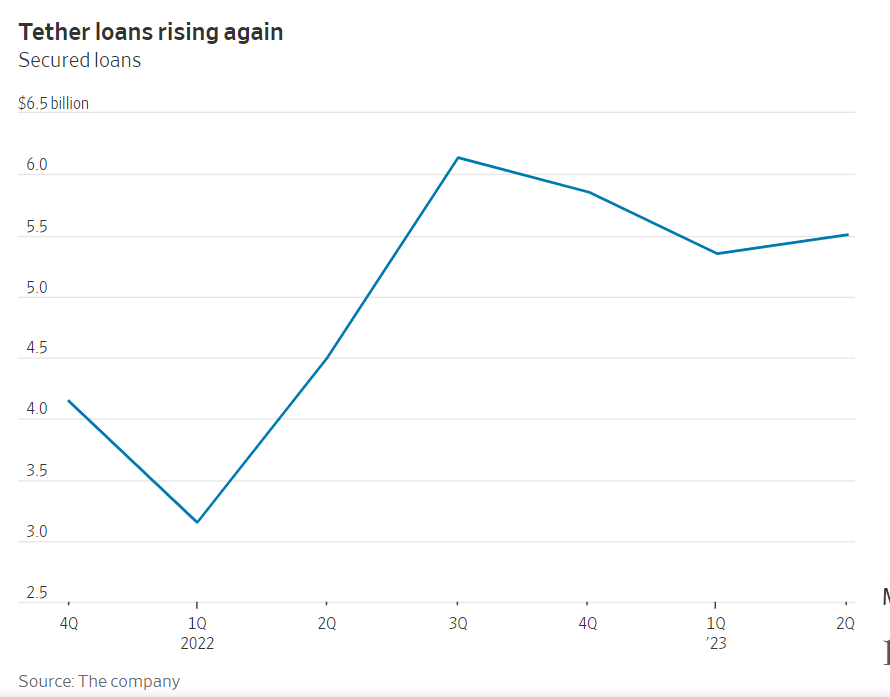

Tether, the largest stablecoin issuer in the crypto market has seen a rise in its stablecoin lending, aka secured loans, in 2023, despite the firm having announced it will cut such loans down to zero in December 2022.

In the company’s latest quarterly report, Tether noted that its assets included $5.5 billion of loans as of June 30, up from $5.3 billion in last quarter. A Tether spokesperson told the Wall Street Journal (WSJ) that the recent rise in stablecoin lending was due to a few short-term loan requests from clients with whom the firm has “cultivated longstanding relationships.” The spokesperson also said that the company plans to cut such loans to zero by 2024.

The stablecoin loans had become a popular lending product for the stablecoin issuer, allowing customers to borrow USDT from Tether in return for some collateral. However, these secured loans were always shrouded in controversy due to a lack of transparency on the collateral and the borrowers.

A WSJ report in December 2022 raised concerns about the products, as well about claims about these loans were fully collateralized. The WSJ questioned Tether’s ability to meet redemption requirements in times of crisis.

Related: Crypto Biz: You can’t stop the Tether FUD

Tether addressed these controversies last year prior to announcing its plan to eliminate secured loans entirely in 2023. At the time the stablecoin issuer called the concerns around secured loans “FUD” and claimed the loans were over collaterized.

The recent rise in secured loans for Tether comes amid growing market dominance and profit for the firm. Tether reported $3.3 billion in surplus reserves up from just $250 million last year in September. Cointelegraph reached out to Tether for comments but has not yet received a response.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Deposit risk: What do crypto exchanges really do with your money?

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cointelegraph.com/news/tether-2023-stablecoin-loans-rise-despite-size-down-plans