Nowadays, debit card payment processing is an essential part of the payment business. With customers demanding seamless and secure payment options, understanding the basics of debit card processing has become more important than ever.

In this post, we explore the secrets of debit card payment processing and take you on a journey through debit card transaction process flow and latest technologies that are shaping the future of card payments.

Table of contents

Key takeaways

- Debit card payment processing is a complex process involving multiple financial institutions.

- Businesses must be aware of the different fees associated with debit card payments processing ( interchange fees and markup fees).

- There are a nimber of various payment technologies, such as EMV chip cards, contactless payments, and mobile wallets to process debit card payments.

What is the difference between debit and credit cards?

A debit card is a type of payment card that debits payments directly from the consumer’s current account instead of taking out a loan from a bank or card issuer. Debit cards are similar in convenience to credit cards, but also offer many of the same consumer protections, especially when issued by well-known payment service providers such as Visa or Mastercard.

A credit card, usually issued by a financial institution such as a bank, allows the cardholder to borrow funds from the institution. By using the card, the cardholder commits to repaying the borrowed money along with interest, as per the terms set by the institution.

Payment Processing Software

Become a Payment Service Provider faster with SDK.finance software

Unlike debit cards, where transactions are deducted directly from the available balance, credit card users must repay the borrowed amount by a certain due date. If the full amount is not repaid on time, interest may be charged on the remaining balance.

Below we highlight the key differences between credit and debit cards:

| Feature | Debit cards | Credit cards |

| Source of funds | Directly linked to the user’s bank account | Credit extended by the card issuer |

| Spending limit | Limited to the available funds in the linked bank account | Predetermined credit limit |

| Transaction process | Immediate process of the purchase amount from the bank account | Borrowed money that must be repaid by the due date |

| Interest charges | Typically interest-free | Incurs interest if the balance is not paid |

| Building credit | Does not directly impact credit score | Can positively impact credit score if used responsibly |

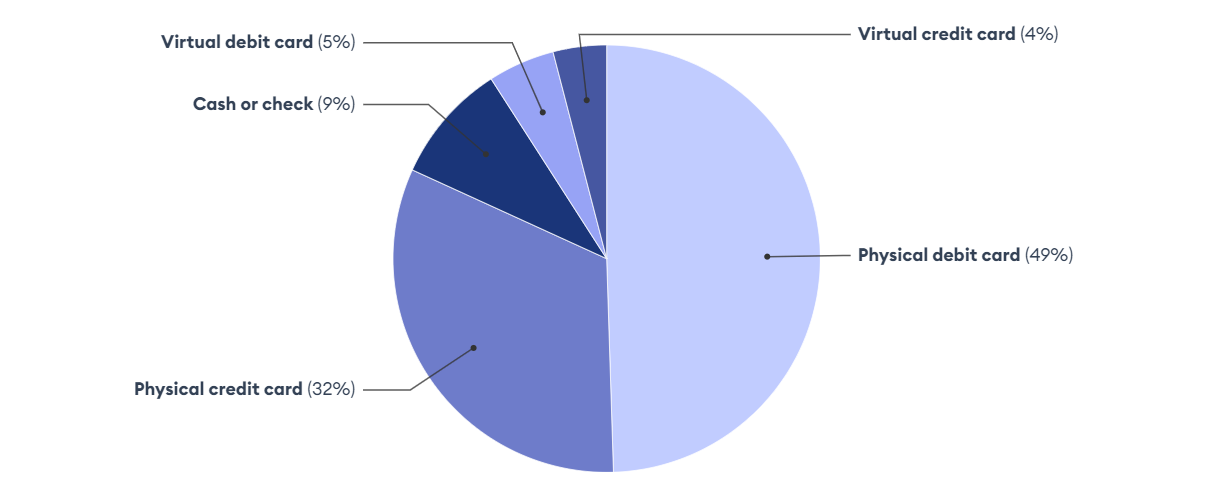

Debit and credit cards are the most commonly used payment methods, with 54% of consumers using a physical or virtual debit card and 36% of consumers using a physical or virtual credit card.

Statistics on preferred method of card payments

Source: Forbes Advisor Survey

Having compared the features of debit and credit cards, we now turn to the practical mechanics of debit cards. Understanding how these payment instruments work in real-time transactions is a key step for payment processing businesses.

How does a debit card transaction work?

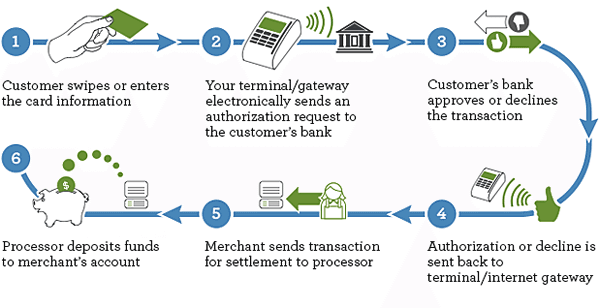

At its core, debit card payment processing encompasses the behind-the-scenes procedures necessary for a business owner to accept debit cards from their customers. However, from the perspective of the payment system, this is a complex process involving several steps:

- Customer initiation: the customer presents their debit card as the chosen method of payment for a transaction.

- Card interaction: the card is either dipped, tapped, or swiped using a card terminal device at the point of sale.

