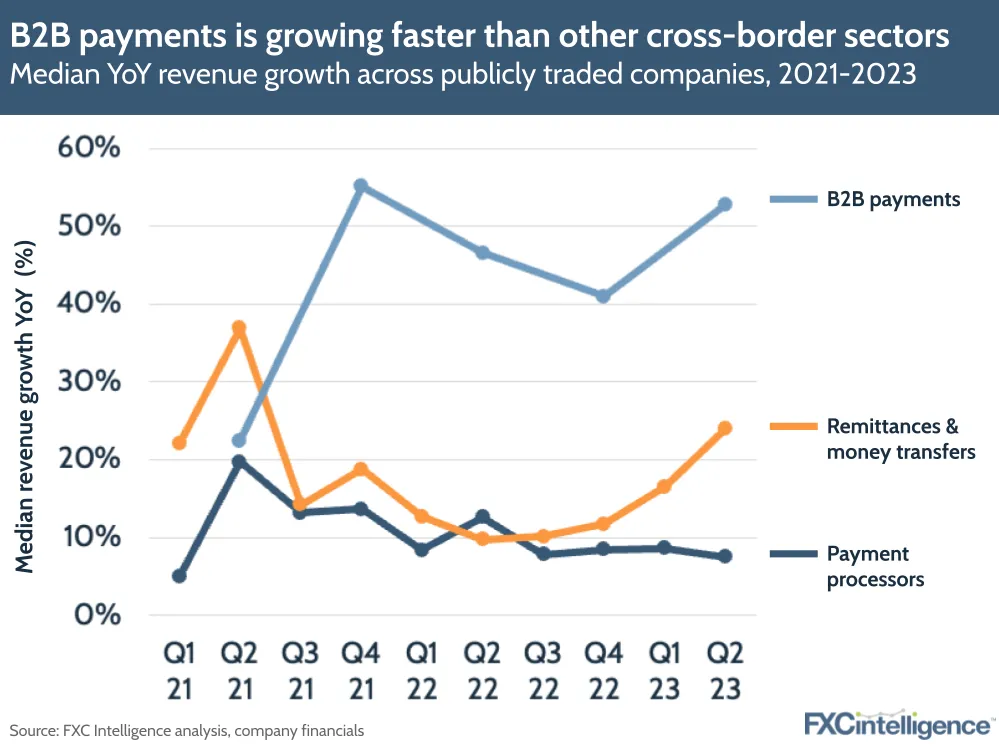

B2B payments is rapidly evolving as the new battleground for foreign exchange providers. It has the fruitful combination of delivering consistently high growth but remaining relatively untapped, as a significant chunk of business payments still flow through

traditional banks.

Growth in the B2B sector in FX payments widely outpaces other business lines. According to research by

FXCintelligence, Payoneer has witnessed its B2B accounts payable/accounts receivable (AP/AR) segment gain an impressive 39% year-on-year volume growth, now accounting for over 10% of the company’s overall volume, while Wise’s business revenue soared with a 56% year-on-year growth, overshadowing its 47% growth in the personal segment.

The competitive landscape

Some established industry titans are already capitalizing on this opportunity, inspired by the influx of digital challengers entering the space. Take

American Express, for instance. They recently rolled out a cross-border payment solution tailored for small businesses in the US, named American Express Global Pay, which allows businesses to pay suppliers in more than 40 countries and incentivizes new users by waiving any fees in the first 90 days.

At the same time, traditional FX providers, who have historically presented a relationship-focused value proposition around hedging and FX risk strategies for corporates, are recognizing the opportunity in appealing to mid-market businesses with a lower touch digital offering. While the lower transaction values of mid-market businesses don’t justify the same concierge service, they represent huge commercial upside in aggregate, if served in a cost-effective way.

The combination of digital challengers, established institutions, and traditional FX providers waking up to the opportunity in B2B payments has created a buoyant competitive dynamic where differentiation efforts are largely focused on delivering a stand out user experience.

User experience as the critical differentiator for FX providers

Wise CPO Neil Peiris says competition in this space revolves around

three factors – speed, ease of use, and price.

Out of these three factors, most providers choose to focus on user experience as a key differentiator, rather than being drawn into a race to the bottom on price. Businesses often use two or more payment providers, which underlines the need for a best-in-class user experience not only to drive new customer acquisition but to maintain and grow share of wallet.

