escalating demand for carbon units, fueled by an increase in corporate net-zero pledges and the acknowledgement of voluntary carbon reduction units by compliance markets such as CORSIA (the Carbon Offsetting and Reduction Scheme for International Aviation).

Read more: Unveiling hidden carbon footprints: overlooked emissions sources in business operations

The market’s growth is also bolstered by the challenges corporations face in reducing carbon emissions within their value chains. The increasing agreement on using offsets towards interim net-zero targets underscores the VCM’s role as a pragmatic solution to these challenges. In 2023, significant optimism was observed among market participants, with 71% believing that the VCM will be able to accommodate the burgeoning demand stemming from companies’ net-zero commitments and pledges to reduce emissions by 2030. This represents a modest increase from the previous year’s confidence levels, signalling a strengthening consensus on the VCM’s capacity to support wide-ranging environmental goals.

Investments in carbon credit projects have shown remarkable momentum in the past years, with a total of $36 billion allocated to over 7,000 projects from 2012 to 2022. This investment spree, particularly noticeable with $17 billion invested between 2021 and 2023, reflects the corporate world’s escalating commitment to carbon offsetting as a means to achieve their targets. Notably, 2022 alone saw an infusion of $7.5 billion, underscoring the accelerated pace at which the market is expanding.

The focus on nature-based solutions (NBS) is particularly noteworthy, with over 80% or $15 billion of the funding raised dedicated to projects involving nature restoration and improved forest management. These initiatives cover an expanse nearly the size of Italy, highlighting the significant potential of NBS in supporting nature recovery.

Read more: The rising demand for nature-based credits

The VCM is at a critical juncture, with its trajectory poised for significant growth. The investment trends, coupled with the optimistic market sentiment, underscore the VCM’s vital role in the global environmental action framework. As the market matures, the focus on quality, transparency, and integrity will be paramount in ensuring that the VCM not only meets the increasing demand for carbon offsets but also delivers on its promise of contributing to meaningful and sustainable emission reductions. This balance between growth and quality will define the future of the VCM, reinforcing its position as an indispensable tool in the quest for a sustainable and net-zero future.

Forward momentum on carbon pricing

Enhancing the narrative on the growing importance of the VCM, we take a look at carbon pricing, delving into the specifics of market sentiment, future projections, and the underlying factors that contribute to its positive forecast. Drawing upon the insights from the PwC UK survey of International Emissions Trading Association (IETA) members, we can explore the dynamics shaping the future of carbon pricing.

Read more: Cracking the code of carbon pricing: How does it work?

The positive sentiment surrounding global carbon prices is strongly evidenced by the findings from the latest survey conducted by PwC UK, which engaged over 180 IETA members. This optimism is not a fleeting trend but a reflection of a deep-seated belief in the market’s long-term trajectory towards higher prices. Several key insights from the survey help to illuminate the reasons behind this bullish outlook.

Market participants express a unanimous expectation for a continued rise in carbon prices across the board. This anticipation of growth is significant, even though the expected rate of increase may have tempered slightly compared to previous years. The persistence of bullish sentiment from surveys in 2022 and 2021 highlights a consistent expectation of upward price trends across global carbon markets. This confidence is partly anchored in the projected impacts of policy actions and regulatory frameworks aiming to intensify emissions reduction efforts.

A critical driver of this projection is the anticipation of ambitious emissions reduction proposals by the European Commission for the EU’s 2040 climate targets. Nearly half of the survey respondents (46%) expect that the European Commission will propose an emissions reduction target of 75% or greater. Such ambitious targets are likely to tighten the supply of allowances and increase the cost of emitting CO2, thereby pushing carbon prices upward.

Read more: Carbon pricing: global solutions for a global challenge

The survey also sheds light on specific regional expectations that contribute to the overall bullish sentiment on carbon prices. For example, significant developments are anticipated in the US, with the majority of respondents (68%) expecting the extension of the California Cap-and-Trade Program beyond 2030. This extension signals continued and possibly enhanced regulatory efforts to curb emissions in one of the world’s largest economies, likely influencing carbon prices positively.

