- Fed’s Christopher Waller highlighted the remarkable third-quarter US economic growth.

- Michelle Bowman noted that the US economy remains robust.

- British consumer spending last month saw its slowest growth in over a year.

The dollar strengthened on Wednesday, casting a shadow of bearishness on the GBP/USD forecast as traders contemplated the likelihood of an impending US interest rate hike. Meanwhile, investors were anticipating remarks from Federal Reserve Chair Jerome Powell later.

-Are you looking for forex robots? Check our detailed guide-

On Tuesday, Fed Governor Christopher Waller highlighted the remarkable third-quarter US economic growth as a factor to monitor in the central bank’s deliberations on future policy decisions. Notably, the value hit an annualized rate of 4.9%,

Furthermore, his comments prompted a fellow Fed official to explicitly call for another rate hike. Fed Governor Michelle Bowman interpreted the recent GDP data as evidence that the US economy not only remained robust but may have even accelerated. Consequently, it might necessitate a higher Fed policy rate.

Meanwhile, British consumer spending last month saw its slowest growth in over a year, as indicated in a Tuesday survey.

Barclays reported a 2.6% increase in spending on their debit and credit cards from September 24 to October 21 compared to the previous year. It represents the smallest annual rise since September 2022. Moreover, it is a decline from the 4.2% growth seen in the previous month. Additionally, when adjusted for a 6.7% consumer price inflation in September, the actual volume of goods and services purchased by British consumers decreased.

GBP/USD key events today

The UK will not release major economic reports today. Therefore, investors will focus on key events from the US, including,

- Fed Chair Powell’s speech.

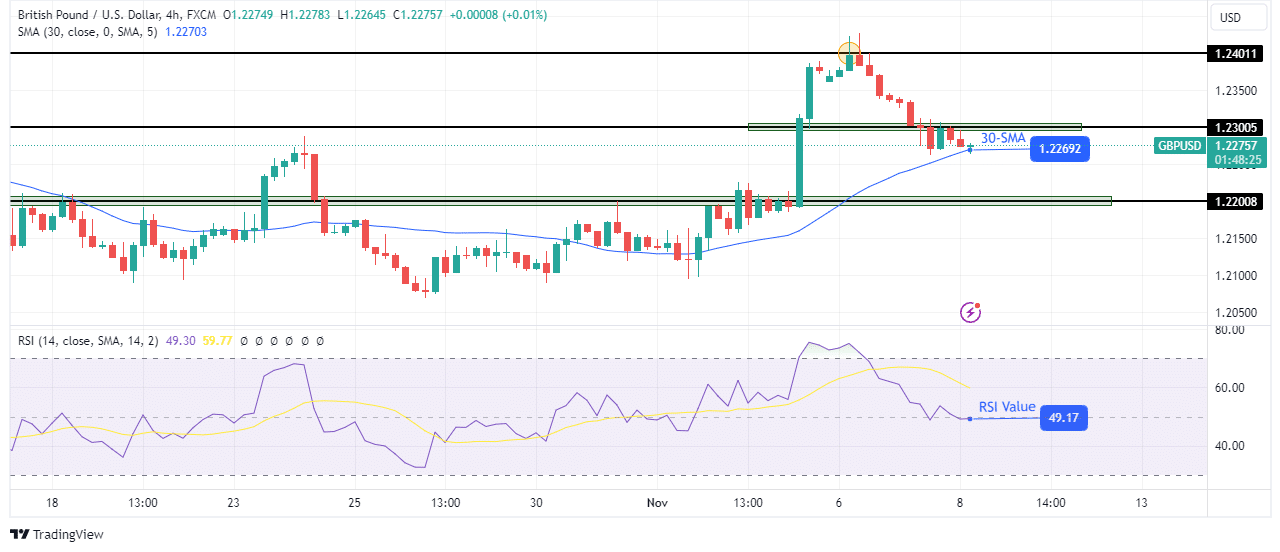

GBP/USD technical forecast: RSI highlights waning bullish momentum.

The pound’s decline from the 1.2401 key level has paused at the 30-SMA support. Similarly, the RSI shows that bulls have lost momentum as it rests on the pivotal 50 mark. 50 is a pivotal level because it separates strength in bulls and bears.

-Are you looking for the best CFD broker? Check our detailed guide-

Therefore, if the RSI stays above 50 and the price above the 30-SMA, there is support for further upside in the pair. However, if it goes below 50 and the price breaks below the SMA, bears will take over. Still, the bullish bias remains, so the price will likely soon break above 1.2300 to retest the 1.2401 resistance level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-forecast-dollar-recovers-after-feds-remarks/