You probably couldn’t pick Kazakhstan out on a map—even though it’s the ninth-largest country in the world.

But Kazakhstan is a superpower in its own right.

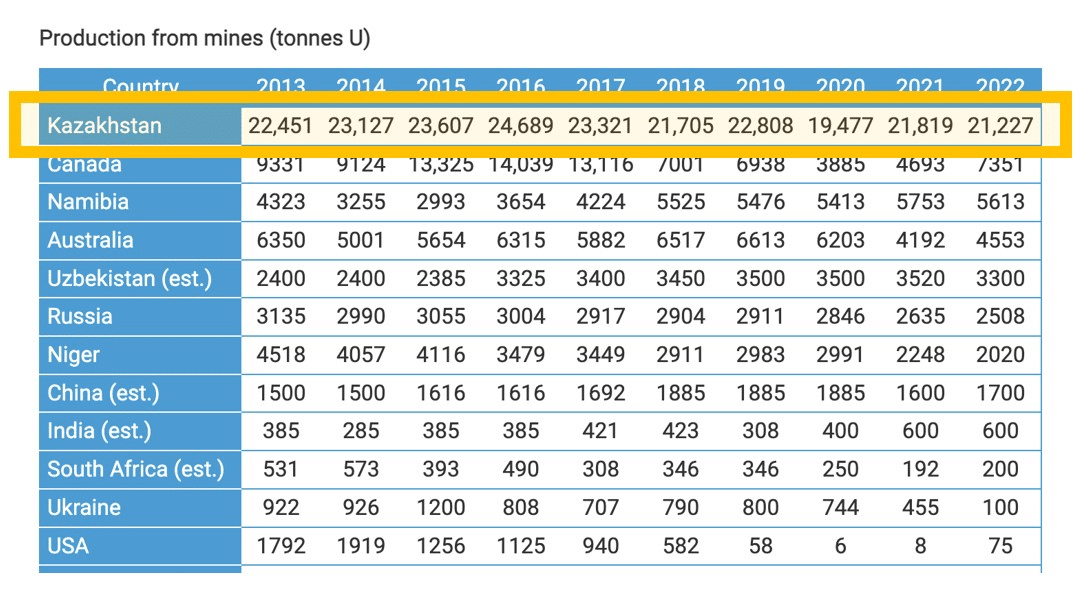

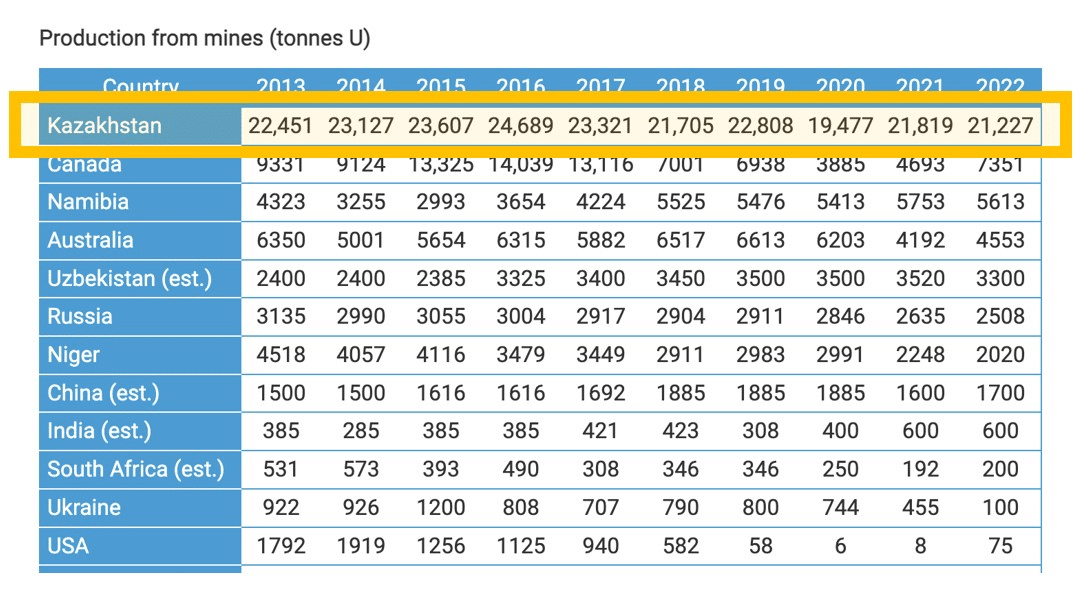

This little-known former Soviet state hosts seven of the twelve largest producing uranium deposits in the world.

