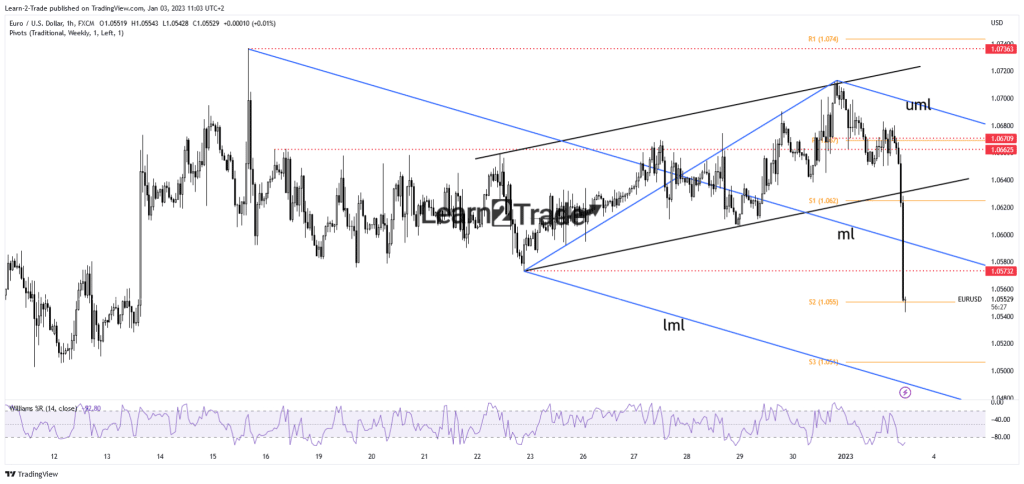

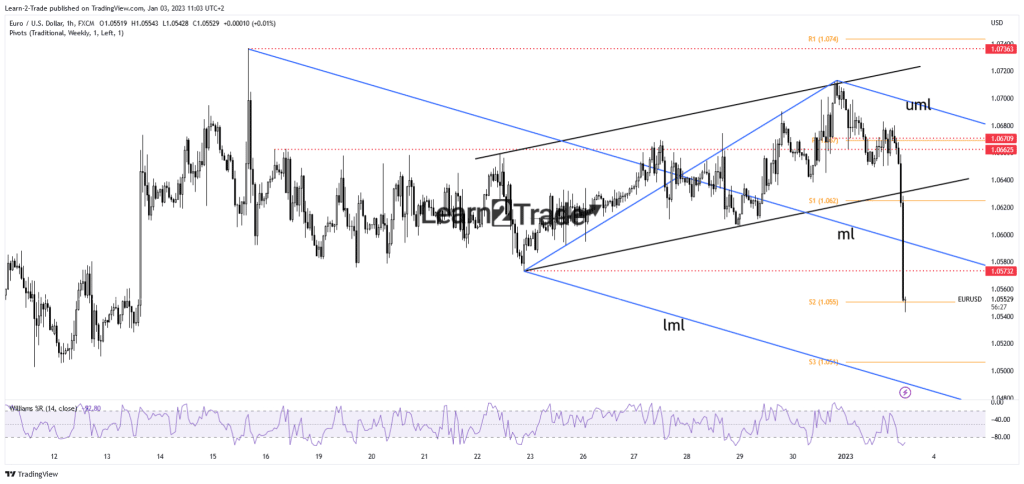

- The EUR/USD pair is strongly bearish as the DXY rallied.

- The lower median line (LML) stands as a potential target.

- After its massive drop, a rebound could be natural.

The EUR/USD price tumbled today, posting lows around 1.0537, far below 1.0683 today’s high. The Dollar Index’s rebound forced the USD to take the lead and dominate the currency market.

–Are you interested to learn more about forex signals? Check our detailed guide-

Fundamentally, the Eurozone data came in mixed yesterday. The Final manufacturing PMI was reported at 47.8 points, matching expectations.

German Final Manufacturing PMI dropped from 47.4 points to 47.1, French Final Manufacturing PMI came in better than expected at 49.2 points compared to the 48.9 points expected, and Italian Manufacturing PMI reported worse than expected data. In contrast, the Spanish Manufacturing PMI came in better than expected.

Earlier today, the German Unemployment Change came in at -13K versus 15K expected, compared to 15K in the previous reporting period. In contrast, German Prelim CPI could also be released, and it’s expected to report a 0.6% drop.

Later, the US data could bring more action on the EUR/USD pair. The Final Manufacturing PMI is expected at 46.2 points, while Construction Spending may report a 0.4% drop versus the 0.3% drop in the previous reporting period.

Tomorrow, the US ISM Manufacturing PMI, JOLTS Job Openings, and the FOMC Meeting Minutes represent high-impact indicators and could shake the markets.

EUR/USD Price Technical Analysis: Trend channel breakout

The EUR/USD pair found strong resistance at the channel’s upside line, and now it has ignored the median line (ML) of the descending pitchfork and the 1.0573 downside obstacles. It’s located above the weekly S1 (1.0550). Staying above it may signal a potential rebound. A throwback could be natural after its massive drop.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The pair may try to come back to retest the broken support level before dropping toward new lows. A valid breakdown below the S2 may announce more declines. The weekly S3 (1.0510) and the lower median line (LML) represent downside targets and obstacles. Still, we cannot exclude a temporary rebound after this massive drop.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-price-under-bearish-pressure-as-new-year-starts/