- In November, US employers expanded their payrolls by 199,000 workers.

- There was an improvement in the US consumer sentiment for December.

- The US central bank will probably maintain rates within the existing 5.25%-5.50% range.

Entering the week, the EUR/USD outlook was bearish, with the euro lingering near the more than three-week low of $1.07235 set on Friday. Meanwhile, the pair experienced a decline on Friday as the dollar surged, fueled by upbeat employment data.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

In November, US employers expanded their payrolls by 199,000 workers, beating economists’ expectations of 180,000. Moreover, the report revealed an unexpected drop in the unemployment rate to 3.7% from October’s 3.9%.

Despite a robust US labor market, traders speculated on Friday that the Federal Reserve could still proceed with a series of interest-rate cuts next year. However, the first reduction could come later than expected, in May. Before Friday’s jobs report, there was a 60% probability rate cuts would start in March. However, the data reduced that to just under 50%, with the first cut now more likely to occur in May.

Meanwhile, another report on Friday indicated a more significant-than-anticipated improvement in US consumer sentiment for December.

Attention now shifts to US inflation data scheduled for Tuesday, with expectations of a continued easing of consumer prices annually. The Fed will announce its policy decision on Wednesday following a two-day meeting. Notably, the US central bank will probably maintain rates within the existing 5.25%-5.50% range.

EUR/USD key events today

Traders do not expect big events today from the Eurozone or the US. As a result, the pair might consolidate ahead of the US inflation report.

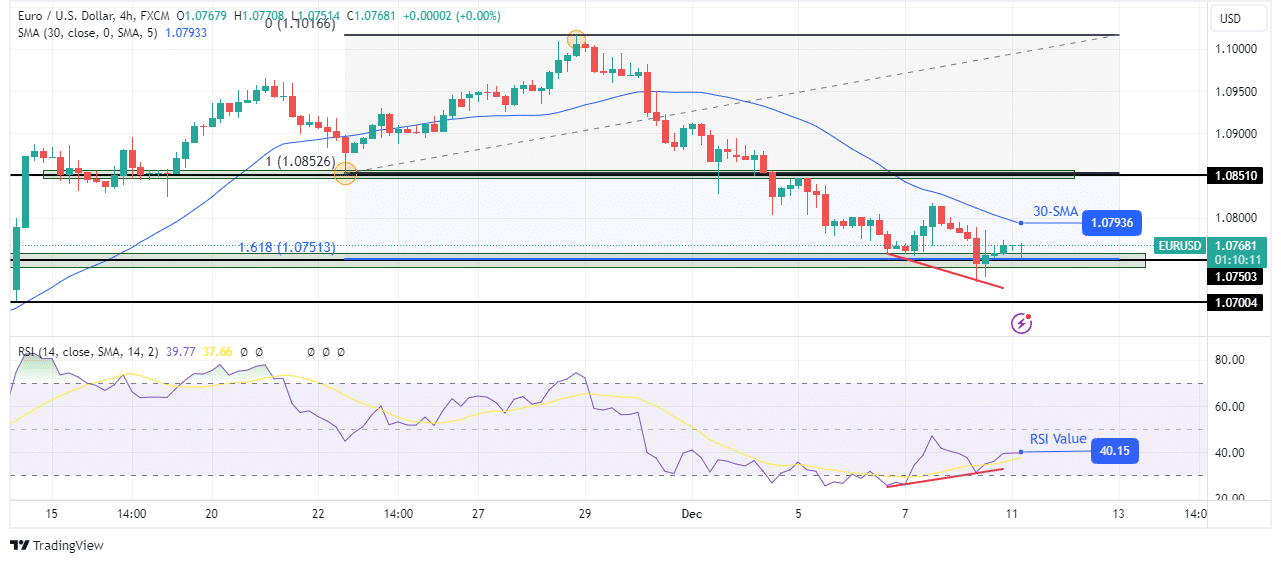

EUR/USD technical outlook: Downtrend pauses at the 1.618 fib extension level

On the charts, Euro bulls have returned after bears got rejected below the 1.0750 key support level. However, the bearish bias remains strong as the price trades below the 30-SMA with the RSI under 50.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Nevertheless, bulls might soon get stronger. The RSI shows a bullish divergence, a sign that bears have weakened at the 1.0750 key level. Moreover, the price has extended to the 1.618 fib level from the previous swing. This big extension might lead to a deep pullback or reversal. The downtrend will only continue if the 30-SMA resistance holds firm.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/11/eur-usd-outlook-euro-hovers-near-three-week-low/