The market size and growth of GLP-1 [glocogen-like peptide-1] medications have been significant in recent years. GlobalData estimates that the GLP-1 market for weight management may reach $100 billion by 2030. GLP-1 medications could potentially compete with advanced diabetic devices, including continuous glucose monitoring (CGM) systems and insulin pumps, and reduce sales of those products.

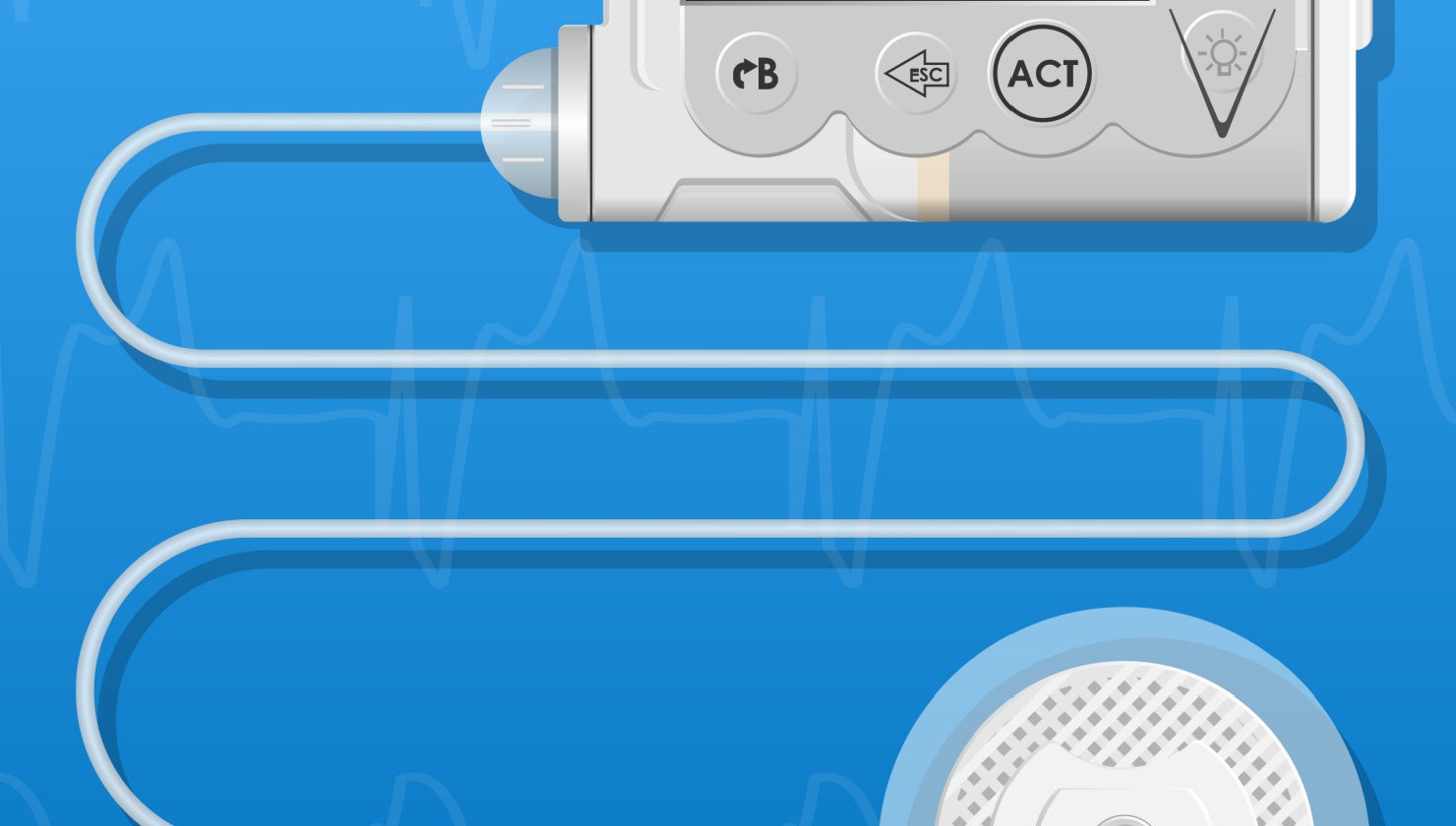

The insulin pumps and CGM market was valued at $11.3 billion in 2023. The market will reach sales of $20.9 billion by 2033, growing at a compound annual growth rate of 6.3% over the period, according to GlobalData forecasts.

GLP-1 medications, also known as glucagon-like peptide 1 receptor agonists, have been shown to be effective in treating obesity and type 2 diabetes by enhancing feelings of fullness (satiety) and suppressing appetite. Medicines such as Ozempic or Wegovy are considered an effective treatment option for patients with obesity and type 2 diabetes. CGM leaders such as Abbott and DexCom maintain positive outlooks.

CGM can help people modify their dietary habits

CGM represents a complementary tool for people with GLP-1 medications to manage their conditions. CGM can help people modify dietary habits to reach wellness and weight loss goals, and the popularity of GLP-1 medications may expand the CGM application to weight management. The market boom has been reflected in the sales figures. Abbott’s FreeStyle Libre sales increased 25.5% to $1.4 billion in Q4 2023. Similarly, Dexcom’s revenue grew 27% to $1.03 billion in the same period.

While GlobalData does not foresee a significant risk from GLP-1 medications on the insulin pump market in the short term, the long-term impacts appear somewhat gloomy. The target users of insulin pumps are insulin-dependent patients: GLP-1 medications can help to improve blood sugar control and reduce the need for additional insulin in patients with type 2 diabetes. It can also delay the need for insulin and limit progression for patients with type 2 diabetes who have not taken insulin yet. However, as the device penetration of insulin pumps is less than 1% of type 2 diabetes patients, according to GlobalData, the overall impact seems to be more moderate.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.medicaldevice-network.com/analyst-comment/glp-1-medications-diabetic-devices-market/