Kazakhstan, using American technology, went from producing 1 million pounds annually to over 46 million pounds annually in 20 years and becoming the world’s largest producer of uranium.

In 2022, it was the top uranium producer, mining 43% of the world’s uranium at 46.8 million pounds. To put that in context: Kazakhstan produced more uranium than the next four countries combined.

The renewed proliferation of nuclear power around the world has made Kazakhstan a hot commodity.

Only it hasn’t controlled its own uranium destiny.

Kazakhstan needed two crucial things to be able to secure a pathway to monetization of its uranium riches:

- uranium refinement and enrichment infrastructure, and

- trade agreements to access uranium sales to utilities around the world

Russia took quick advantage of Kazakhstan’s plight, providing both trade routes and uranium processing infrastructure. Certain companies in the west, like Cameco, took advantage also, which we will get to later.

- For the last three decades, one-third of global uranium supply has been under the control of Rosatom, the state-owned Russian company created under the Russian President, Vladimir Putin’s watch.

But this is now changing in real time…

Russia has tried to implement a different kind of nuclear warfare: control over the energy security of the United States.

You see, Rosatom provides nearly one-third of the enrichment services and one-fifth of the uranium for U.S. nuclear power plants.

“Currently, we’re reliant on Russia for nuclear fuel.”

– former ExIm Bank Advisor Rich Powell

What does that mean?

1 in every 10 homes in America is powered by Russian enriched uranium.

Russia has repeatedly demonstrated its willingness to use that reliance as leverage—as when it threatened to cut off nuclear fuel access in 2014, or when it did cut off natural gas supplies to Europe in 2022.

That alone is a grave national security threat to the U.S. But it gets worse…

The uranium that Russia doesn’t have direct control over is rapidly coming under the domain of another country—one that is even more likely to use it as a weapon, China.

Never Wake a Sleeping Giant

In the last decade, China has increased its nuclear power generation by 400%. And they’re somehow still accelerating their nuclear buildout.

Currently, one-third of global nuclear reactors under construction in the world are in China.

And they’re planning to build at least 100 more.

It’s all part of a plan to become the largest producer of nuclear power in the world in just seven years.

