- The RBA followed the path of the Federal Reserve, pushing back on rate cut expectations.

- The RBA said it needed more convincing that inflation was falling.

- The Aussie strengthened due to a rally in Chinese equities.

Tuesday’s AUD/USD price analysis showed a bullish recovery as investors absorbed hawkish signals from the RBA. Despite the central bank maintaining interest rates, the focus was on its emphasis on the potential for rate hikes.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

The RBA followed the path of the Federal Reserve, pushing back on rate cut expectations.

Recently, major central banks have been saying it’s too early to consider rate cuts as inflation remains high. On Sunday, Fed Chair Powell said the central bank was still not convinced inflation was on a downtrend.

However, the situation in Australia is a bit different. The economy is slowing down, and inflation eased in the fourth quarter. Still, on Tuesday, the RBA said it needed more convincing that inflation is falling. Therefore, it is still possible that the bank will hike rates. Consequently, investors moved the timing of the first RBA rate cut from August to September.

RBA rate hikes started in May 2022, increasing interest rates by 425bps. The high rates have worked to lower demand in Australia’s economy, leading to a decline in inflation from 7.8% to 4.1% in Q4. However, the value is still above the bank’s target of 2%.

Furthermore, the Aussie strengthened with the Yuan due to a rally in Chinese equities. Stocks in China posted record gains on Tuesday as authorities looked to support the weak markets. This also led to a rise in the Yuan.

AUD/USD key events today

The RBA policy meeting closed the major events calendar for the day. Consequently, the pair will likely keep absorbing the central bank’s message.

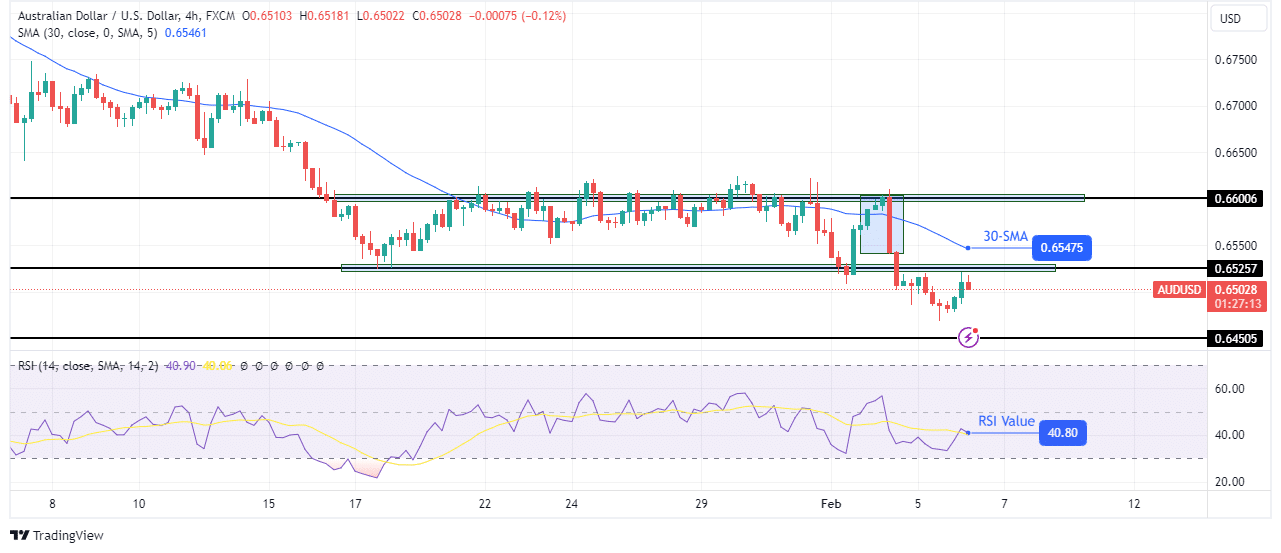

AUD/USD technical price analysis: Downtrend pauses for a temporary pullback.

On the charts, AUD/USD is recovering after plunging below the 0.6525 key support level. However, the recovery comes in a bearish trend because the price is below the 30-SMA and the RSI is below 50. Therefore, it might not go beyond the 30-SMA resistance.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

The recent plunge came after the price made a bearish engulfing candle at the 0.6600 key resistance level. Consequently, bears broke below the 0.6525 support to make a lower low. This new low confirmed the continuation of the bearish trend. Therefore, bears are likely waiting at 0.6525 to resume the downtrend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/02/06/aud-usd-price-analysis-aussie-gains-ground-on-hawkish-rba/