Recent data has brought to light a significant trend in the Bitcoin (BTC) market, revealing that the largest Bitcoin whales are actively accumulating billions of dollars worth of the leading digital asset in 2024.

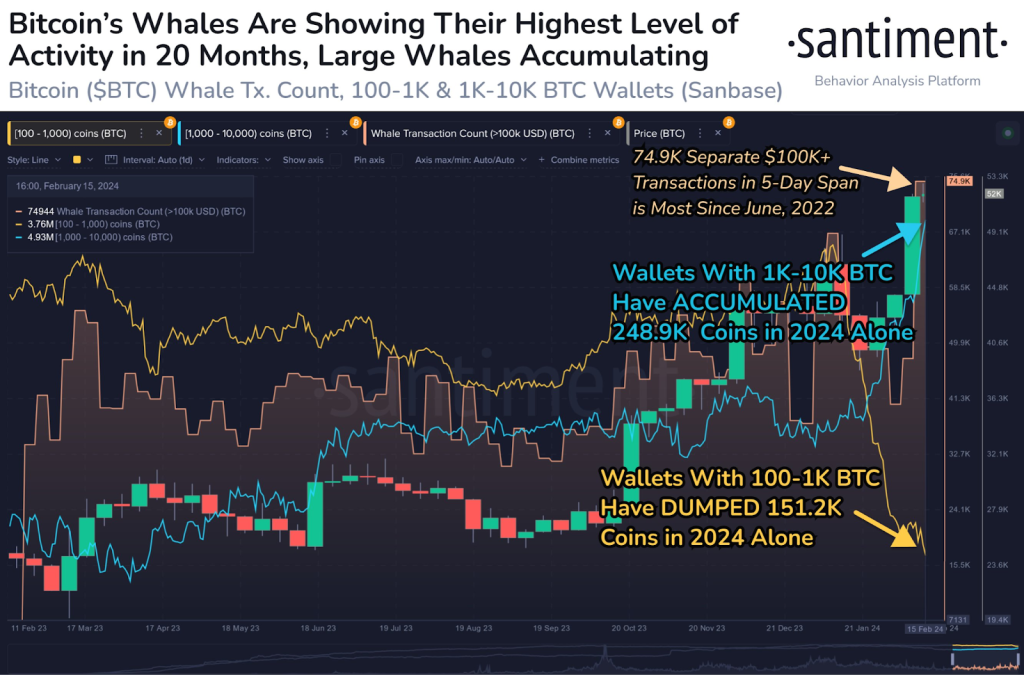

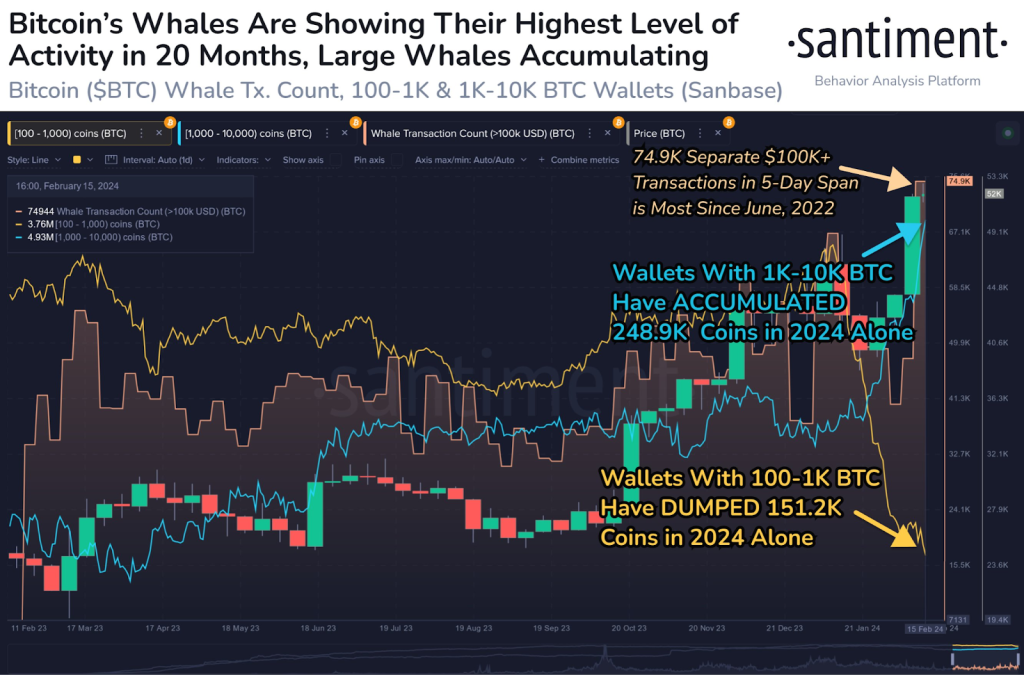

A recent analysis by market intelligence platform Santiment, sheds light on the dynamic movements within the bitcoin space, particularly among entities holding substantial amounts of BTC.

Bitcoin Whales Accumulate Staggering $12.95 Billion

Santiment highlights a distinctive shift in the behavior of different-sized bitcoin wallets. Notably, digital wallets containing 100 to 1,000 BTC have been involved in selling bitcoin throughout the year. On the other hand, the wallets with holdings ranging from 1,000 to 10,000 BTC have been engaged in an aggressive buying spree. The data reveals a clear pattern:

- 1,000-10,000 BTC wallets: A staggering $12.95 billion has been added to these wallets in 2024.

- 100-1,000 BTC wallets: Conversely, wallets in this range have witnessed a net decrease of $7.89 billion in Bitcoin holdings in 2024.

This data signals a noteworthy accumulation of bitcoin by larger wallets, far surpassing the selling activities of smaller whale cohorts. Santiment explains these developments, stating:

“The net difference in these smaller and larger wallets typically associated with the highest tiers of active whales indicates an estimated +$5.06 billion in Bitcoin accumulation by 100-10,000 BTC wallets thus far this year.”

Moreover, according to the post, there has been a surge in transactions surpassing the $100,000 value mark within the last five days, reaching the highest level observed since June 2022. This increase in activity reflects a notable uptick in interest from significant stakeholders.

“There has been a clear rise in interest from key stakeholders after Bitcoin’s cross above $50,000 this week,” explains Santiment.