Furthermore, the survey highlights a growing optimism for the development of carbon pricing mechanisms in Latin America, particularly in Brazil, Chile, and Colombia. The expectation that these countries will launch operational Emissions Trading Systems (ETS) by 2026 suggests an expanding geographical scope for carbon pricing, which could further stimulate demand for carbon offsets and elevate prices.

The survey does indicate a cautious adjustment in price expectations for the 2023–2025 and 2026–2030 periods, with a noted decrease for almost all markets except for the EU ETS price for the 2026–2030 period, which remains projected at €100/tCO2. This nuanced perspective reflects a more measured expectation, acknowledging the complexities of market dynamics while maintaining confidence in the long-term trend of rising prices. For instance, the EU ETS price already reaching €100.34/tCO2 in February 2023 and the UK ETS price hitting £97.75/tCO2 (€115) in August 2022 exemplifies how current prices are aligning with or even surpassing these long-term projections.

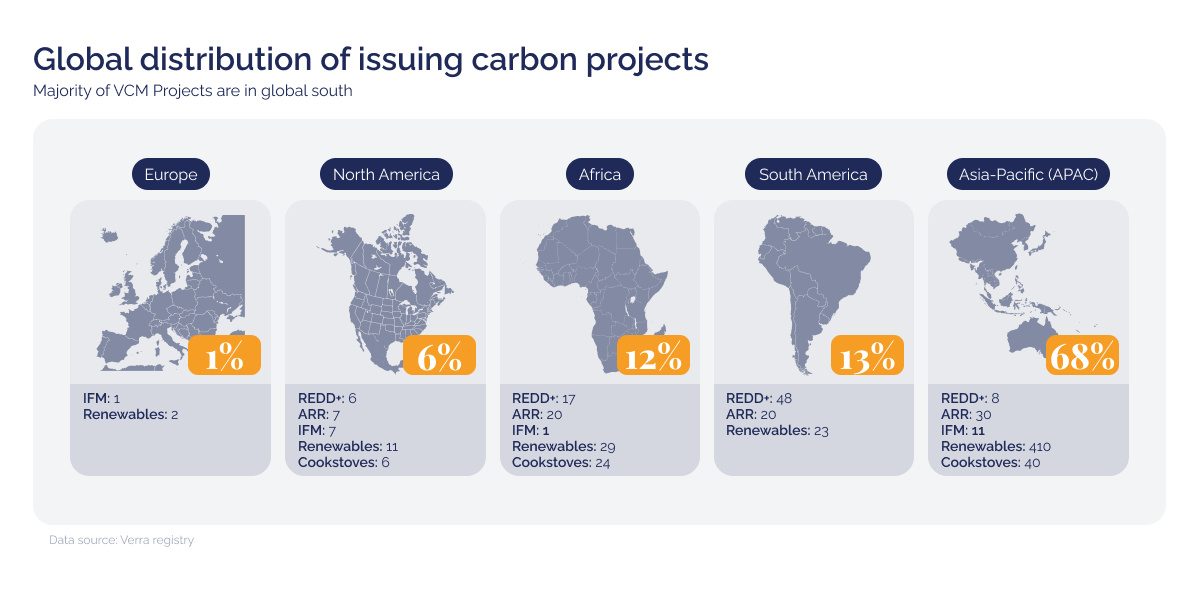

Global distribution of issuing carbon projects, illustration.

Global distribution of issuing carbon projects, illustration.

The carbon price’s bullish growth projections are further supported by the EY Net Zero Centre, which forecasts a verified emission reduction price rise of 9.5% to 15.0% per year towards 2035 and a 4.0% to 6.0% price increase from 2035 to 2050.

