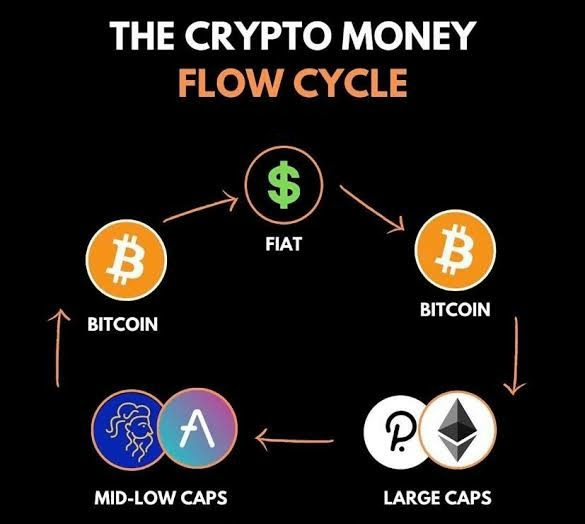

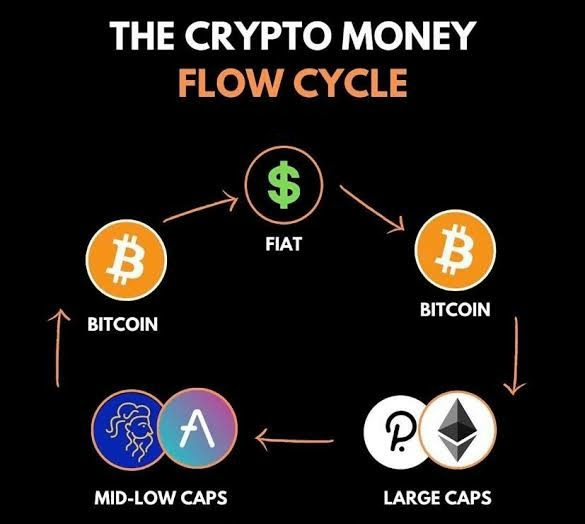

Before non-fungible tokens (NFT) came on the scene, the following chart was a fairly good representation of patterns that happened in the industry.

Fiat currency flowed largely through Bitcoin and other large caps before trickling down to mid caps and finally to low caps (also affectionately known as “shitcoins”).

A couple of things have changed in the past two years, one being the emergence of NFTs as a digital asset class that fits somewhere in the above cycle.