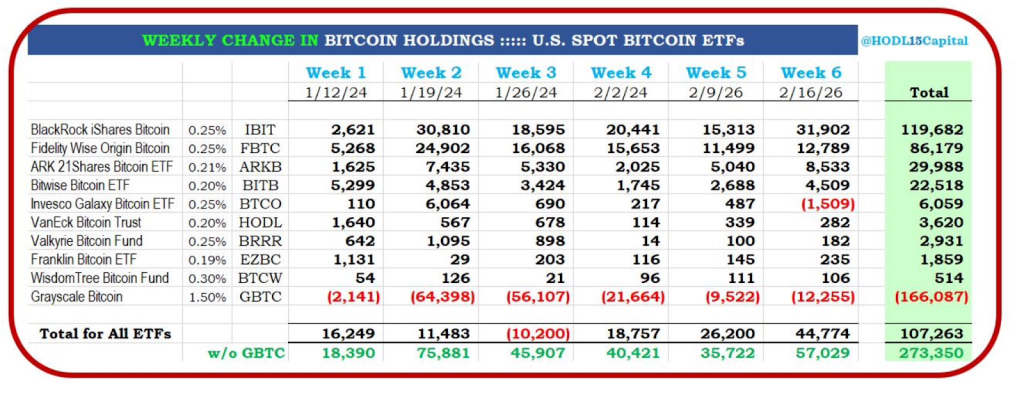

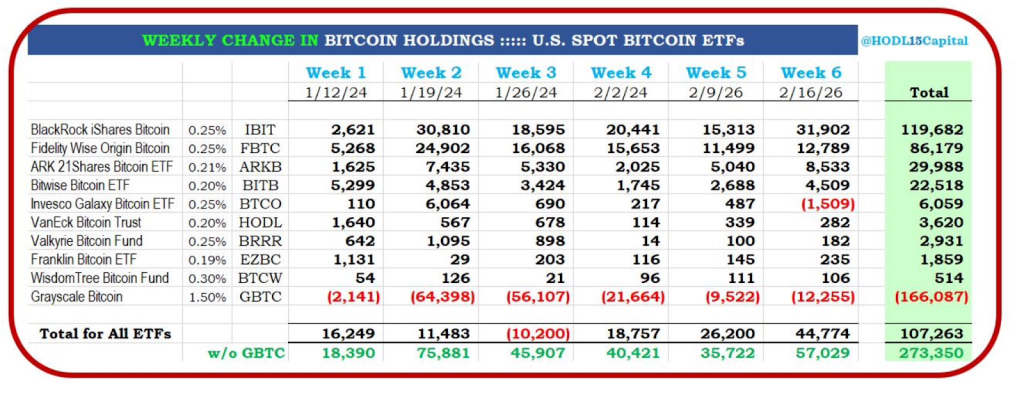

The widespread adoption and accumulation of bitcoin are credited to the approval of Bitcoin spot Exchange-Traded Funds (ETFs), according to the analyst HODL15Capital. It is worth noting that, since their launch, the ETFs have been amassing bitcoin. They collectively hold 107,263 bitcoin as of Friday.

Bullish Market Sentiment

The upward trend in significant accumulation of bitcoin by prominent whales points towards a bullish sentiment among key players in the digital asset space. Bitcoin’s price has witnessed a robust rally over the past few weeks, breaking above the $50,000 resistance level.

As of Tuesday morning, BTC is trading towards the $52,000 resistance level on the daily chart, rebounding from $40,000 earlier in January.