Research by

Swift specifically highlights the importance of user-friendliness as a key driver of customer loyalty. In fact, 61% of the SMBs surveyed said they wouldn’t return to a provider if the payment process wasn’t as effortless as expected. As a result of poor user experience, FX providers end up with large volumes of customers that are either inactive or only processing a very small percentage of their total foreign payments with them, which in turn negatively impacts profitability on a per customer basis.

The specific drivers of a flawless user experience can be difficult to define in terms of concrete features or customer expectations. Our research shows that a strong indicator of a positive experience is how integrated the user flow is with the rest of the business’s financial operations. SWIFT ranks “integrations” as the third most crucial purchase driver for SMBs, while leading FX provider

Equals singled out accounting integrations as their most requested feature.

Automating payment runs & streamlining reconciliation: Opportunities to embed cross-border payments into financial operations

After identifying that connectivity to business financial software can improve competitive differentiation, the next challenge FX providers face is knowing where to begin. An ‘accounting integration’ could mean automating a range of different workflows, which must be technically scoped out, and that’s before considering the range of different platforms to integrate with to service customers using different software. Research with Codat’s customer base that include providers like Currencies Direct, Fexco, Nium have revealed two key solutions to move the needle on user experience.

-

Automating payment runs

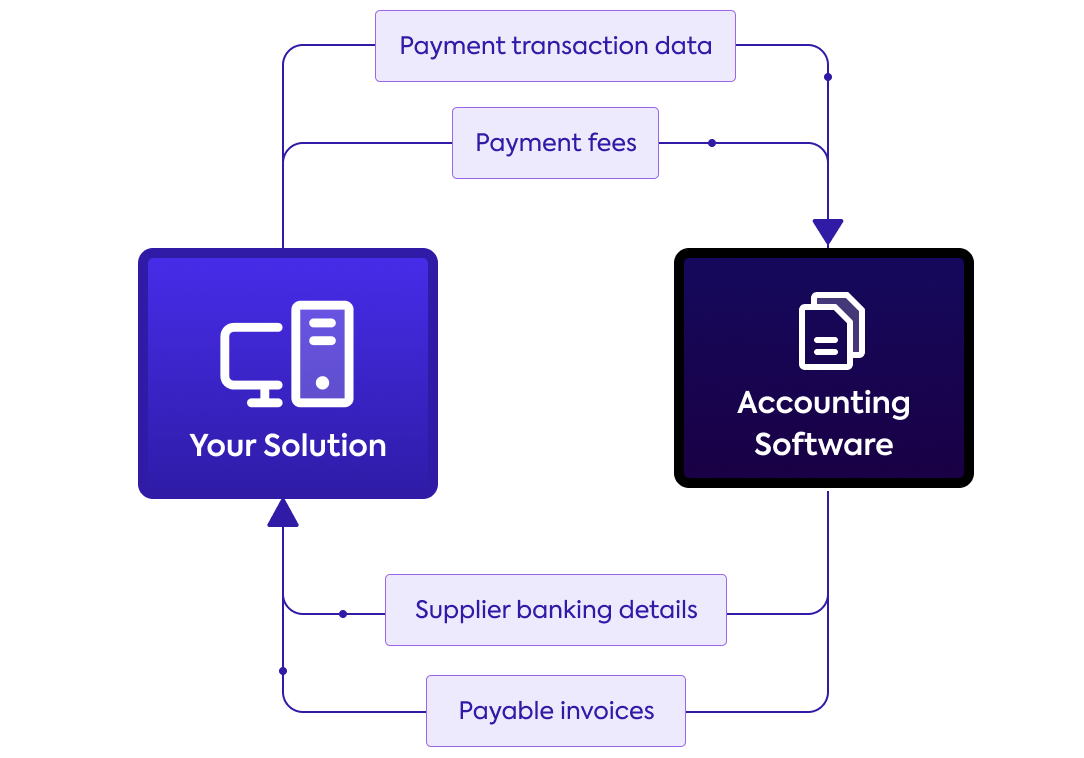

One common hurdle is automating payment runs. When making batch payments, research shows that the process of uploading supplier payment details, often in the form of a spreadsheet, is a major inefficiency and source of frustration for accounts payable teams.