- Data transmission: your POS system captures the card information and transmits this data to the customer’s card processing network (such as Visa or MasterCard).

- Verification and fraud evaluation: the card processing network verifies the transmitted data for accepting debit card payments.

- Communication with the issuing bank: the processing network forwards the data to the issuing bank, which is the bank that issued the customer’s debit card.

- Funds confirmation: the issuing bank confirms the online debit card transactions and sends an approval signal back to the merchant or business owner.

Debit card transaction process flow

Source: Research Gate

Types of debit card transactions

Debit card transactions can be divided into three categories: PIN-based, signature-based and contactless/mobile payments. Each type of debit card transaction offers unique features and benefits that cater to different customer preferences and security requirements.

PIN-based transactions

PIN-based transactions require the customer to enter a personal identification number for verification. This type of transaction is considered more secure than signature-based transactions because the customer must enter a unique and confidential PIN to confirm their identity.

The use of a PIN introduces an additional layer of security to debit card payment processing that makes unauthorized access to the customer’s account more difficult.

Signature-based transactions

Signature-based transactions, on the other hand, are processed via credit card networks and require the customer’s signature for authorization. The transaction is processed like a credit transaction and the customer does not have to enter a PIN number. Instead, they must provide a signature to authorize the transaction.

While this method is less secure than PIN-based transactions, it provides a more convenient payment alternative for customers who do not wish to use a PIN.

Contactless and mobile payments

Contactless and mobile payments use Near Field Communication (NFC) technology to enable quick and convenient transactions without physical contact. Customers can simply tap their card or mobile device on a compatible terminal to initiate a transaction. This technology provides an added level of convenience and security, as customers do not need to enter a PIN or provide a signature, processing debit card payments.

Examples of contactless payment methods include Apple Pay, Google Pay, and Samsung Pay.

White-label money transfer software

Develop a P2P payment or remittance app on top of SDK.finance Platform

Debit card payments processing fees

If you are going to start a payment processing business it is essential to understand debit card payments processing fees. It is a complex process as transaction fees include interchange fees and payment processor markups and can vary depending on transaction size and merchant category.

Interchange fees

Interchange fees are set by card networks and are paid to the issuing bank for each transaction. These fees are determined by a variety of factors, including:

- the type of transaction

- card type

- transaction type

- merchant category

For effective management of payment processing costs, businesses need to comprehend how interchange fees are calculated.

Payment processor markups

Payment processor markups are additional fees charged by payment processors for debit card online payment processing. These markups are typically shared among the parties involved in processing the transactions, including the payment processor and acquiring bank. Furthermore, the markup fees are usually negotiable and can differ from one processor to another.

Comprehending payment processor markups empowers businesses to negotiate better rates and save on their debit card processing fees.

Debit card payment processing technologies

As technology continues to evolve, so do the payment methods available for debit card transactions. Today, businesses can choose from various payment technologies, such as EMV chip cards, contactless payments, and mobile wallets to process debit card payments.

EMV technology

EMV (Europay, Mastercard, Visa) technology enhances security by using embedded chips in debit cards. These chips generate unique codes for each transaction, reducing the risk of fraud compared to traditional magnetic stripe cards.

Contactless payments

Near Field Communication (NFC) technology allows for contactless payments, where customers can simply tap their debit cards on a compatible terminal. This method enhances speed and convenience.

Mobile wallets

Debit cards can be integrated into mobile wallet applications like Apple Pay, Google Pay, or Samsung Pay. Users can make payments by tapping their smartphones or smartwatches at compatible terminals.

Advanced architecture

Three cutting-edge architectures crafted to enhance secure mobile payments include:

- Encryption and tokenization used to replace sensitive card information with a unique token. In the event of a data breach, the token is useless to hackers, enhancing the security of debit card processing.

- Cloud-based point-of-sale systems that help to centralize data storage and processing.

- Secure element systems offer a dedicated, tamper-resistant environment for storing sensitive information.

Adoption of these technologies reinforces the security infrastructure, ensuring that debit card transactions remain at the forefront of efficiency, speed, and safety.

SDK.finance payment processing software

SDK.finance payment processing software serves as a scalable foundation for building PayTech products. You can start providing your payment services without having to build your system from scratch.

Our FinTech Platform provides a complete stack of debit card payments processing services for merchants, allowing them to accept payments, from online to POS and QR payments.

Benefits of SDK.finance payment processing software

- Faster time-to-market

Our pre-developed system is a shortcut for becoming a payment service provider, without having to start software development from scratch.

- Streamlined integrations

With 400+ API endpoints you can seamlessly connect with a wide range of payment providers and services for efficient and cost-effective debit card processing.

- Flexible delivery

You can choose an affordable hybrid-cloud SaaS model or an on-premise source code version for full control and independence.

Our FinTech Platform equips merchants with a comprehensive suite of debit card payments processing services, enabling seamless acceptance of payments across various channels, from online to offline transactions.

Wrapping up

Debit card payment processing plays a vital role in modern business, providing a convenient and secure payment method for customers. By understanding the various aspects of debit card processing, businesses can offer their customers a seamless and secure payment experience. As technology continues to evolve, adapting to new payment methods will help payment companies thrive in the ever-changing world of FinTech business.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://sdk.finance/debit-card-payments-processing-the-payment-flow-fees-and-technologies/