- US yields remained elevated, boosting the US dollar.

- Traders are on high alert for potential intervention by Japanese authorities.

- BOJ policymakers were divided on when the central bank could exit negative interest rates.

Today’s USD/JPY forecast is optimistic, given that the US dollar has achieved its highest level in ten months, pushing the yen further into intervention territory. This surge came amid anticipation of enduring higher US interest rates.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Although US Treasuries stabilized following a recent heavy sell-off, yields remained elevated. Consequently, it ensured continued strength in the US dollar. Moreover, Fed officials have recently been signaling the potential need for further interest rate hikes. This followed the central bank’s decision to keep rates steady last week while adopting a more hawkish monetary policy stance.

As a result, US Treasury yields climbed to multi-year highs recently as money markets adjusted their expectations regarding the peak level of US rates. Additionally, tighter monetary conditions now appear likely to persist longer than initially anticipated.

The elevated US yields posed challenges for the yen. The dollar/yen pair is sensitive to fluctuations in long-term US Treasury yields, especially in the 10-year segment.

Furthermore, the yen’s gradual decline toward the psychologically significant level of 150 per dollar has put traders on high alert for potential intervention. Japanese authorities have been increasingly vocal about the weakening currency.

Some view the 150 level as a threshold that could prompt Japanese authorities to intervene, similar to their actions last year. Meanwhile, the Bank of Japan’s July meeting minutes came out on Wednesday. Notably, the minutes revealed that policymakers agreed on maintaining ultra-loose monetary policies. However, they were divided on when the central bank could exit negative interest rates.

USD/JPY key events today

Markets are awaiting data from the US on:

- Core durable goods orders.

- Crude oil inventories.

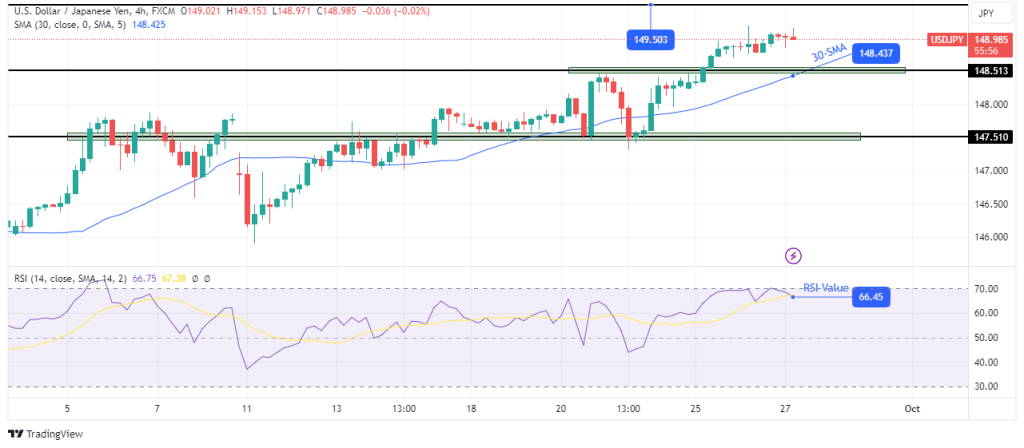

USD/JPY technical forecast: Bulls overcome 148.51 resistance for new highs.

The bullish trend for USD/JPY on the 4-hour chart has progressed. Bulls have crossed above the 148.51 resistance level to make new highs. Furthermore, bullish control can be seen in the distance between the price and the 30-SMA, which has grown.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Meanwhile, the RSI favors bullish momentum as it is just shy of the overbought region. The price currently trades with the nearest resistance at 149.50 and the nearest support at 148.51. Given the bullish bias, bulls might soon retest the 149.50 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/usd-jpy-forecast-more-gains-intensifying-yen-intervention/