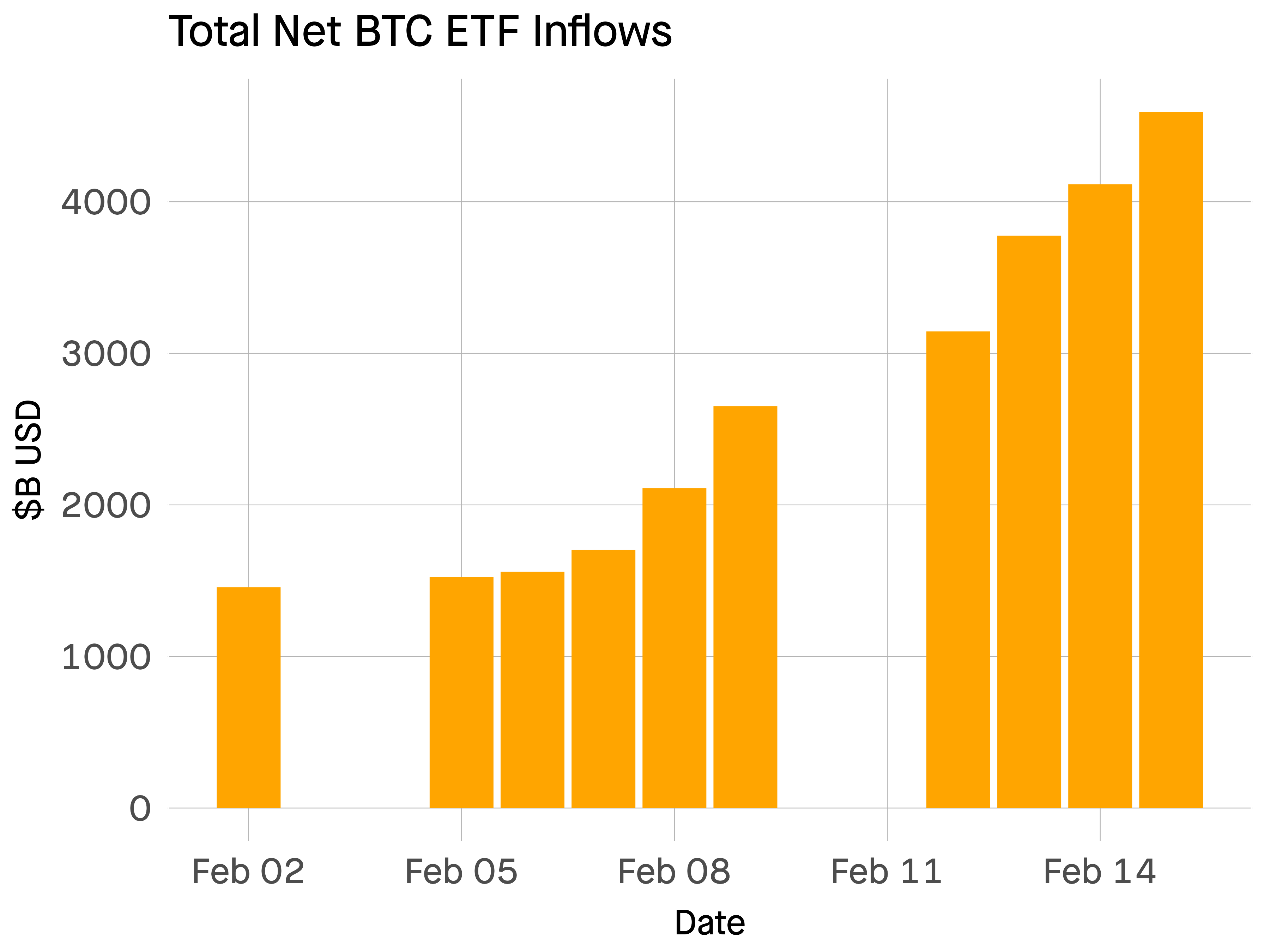

The Bitcoin exchange-traded funds (ETFs) launched on January 12, about a month ago. On the first day, investors bought $655m & nearly $2b in the first three days.

Since then, the figure has swelled to $4.6b.

It’s not a fair comparison but for fun, we can compare the Bitcoin interest to the largest technology IPOs for a sense of scale.

| Company | IPO Date | Raised $B |

|---|---|---|

| May-12 | $16.0 | |

| Uber | May-19 | $8.1 |

| Snap | Mar-17 | $3.9 |

| Airbnb | Dec-2 | $3.5 |

| Snowflake | Sep-2 | $3.4 |

| DoorDash | Dec-2 | $3.4 |

| Lyft | Mar-19 | $2.6 |

| Nov-13 | $2.1 |

Within the first three days, BTC ETFs had raised as much capital as the Twitter IPO. As of today, the amount raised is larger than all technology IPOs aside from Facebook/Meta & Uber.

The comparison isn’t a precise one for a few reasons. First, Bitcoin is a commodity, not a company. Second, I’m comparing cumulative inflows as opposed to inflows from the public offering, a single financing event.

Setting that aside, the insight is the scale of the interest in BTC is as large as some of the most important technology offerings ever.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.tomtunguz.com/btc-etf-flows/