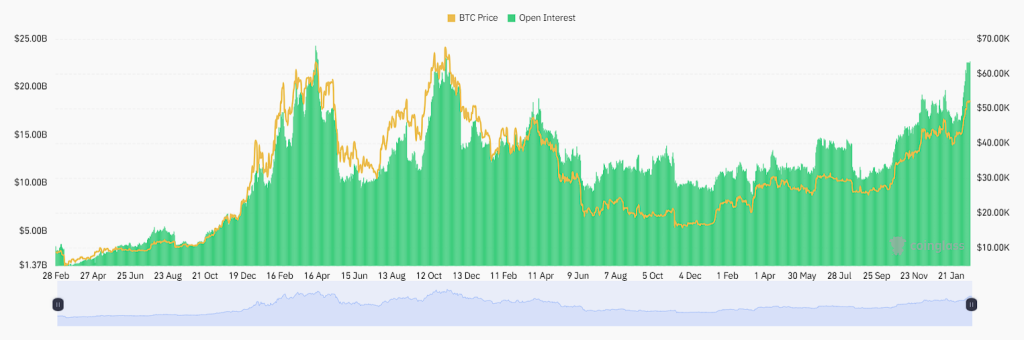

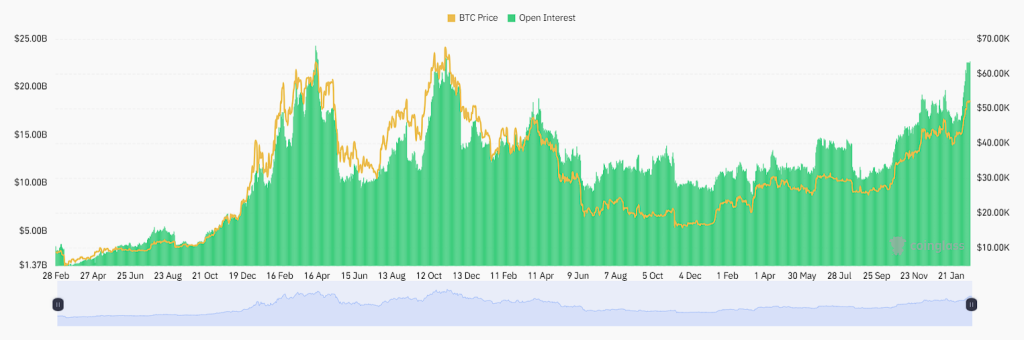

Interestingly, aligning with the accumulation by substantial Bitcoin whales, traders are returning to the market in large numbers. The open interest metric, an important indicator for evaluating futures market sentiment, shows a sudden spike in investors’ interest.

While such a surge is natural in a bullish market environment, it raises the potential for heightened volatility and, possibly, a long liquidation cascade that could lead to a rapid market drop.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitcoinnews.com/markets/bitcoin-whales-accumulate-13b-in-2024/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-whales-accumulate-13b-in-2024