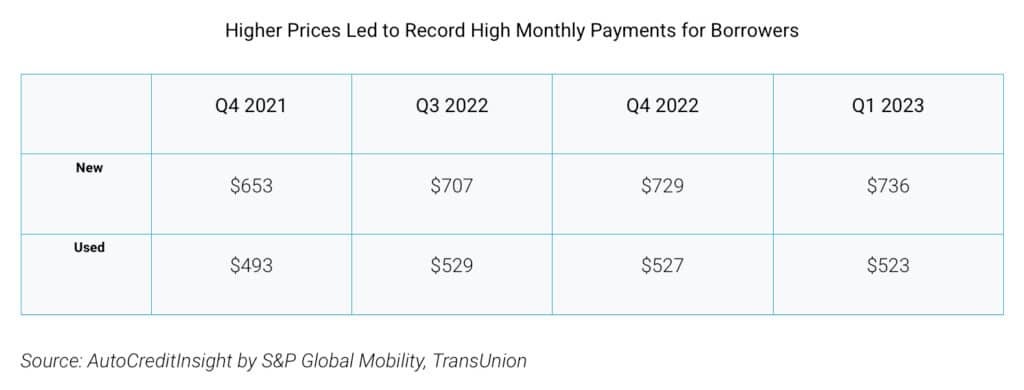

The drop in used car prices is great for current buyers, but it’s putting those who bought vehicles when prices are at record highs in a potential bind — one that could see a jump in loan delinquencies.

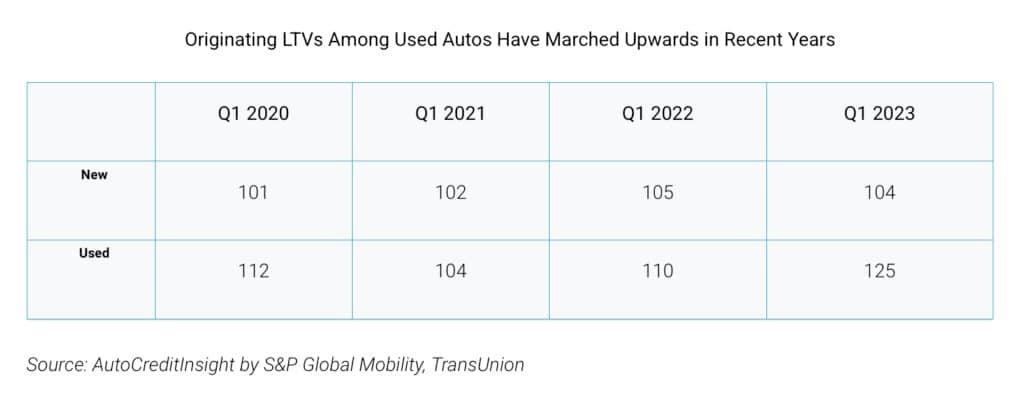

According to a new study from TransUnion and J.D. Power, originating loan-to-value ratios, or LTVs, are on the rise, moving up from 110 in the first quarter of 2022 to an average of 125 this year. The ratio was just 104 in 2020.

LTVs are the difference between the original loan amount and the current market value of the vehicle. Since new vehicle prices have been at or near record highs for about 18 months now, the LTV ratio is headed in the wrong direction.

Lower ratios are indicative of more equity in a vehicle, which can be helpful if the vehicle owner runs into a problem and needs to shed the vehicle. It’s less likely they’ll be underwater, or simply put: owe more than the vehicle is worth.

How did it happen?

The problem wasn’t really a problem for some time as the dearth of new vehicles forced many to buy used vehicles, which saw demand outstripping supply in that segment as well. However, automakers have been resolving their supply chain issues, and production levels are on the rise.

Since more vehicles are being produced, the supply is getting much closer to meeting demand. As that happened, the first change the market saw was a decline in the value of used vehicles. People didn’t need to “settle” for used cars since new ones were now available.

“To a large extent, used vehicle values were elevated as a result of the scarcity brought on by pandemic-related supply chain and inventory issues,” said Satyan Merchant, senior vice president and auto business leader at TransUnion. “As those issues have abated, and inventories have begun to return to more of a normal state, the value of those used vehicles have begun to decline.”

What does it mean?

One might think that the widening of the ratio isn’t a big deal, but it can be. On a large scale, it can be a predictor of higher delinquencies on auto loans, according to the study. A few years ago, when the LTV ratio was 140 or higher LTV at origination and then declined during the next 24 months, the risk of delinquency declined as well.

In fact, among those whose LTVs had dropped to less than 100 by Q4 2022, their risk of 60-plus days past due delinquency was about one-quarter that of a subprime borrower with an LTV that remained at 140 or higher.

The study results ultimately suggest that those who have equity in a vehicle, will try to protect that equity by making the payment. However, when the reverse happens, delinquencies rose.

“Vehicle financing continues to evolve as the market emerges from pandemic-related disruptions. While many lenders and consumers have benefited from elevated vehicle values and lower delinquencies during the pandemic, vehicle values are expected to decline,” said Merchant.

“Given the possibility that accelerated depreciation will result in negative existing LTVs for longer periods, this will be especially important for lenders to monitor. Lenders would be best served to utilize the necessary tools and resources, such as trended and alternative data at underwriting, to successfully optimize each phase of the vehicle financing lifecycle.

“As vehicle prices have risen and overall inflation remains elevated, consumers are increasingly starting in higher-than-average LTV positions to afford used vehicles. It’s more important than ever for consumers to effectively manage their payments to fit within their budgets while also allowing for a cushion for other ongoing expenses like insurance and repairs.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.thedetroitbureau.com/2023/06/declining-value-of-vehicles-portends-new-round-of-delinquencies/