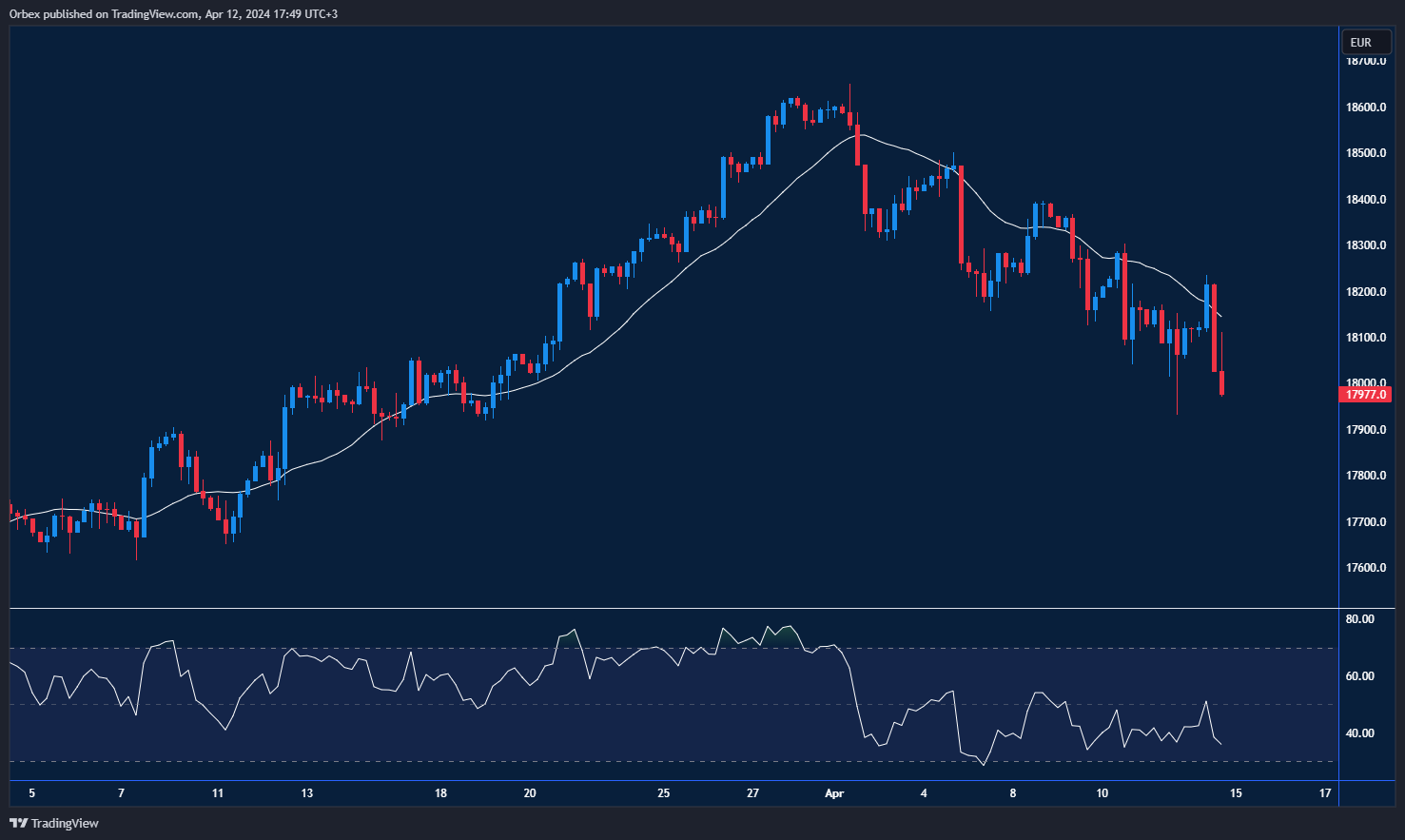

The GER 40 dead cat bounce drops prices

The GER 40 continues to decline as a dead cat bounce begins its formation. A move below 18000 indicates an acceleration to the downside. Bears are now looking to recover to the previous swing low of 17600 following a brief consolidation. 17900 is the first hurdle to break before a selloff can continue. If price action can swing higher, it will need a break above 18250, and 18600 will be in sight.

AUDUSD breaks critical support

The Australian dollar came under renewed selling pressure as the pair cracked the 0.6500 level. The price is looking to test this year’s low at 0.6440 on the chart. This might pause any bullish revival in the short term as the bigger picture remains downbeat. 0.6540 is the level to see if bulls are ready to step in and offer support. Otherwise, the swing low of 0.6400 is a critical floor.

