Report | Jan 18, 2024

Image: CCAF and WEF, 2024 Future of Global Fintech Report

Image: CCAF and WEF, 2024 Future of Global Fintech Report2024 Fintech Report: Resilience, Regulation, and Inclusive Growth

The 2024 Global Fintech Report – Towards Resilience and Inclusive Growth, a collaboration between the World Economic Forum and the Cambridge Centre for Alternative Finance, unveiled at Davos 2024 pivotal insights into the fintech industry’s trajectory, marked by resilience, innovation, and transformative growth. This comprehensive analysis, based on a survey of 227 fintech firms, offers a key look into consumer trends, regulatory dynamics, and technological advancements shaping the future of financial technology.

Key Insights:

Resilient Customer Growth

The fintech sector has shown continued growth in the post-COVID era, with an average customer growth rate exceeding 50% across all business models surveyed with insurtech leading the pack at 66% (2021-2022). Custromer growth exceeded 50% across all regions (2021-2022) except SSA (Sub-Saharan Africa). The top 3 sources for acquiring customers was through social media (70%), referrals (68%), and website (65%).

See: Chatham House: Global Digital Platform Regulation Insights

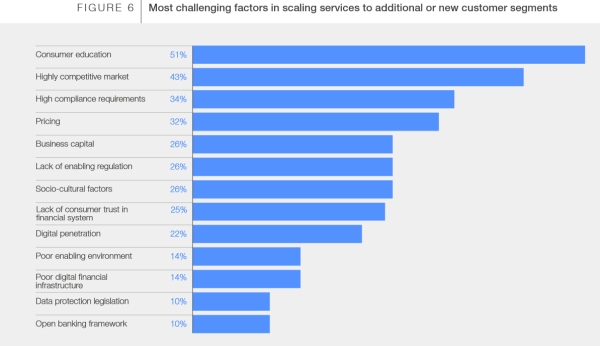

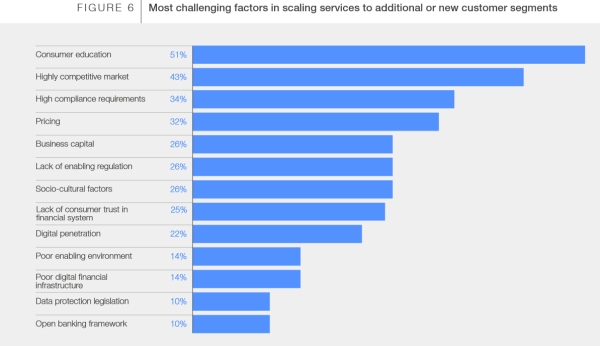

The top challenges faced when trying to scale customer demand to new customer segments were customer education (51%), competition (43%), and compliance and regulation (34%) – see table below. This robust expansion highlights the sector’s resilience and the accelerating global shift towards digital financial services.

CCAF and WEF 2024 Global fintech report challenges in scaling customer growth

CCAF and WEF 2024 Global fintech report challenges in scaling customer growthRegulatory Environment Is A Double-Edged Sword

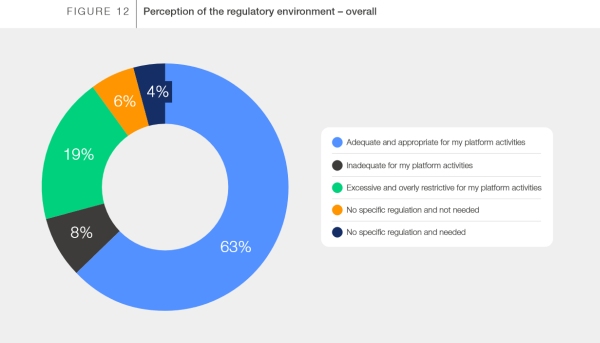

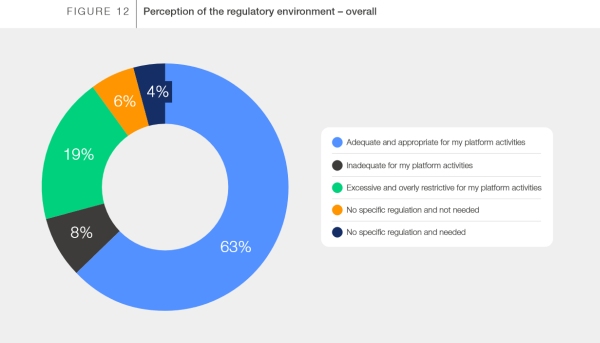

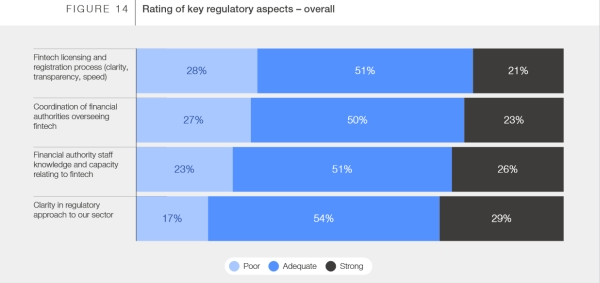

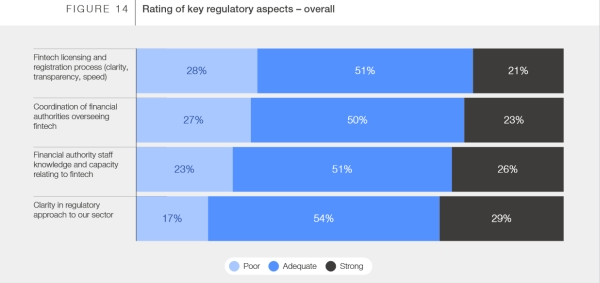

While 63% of fintechs view their regulatory environment as adequate, challenges persist in compliance, licensing, and registration processes. The report emphasizes the necessity of regulatory frameworks that balance innovation encouragement with consumer protection.

