- US consumer prices rose by 0.3% for the month and registered an annual growth of 3.4%.

- Traders believe that the BoE’s benchmark rate will decline rapidly this year.

- Recent data indicated a contraction in the British economy in October.

The GBP/USD price analysis hinted at a subtle bearish tilt amid a strong dollar as investors assessed the impact of an upbeat US inflation report. However, there are still expectations that the Federal Reserve could cut rates as early as March.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Notably, US consumer prices rose by 0.3% in December and registered an annual growth of 3.4%. This beat economists’ expectations of a 0.2% gain and a 3.2% annual rise, respectively.

Meanwhile, Bank of England Governor Andrew Bailey refrained from discussing the UK’s economic outlook on Wednesday. However, he highlighted the decrease in mortgage rates.

At the same time, the market perception has shifted towards the belief that the BoE’s benchmark rate will decline rapidly this year. Moreover, futures markets indicate that traders expect about four rate cuts in 2024, possibly as early as May but certainly by June.

Elsewhere, recent data indicated a contraction in the British economy in October, increasing the risk of a recession. The CEO of Tesco, the UK’s largest retailer, expressed “cautious optimism” about the UK consumer in 2024. Meanwhile, Sainsbury’s reported robust Christmas food sales but noted weakness in demand for other essential products.

Notably, the pound emerged as one of the best-performing currencies against the dollar in 2023, recording a gain of 5.2%, the most in six years. It was supported by some of the highest interest rates among developed economies.

GBP/USD key events today

- The US PPI report

- The US core PPI report

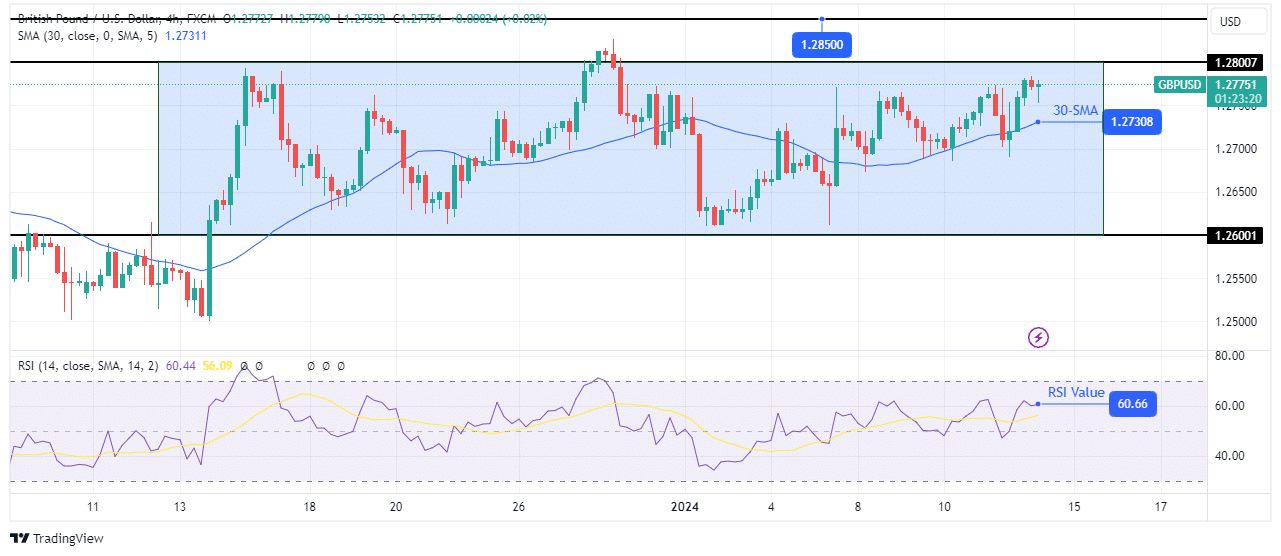

GBP/USD technical price analysis: Bulls approach strong resistance at 1.2800

On the technical side, GBP/USD is bullish as the price trades above and respects the 30-SMA support line. At the same time, the RSI respects the pivotal 50 level as support, staying in bullish territory.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

However, on a larger scale, the pound trades in a range with support at 1.2600 and resistance at 1.2800. Consequently, the current bullish move might pause at the 1.2800 range resistance. The bullish move can only continue if the price breaks out of consolidation. Otherwise, bears will take over at 1.2800 and target the 1.2600 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/12/gbp-usd-price-analysis-investors-digest-us-cpi-data/