Celebrating 7 Years of Regulation Crowdfunding: 4100 Startups Now Valued at $60 Billion

Crowdfund Capital Advisors | Sherwood Neiss | May 16, 2023

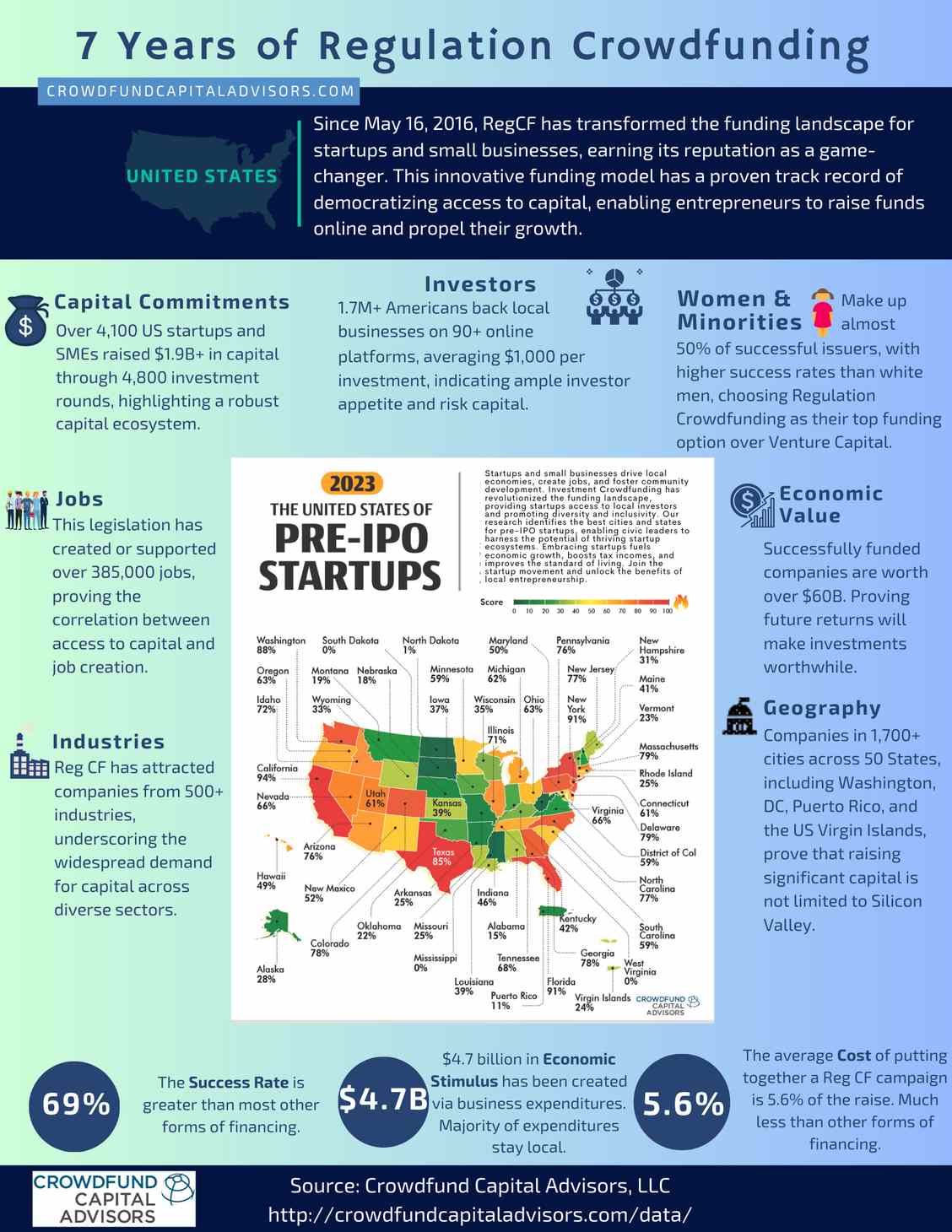

Image: Crowdfund Capital Advisors

Today marks a significant milestone as we celebrate the 7th anniversary of Regulation Crowdfunding (Reg CF).

Regulation Crowdfunding (Reg CF) has become successful for several reasons:

- Democratization of Investment: Reg CF has significantly democratized access to capital, enabling individuals to invest in the companies they believe in. This democratization has diversified the investor pool and allowed people who might not otherwise have access to investment opportunities to participate in the financial growth of startups and small businesses.

- Promotion of Diversity and Inclusivity: Reg CF has promoted diversity and inclusivity in the entrepreneurial ecosystem. With up to 50% of the capital going to companies with at least one woman or minority founder, this type of funding is opening the doors for underrepresented groups in business.

- Job Creation: Reg CF has proven to be a significant job creator. It has been instrumental in creating or supporting over 380,000 jobs, thereby becoming an important factor in driving local economies.

See: Equity Crowdfunding Demystified: Insights from Wefunder and Equivesto

As for the impact of Regulation Crowdfunding:

- Economic Impact: To date, $1.8 billion has been invested by 1.7 million investors into over 4,100 startups and small businesses across 1,700 cities in the USA. Moreover, it has contributed approximately $4.7 billion to the overall economy through salaries, inventory, rent, professional services, and various operational expenses.

- Wealth Creation: Companies that have raised funds via Reg CF are now valued at over $60 billion, indicating that average American investors have the potential to realize substantial wealth. This democratizes wealth creation, providing an opportunity for everyday Americans to partake in the financial success of early-stage companies.

- Promotion of Entrepreneurship: By unleashing the entrepreneurial spirit of America, Reg CF has generated jobs and fostered economic growth, becoming a powerful force in supporting local businesses and driving economic prosperity.

Overall, Regulation Crowdfunding has had a significant impact on the US economy and society by democratizing capital, creating wealth, generating jobs, and boosting local economies. Its future potential remains robust, with more opportunities expected to arise for individuals to participate in this transformative investment landscape.

See: CCA 2022 Investment Crowdfunding Report: 7 Charts Highlight Growth and Impact

Sherwood Neiss, Principal at Crowdfund Capital Advisor:

Regulation Crowdfunding has unlocked an unprecedented opportunity for everyday Americans to invest in early-stage companies and participate in the creation of wealth. It has brought about a level playing field, something that the private capital markets have not been able to accomplish until Reg CF became a reality.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://ncfacanada.org/celebrating-7-years-of-regulation-crowdfunding-4100-startups-now-valued-at-60-billion/