If one digit or one space is in the wrong place for a single supplier, it causes the whole batch to fail and the user must start again. Allowing users to connect their accounting or ERP system to pull supplier payment details directly from their financial software is a simple integration that can save AP teams precious time per payment run.

2. Streamlining post payment reconciliation

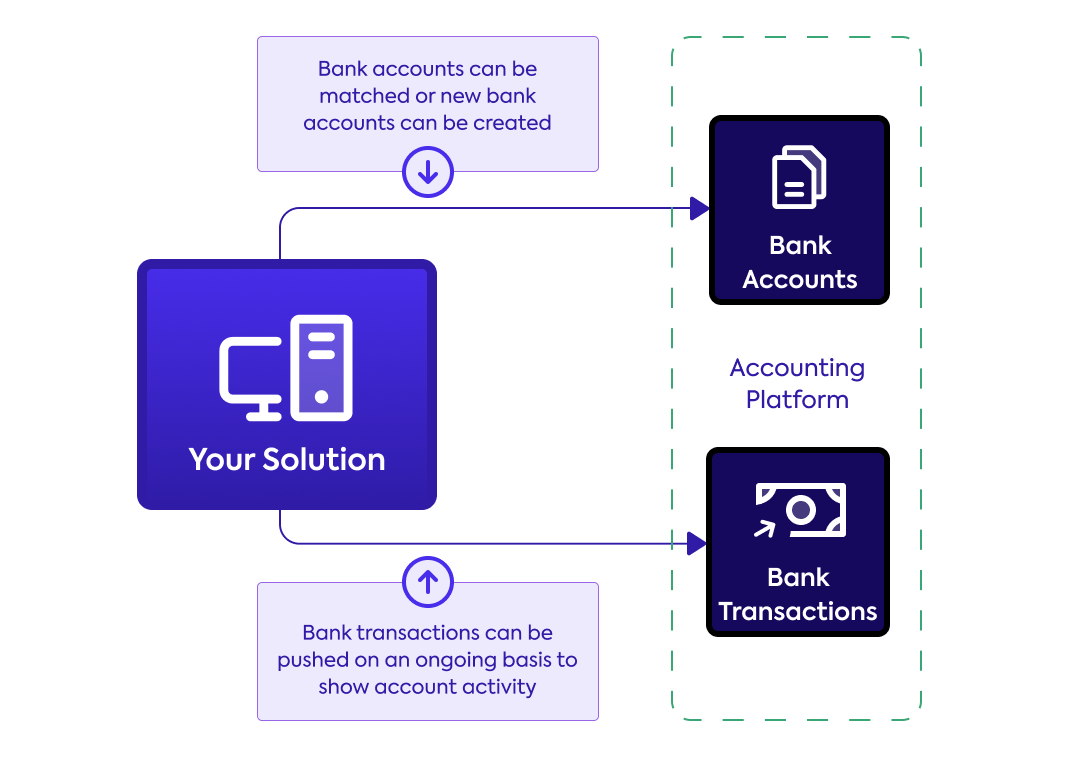

Another hurdle FX providers face is streamlining bookkeeping. The work finance teams must do to record foreign currency transactions in their accounting records is often an afterthought for cross-border payment providers. When multiple currencies are involved, reconciling payments becomes more painful, particularly for businesses processing large volumes of payments – the most valuable customers for cross-border payment providers.

Implementing a bank feed – an automated transaction feed from the payment provider into customers accounting software significantly reduces the lift. All the key transaction details, amount, date, counterparty and payment reference, appear in customer’s accounting software, ready to to be reconciled.

Staying ahead of the curve in cross-border payments

The value of integrating accounting software is evident by the number of top FX providers that have already incorporated such features. Of FXC Intelligence’s top cross-border payment providers in the venture backed category – over 40% already have some kind of integration to accounting software providers mentioned on their website. These integrations are quickly becoming the industry standard, and the absence of these features may soon be a notable disadvantage, leaving those FX providers at the bottom of the pack.

As the competition in the B2B FX payments arena continues to evolve, providers who can successfully integrate and streamline their processes will be well-placed to unlock new avenues for growth.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.finextra.com/blogposting/25116/the-surprising-link-between-share-of-wallet-and-accounting-connectivity-in-cross-border-payments?utm_medium=rssfinextra&utm_source=finextrablogs