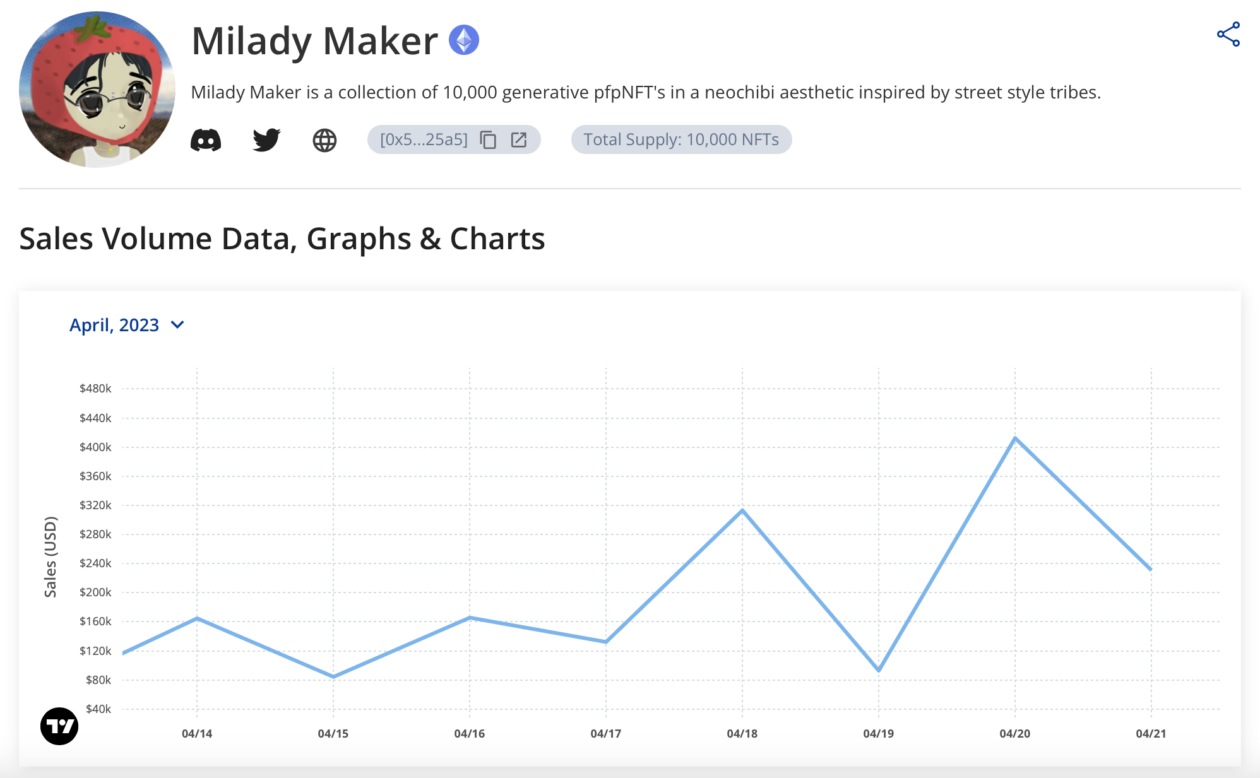

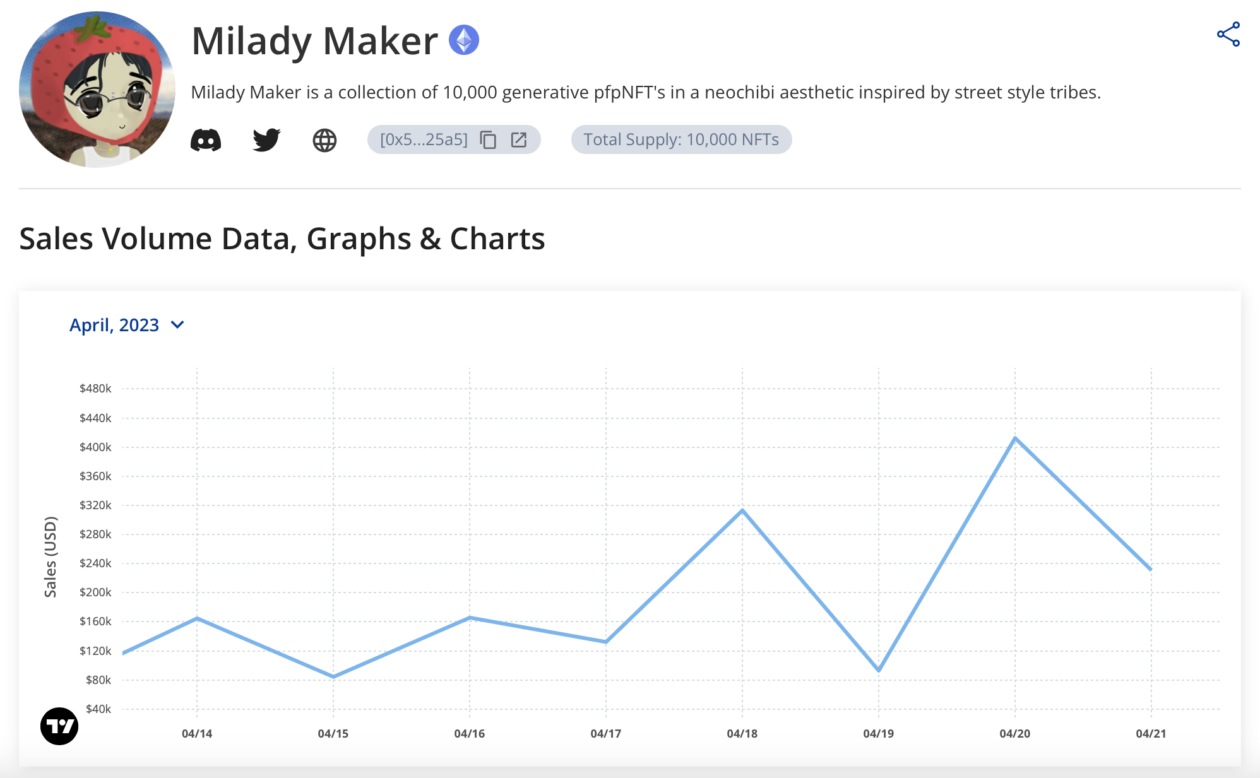

It’s my opinion that NFTs, especially PFPs, are a hybrid of an identity solution, a club and a fungible token. There are different sizes by market cap, Bored Ape Yacht Club (BAYC) and Azuki being the large cap of the NFT market, Mfer’s, Nakamigo’s, and Milady’s being the mid caps and then basically the rest making up the small caps. Finally, add to the mix memecoins. They really do not profess to have any utility other than social media posting and having fun!

Fun + memes can now be a digital asset? Yeah. We see this by looking at $DOGE, $SHIBA, and now $PEPE, which reached a $150m market cap in several days. The Milady Maker PFP community is rumored to be behind the $PEPE memecoin emergence.

Memecoins came back in after the Nakamigos and BAYC communities stagnated and had some large holders leave the community. That, combined with the boredom of retail crypto folks, and boom, on the scene comes memecoin season! It took over for a few days this past week with $PEPE, and others which I don’t really want to mention because I’m not sure it will be a long loved meta. But who knows?

The Milady Maker’s PFP assets rose this past week as the memecoin meta kicked off.

These new digital assets are now throwing more curve balls into the flow, and it’s yet to be seen where they fit in. One thing I know for certain, though, is that when large caps run, they rise fast, sucking all the liquidity from mid-lower caps. When they stop running, the capital flows back to mid-low caps. This pattern can happen across all classes (NFTs, fungible tokens) and also across categories as well (PFPs, Game-FI, fungible tokens, and utility NFTs), which is causing the Web3 scene to seem very chaotic.

With these liquidity ebbs and flows causing uncertainty even for the most seasoned traders, it’s clear that new patterns are emerging in the brave new world of NFTs and memecoins.

Note that the observations presented in this text are not intended as financial advice but rather the insights of an individual who has an interest in recognizing trends and patterns, much like many others in this space.

The Forkast 500 NFT Index is down over 2% over the past seven days, reflecting a sharp decline in the NFT market. A new memecoin called $PEPE has been trading at volume, causing high transaction fees on Ethereum. NFT volume, on the other hand, has suffered as traders practice patience, with many waiting for fees to normalize.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://forkast.news/uncertainty-in-crypto-cycles-from-memecoins-nfts/