- The Swiss National Bank cut interest rates by 25 basis points.

- Fed policymakers emphasized caution as the central bank prepares to cut rates.

- The data revealed a drop in consumer sentiment in Australia.

The AUD/USD outlook points upwards as the dollar steps back from recent peaks as traders take profits. However, the journey hit a minor bump as Australia unveiled disappointing consumer sentiment figures for March.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

The dollar rallied last week as it became clear that major central banks were preparing to cut rates later this year. This came after the Swiss National Bank cut interest rates by 25 basis points to 1.5%. Notably, the move highlighted the more cautious Fed, leading to a rally in the dollar.

On Monday, Fed policymakers emphasized caution as the central bank prepares to cut rates. Some, including Raphael Bostic, even lost confidence that inflation would soon reach the 2% target.

Furthermore, the currency is subdued ahead of a slow, short week. Investors are now expecting the core PCE price index figures to provide a better look at the state of inflation. If the figures beat forecasts, it could lead to another rally in the dollar, as it would increase doubts about a Fed rate cut in June.

Meanwhile, in Australia, data revealed a drop in consumer sentiment due to economic worries. This decline followed the RBA meeting, in which the central bank became more neutral. However, the report shows that consumers have little expectation for rate cuts in the country. This led to a brief decline in AUD/USD before the pair recovered due to the weaker dollar.

AUD/USD key events today

- US CB Consumer Confidence

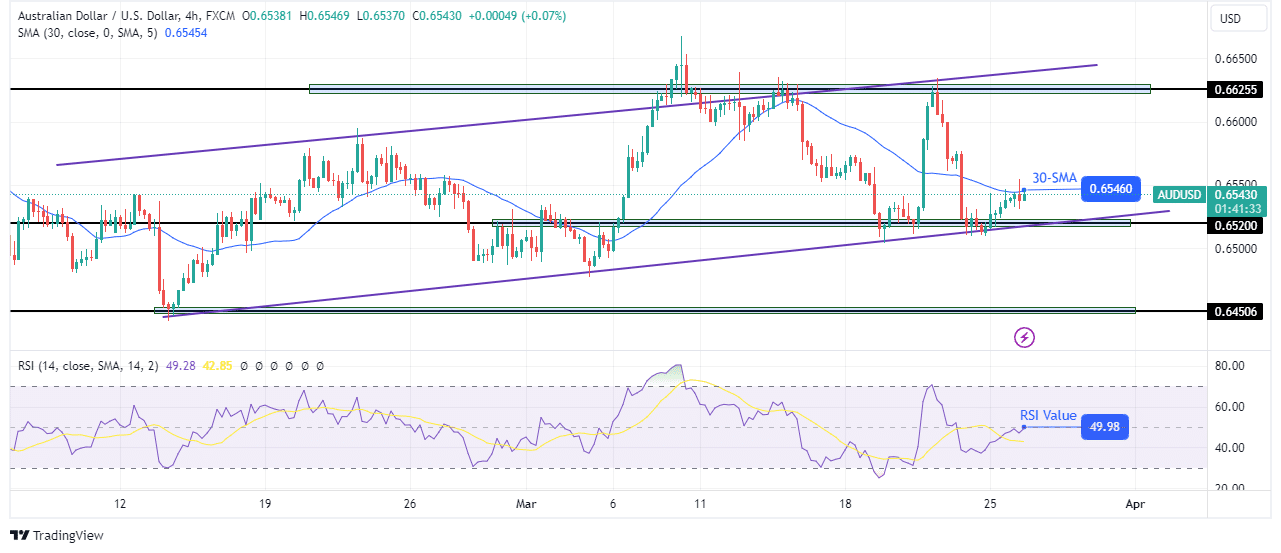

AUD/USD technical outlook: Weak bulls challenge 30-SMA resistance

On the technical side, the AUD/USD price is climbing after retesting a support zone comprising the 0.6520 support level and its channel support line. Notably, the price has been trading in a bullish channel, bouncing higher every time it retests the support. At the moment, bulls have taken charge.

-Are you interested in learning about the forex indicators? Click here for details-

However, price action shows weak momentum, as seen in the small-bodied candles. At the same time, the price is facing the 30-SMA resistance, which might pose a challenge. If the SMA holds firm, the price might break out of its channel to retest the 0.6450 support level. On the other hand, if bulls push above the SMA, the price will likely make a new high above the 0.6625 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/03/26/aud-usd-outlook-dollar-retreats-amid-profit-taking/