- Australia’s employment surged while the unemployment rate fell in February.

- Markets expect 37bps in cuts from the RBA, down from 44bps.

- The Fed kept its outlook for 3 rate cuts in 2024.

The AUD/USD forecast points firmly upwards after Australia recorded the largest monthly employment gain in a decade. At the same time, the dollar weakened after the Fed maintained its rate cut outlook despite the recent hot inflation figures.

-Are you interested in learning about the Bitcoin price prediction? Click here for details-

Australia’s labor market showed massive strength in February. Employment surged while the unemployment rate fell. Notably, jobs in the country rose by 116,500 in February. This was a significant increase from the 15,200 gain in the previous month. Meanwhile, the unemployment rate dropped from 4.1% to 3.7%.

Australia’s labor market had shown weakness in January, leading to increased bets for an RBA cut. Consequently, policymakers were less hawkish at the policy meeting on Tuesday. However, the Wednesday report revealed that labour market demand remains high. As a result, markets now expect 37bps in cuts from the RBA. Before the data, this figure was at 44 bps.

Meanwhile, the dollar was subdued after the FOMC meeting, where the central bank held rates. After the recent inflation figures, there was speculation that policymakers would be less dovish. However, Powell maintained his dovish stance, saying inflation was still in a downtrend. Therefore, the Fed kept its outlook for 3 rate cuts in 2024. Meanwhile, economic projections showed expectations for a strong economy in 2024.

AUD/USD key events today

- US unemployment claims

- US flash manufacturing PMI

- US flash services PMI

AUD/USD technical forecast: Price soars above 30-SMA

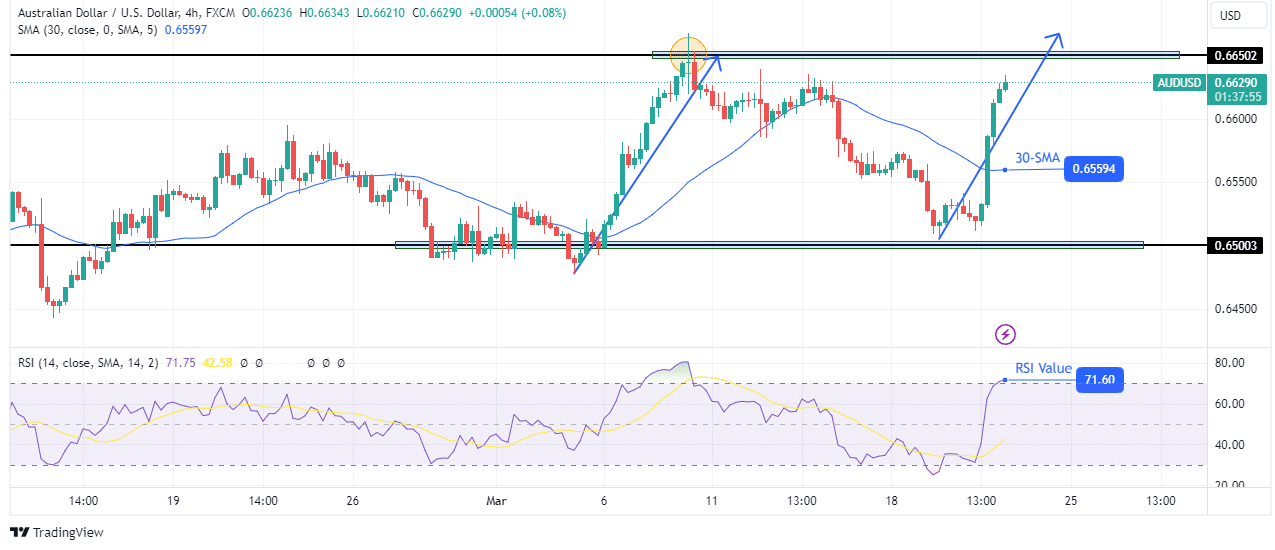

On the technical side, AUD/USD has had a sharp bullish reversal and now sits well above the 30-SMA. At the same time, the RSI has shot up to the overbought region, showing solid bullish momentum. Initially, bears had been in control of the market. However, bulls took over before the price got to the 0.6500 key support level.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The takeover was sharp and steep, and the price quickly approached the 0.6650 key resistance level. If the current bullish leg mirrors the previous one, the price might break above the 0.6650 key resistance level. In such a case, the bullish trend would continue higher. However, if the resistance holds firm, the price might fall to retest the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/03/21/aud-usd-forecast-aus-employment-jumps-to-10-yr-top/