CCAF and WEF 2024 Global fintech report perceptions of regulatory environment

CCAF and WEF 2024 Global fintech report perceptions of regulatory environmentOverall, the greatest challenges faced by fintechs were in licensing, registration, and authority coordination. These areas received the most negative ratings, particularly in emerging markets and developing economies (EMDEs), where licensing posed a significant challenge. Additionally, fintechs critical of an ‘excessive and overly restrictive’ regulatory environment generally gave lower ratings across all regulatory aspects.

CCAF and WEF 2024 Global fintech report ratings of key regulatory aspects

CCAF and WEF 2024 Global fintech report ratings of key regulatory aspectsTech Advancements at the Forefront

Artificial Intelligence (AI) is earmarked as a game-changer for the fintech industry, with 70% of surveyed firms acknowledging its significance in shaping the industry’s next five years. This highlights the crucial role of technology in driving future fintech developments.

See: IMF Issues Warning on AI’s Impact on Global Jobs

Financial Inclusion and Underserved Markets

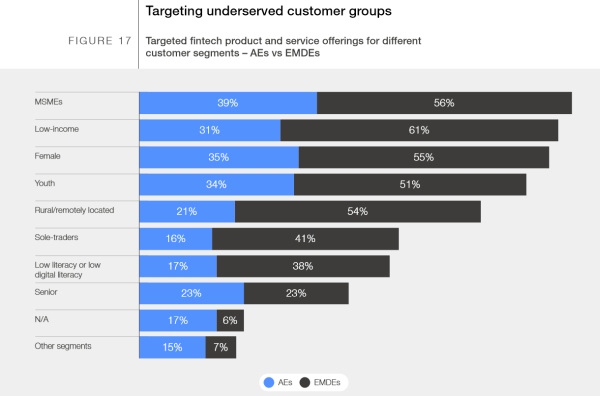

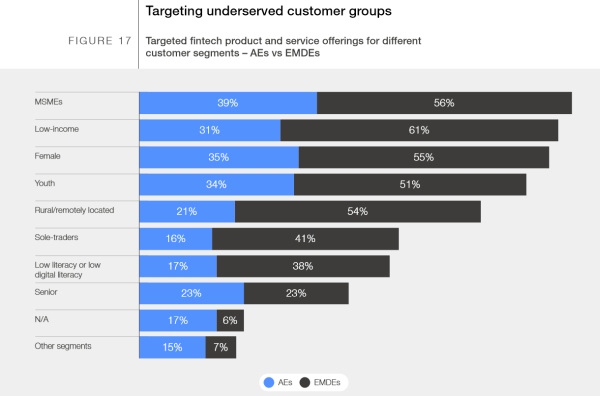

Fintechs are increasingly focusing on underserved segments, promoting financial inclusion. The report notes a significant portion of fintechs in emerging markets are dedicated to providing services to these groups, addressing key societal issues like gender disparity and sustainability.

CCAF and WEF 2024 Global fintech report fintechs targeting underserved groups

CCAF and WEF 2024 Global fintech report fintechs targeting underserved groupsTraditional banks have historically focused on lending to specific customer segments, mainly those with a formal financial history and living in urban areas. This approach has often excluded low-income individuals, particularly in Emerging Markets and Developing Economies (EMDEs), from accessing essential financial services and products.

Fintechs, leveraging digital technology and mobile phone adoption, have significantly widened the availability and affordability of financial services. They hold the potential to reach the further 1.4 billion unbanked and many more underbanked people globally.

Fintechs are increasingly serving traditionally underserved groups, including women, low-income individuals, and rural or remotely located customers. These segments represent a substantial portion of fintech customer bases globally, averaging 39% for female customers, 40% for low-income, and 27% for rural or remotely-located customers. This approach contributes significantly to the growth of their customer bases.

See: BoC: Redefining Financial Inclusion for CBDCs

These underserved segments also contribute notably to fintechs’ total transaction values, with 39% from female, 26% from low-income, and 31% from rural or remote customers. This trend is consistent across Advanced Economies (AEs) and EMDEs, with some disparities. For instance, AEs report a higher proportion of female customers, while EMDE fintechs serve more low-income and rural customers.

Through product and service offerings, fintechs are also contributing to environmental sustainability

The United Nations Secretary-General’s task force on digital finance has identified fintech companies as key players in accelerating the financing of the Sustainable Development Goals (SDGs). Adopted by the UN in 2015, the SDGs aim to address poverty and other social issues. Fintechs are increasingly incorporating the UN SDGs into their business strategies, becoming agents for catalyzing sustainable finance and fostering a green, inclusive economy.

CCAF and WEF 2024 Global fintech report SDG links, AEs vs EMDEs

CCAF and WEF 2024 Global fintech report SDG links, AEs vs EMDEsClosing

The findings of the 2024 Global Fintech Report highlights the sector’s resilience and growth potential and also underscores the critical role of consumer demand, regulatory frameworks, and technological innovation in shaping an inclusive and sustainable financial landscape. Fintechs are not just transforming the financial sector; they are playing a crucial role in promoting financial inclusion.

See: Sustainability: A Must for Fintech Growth

By targeting underserved segments, they are helping bridge the gap left by traditional banking services, offering a more equitable and environmentally sustainable financial landscape. This inclusive approach is essential for building a more financially empowered global population, particularly in regions with significant unbanked and underbanked communities. Fintechs’ focus on inclusion is a vital step towards a more inclusive and equitable global financial ecosystem.economy.

Download the 47 page PDF report –> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/ccaf-and-wef-unveil-2024-global-fintech-report-at-davos/