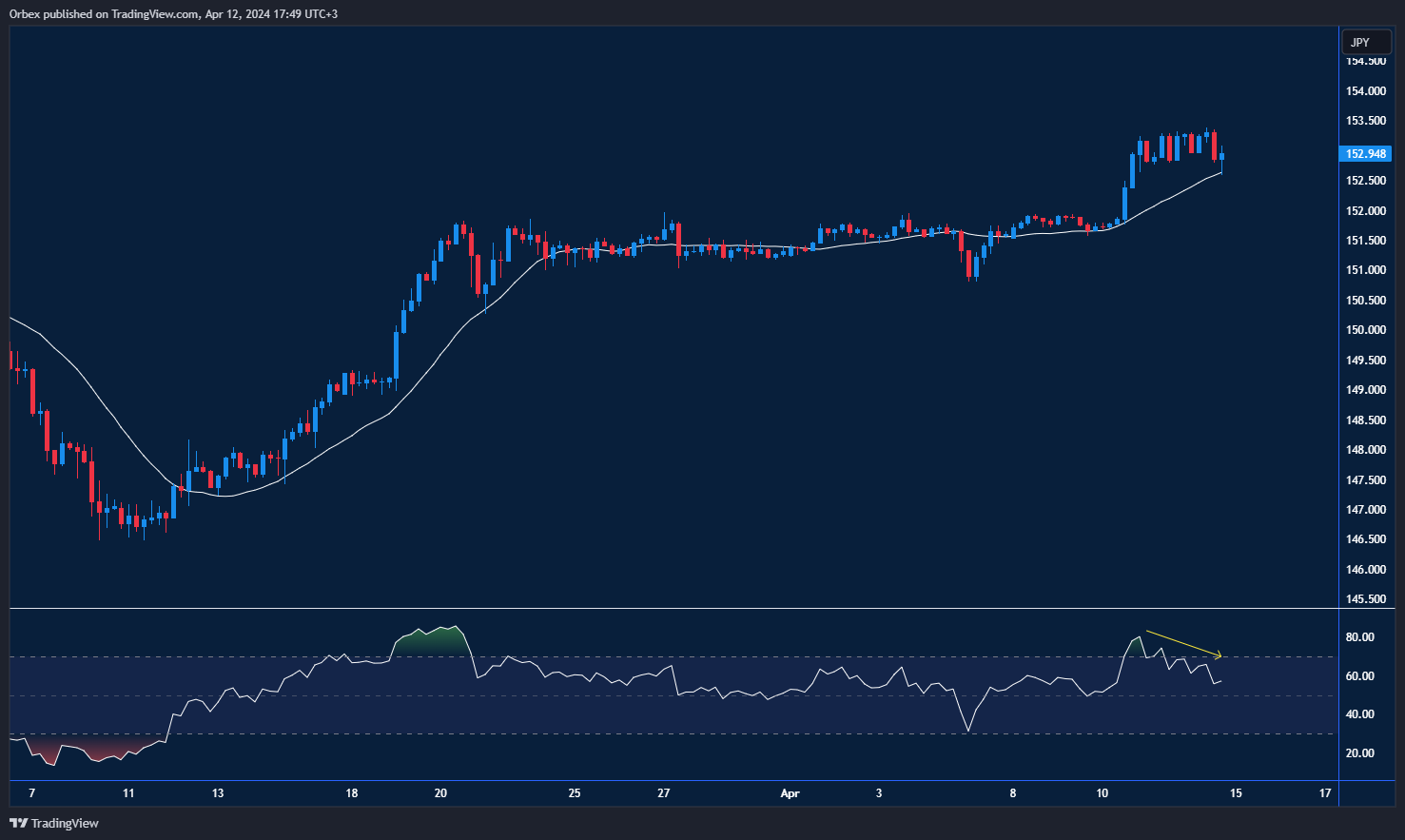

USDJPY bounces higher

The US dollar continues to climb on the back of the recent CPI report, which still lingers in the markets. Sentiment remains positive as the pair achieves a series of higher highs despite a solid consolidation. The greenback has secured a solid foundation above 152.00, and a close above 153.50 could carry the price to a hefty 155.00 psychological level. As the RSI drops back to the neutral area, a bearish divergence has opened, with 151.20 being the first level to see if a sharp rebound is on the horizon.

Test your forex trading strategy with Orbex

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.orbex.com/blog/en/2024/04/intraday-analysis-usd-continues-to-dominate