From a carbon market perspective, EY, McKinsey, and BCG, alongside Morgan Stanley, which all anticipate a multi-fold expansion, suggest a market value ranging from $30 billion to $50 billion by 2030. The more optimistic outlooks from Goldman Sachs and Wood Mackenzie forecast a market size of $100 billion by 2030, indicating potential for exponential growth if the right conditions and commitments persist. A conservative projection comes from PwC, estimating growth of up to $30 billion by the same year—still a 10-fold growth compared to today’s $3 billion market. The consensus across all price and market predictions is the rapid and substantial growth of the market, marking it as a promising long-term investment opportunity.

Projected growth of VCM demand, illustration.

Projected growth of VCM demand, illustration.

Nature-based solutions as a prominent compensation option

Nature-based solutions (NBS) are increasingly recognised as a vital component in the portfolio of environmental-forward strategies, particularly within the context of the VCM. NBS involves the sustainable management and utilisation of natural ecosystems to tackle a range of societal challenges, encompassing deforestation, water security, water pollution, food security, human health, and disaster risk management. In the realm of safeguarding nature, NBS primarily focuses on enhancing the capacity of natural ecosystems to absorb or store carbon dioxide from the atmosphere, thus serving as a natural carbon sink.

Types of carbon credits, illustration.

Types of carbon credits, illustration.

In the VCM, NBS projects are a popular option for compensating hard-to-abate carbon emissions as many such projects, like the ones of DGB Group, offer various advantages in addition to carbon mitigation. By investing in projects that restore or conserve natural ecosystems, companies and individuals can compensate for their emissions through the carbon reduction units generated by these projects. The attractiveness of NBS in the VCM thus lies not only in their effectiveness in sequestering carbon but also in their ability to deliver a wide range of environmental and social co-benefits.

Explore DGB’s impactful nature-based projects

To ensure the integrity and effectiveness of NBS carbon reduction units, rigorous standards and certification processes are applied. These processes verify the amount of carbon sequestered or emissions avoided and ensure that the projects contribute to Sustainable Development Goals. Such verification is crucial to maintaining trust in the VCM and ensuring that NBS projects provide real, measurable, and long-term benefits to nature and communities.

DGB Group’s nature-based solutions: your path to reduced emissions

Nature-based initiatives are pivotal in advancing towards net-zero objectives, as they not only capture and store carbon but also play a vital role in ecosystem preservation and community empowerment. These initiatives pave the way for sustainable and resilient responses that contribute significantly to global environmental protection while also being integral to the expanding scope and impact of carbon markets.

Local man working in a tree nursery, Hongera Reforestation Project, DGB.

Local man working in a tree nursery, Hongera Reforestation Project, DGB.

As carbon markets continue to grow and evolve, the role of nature-based solutions becomes increasingly central. This growth is driven by a rising demand for carbon units, which are often generated through projects like reforestation. These projects not only help achieve environmental targets but also offer a tangible way for individuals, organisations, and governments to contribute to global carbon mitigation efforts. They are instrumental in revitalising ecosystems, safeguarding biodiversity, and enhancing the health and wellbeing of both communities and the planet. That is why DGB is ideally positioned for growth and impact. With our NBS, we offer individuals, organisations, and investors the opportunity to benefit from the carbon market and rising demand for carbon reduction units. We can help you measure, reduce, and compensate for your carbon footprint with verified carbon units.

Start measuring your carbon footprint

By spotlighting the transformative impact of nature-based projects and their contribution to carbon markets, we can ignite a movement towards a greener, more sustainable future. It’s time to acknowledge the significant role of these initiatives in not only achieving environmental goals but also in bolstering the growth of carbon markets. By investing in NBS with DGB, you reduce your environmental impact and benefit from the growing carbon market, all while making a positive impact on nature.

Contribute to safeguarding nature with DGB’s carbon units

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.green.earth/blog/bullish-growth-projections-in-the-carbon-market-1