- Inflation data from the US supported investor expectations of looming rate cuts.

- Powell said that the rate hike cycle was likely at an end.

- Economists do not foresee any changes at the upcoming BOJ meeting.

In the USD/JPY weekly forecast, the winds of change are steering towards a bearish outlook. This trend comes as the Federal Reserve’s policy takes a dovish turn while the BoJ’s outlook takes a slightly hawkish twist.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Ups and downs of USD/JPY

USD/JPY ended the week in the red as the dollar weakened after the FOMC meeting. Moreover, inflation data from the US supported investor expectations of looming rate cuts. At the FOMC meeting, Powell said that the rate hike cycle was likely at an end. This opens the door for rate cuts in 2024.

Additionally, investors were speculating on ending negative interest rates in Japan. This helped the yen gain on the dollar. However, changes are not expected at next week’s BoJ policy meeting.

Next week’s key events for USD/JPY

The BOJ will meet next week, and investors do not expect any policy changes. More than 20% of economists in a Reuters poll anticipate the Bank of Japan will start scaling back its ultra-loose monetary measures in January. However, none of the economists in the poll foresee any changes at the upcoming meeting.

Moreover, the durable goods orders and the gross domestic product from the US will show the state of the economy. As such, these reports will impact Fed rate cut bets.

USD/JPY weekly technical forecast: Bears unravel the recent bullish rally

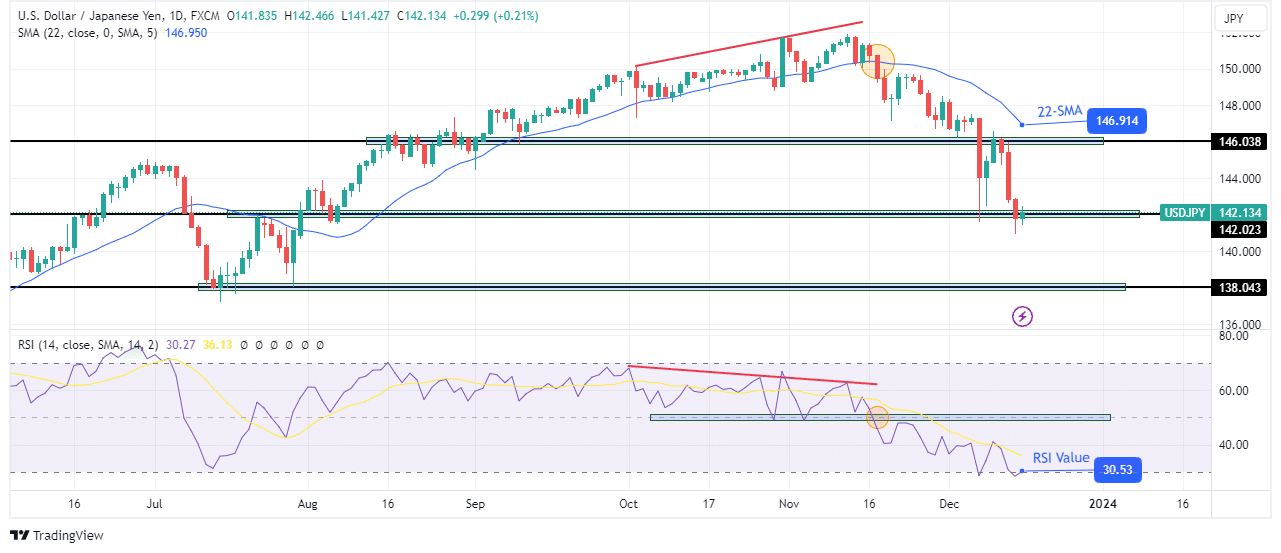

USD/JPY has retraced most of the recent bullish move after bears took over by breaking below the 22-SMA. The bearish sentiment shift occurred after bullish momentum weakened with a bearish RSI divergence. Therefore, the bears were finally strong enough to breach the 22-SMA resistance. At the same time, the RSI crossed below 50. Now that bears are in control, the price is breaking below support levels while keeping below the 22-SMA.

–Are you interested to learn more about forex tools? Check our detailed guide-

The most recent support breach was at the 146.03 level. The price broke and retested this level, which is now challenging new support at 142.02. If bears can close below this support, the price will decline to 138.04. However, the price might consolidate if the level holds as the 22-SMA catches up.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/16/usd-jpy-weekly-forecast-fed-boj-divergence-leads-sellers/