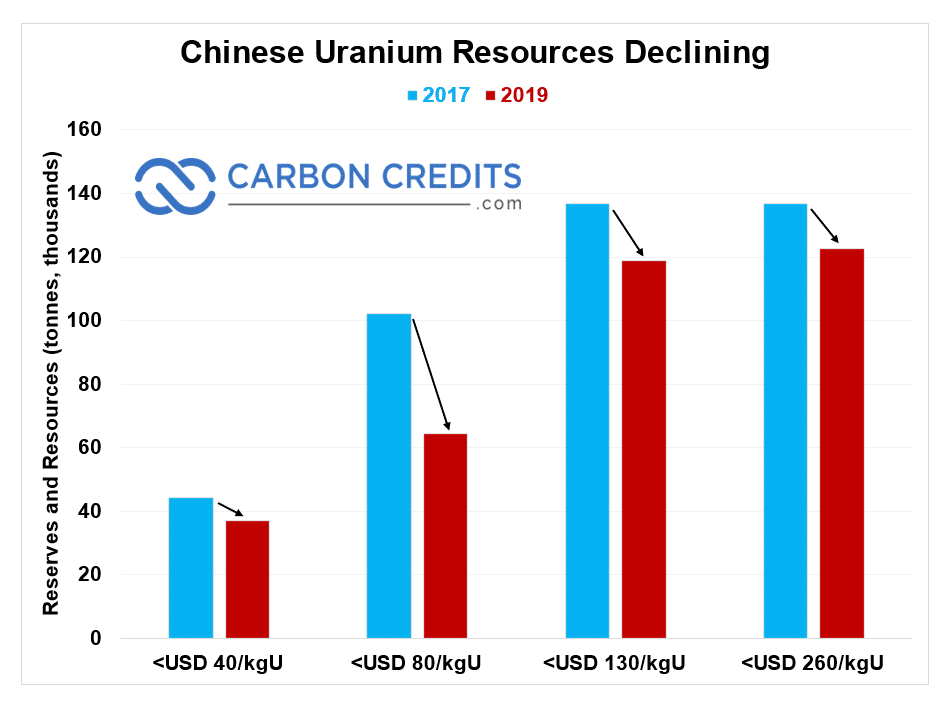

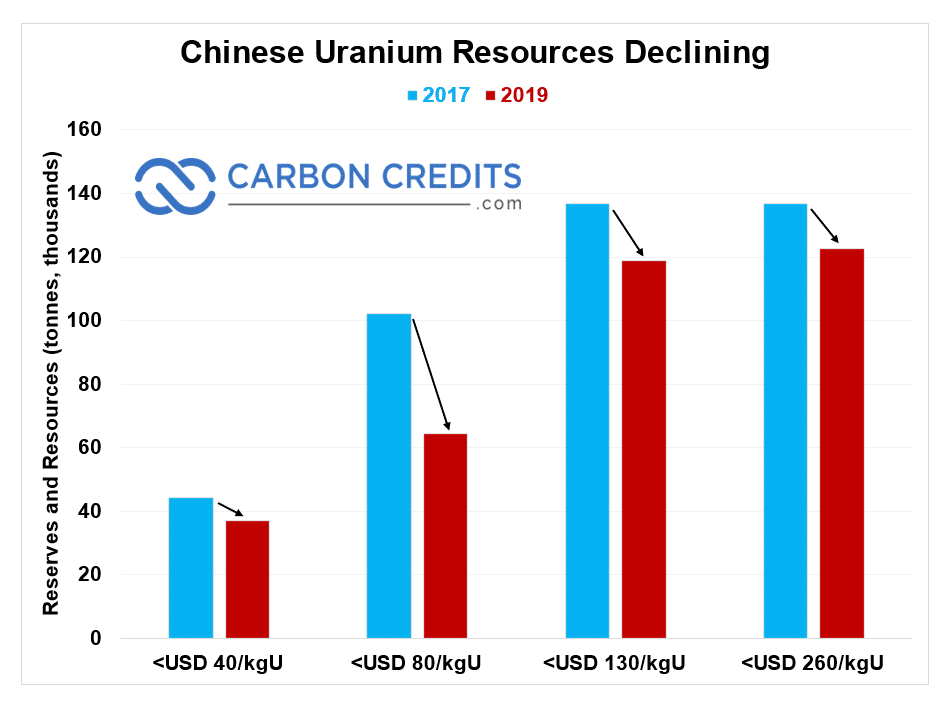

But China has struggled to produce the uranium required to fuel those reactors. In 2023, it’s expected to mine just 15% of its domestic uranium demand.

And its uranium resources are rapidly shrinking.

At the current rate of decline, China’s entire uranium resources at any price point will last less than a decade. And that’s if it builds zero new reactors.

China is well aware that to secure its economic growth it must be able to secure lower cost clean base load energy.

Has America lost its Nuclear Advantage?

- The U.S. could power about four of its nuclear reactors with domestic uranium production.

The other 92 require imported uranium.

From where? Mother Russia.

In 2021, 54% of U.S. uranium purchases came from Russia or former Soviet states (Kazakhstan and Uzbekistan).

The U.S. can’t buy more from Canada and Australia, the other two main producers as those nation producers have sold and hedged their production in long term contracts.

China has bought the dragon’s share of uranium in every other major producing country.

Here’s the bottom line…

- If the U.S. does not immediately build a domestic uranium industry,

Russia and China could easily destroy the United States’ secure supply of nuclear power.

U.S. leadership, including Trump, Biden, Congress, and the Secretary of Energy, recognizes the danger this presents.

Energy Secretary Dan Brouillette says that the current state of uranium production “threatens our national interest and our national security.”

So last year, a bill was introduced in the House and Senate: the National Opportunity to Restore Uranium Supply Services In America Act of 2022.

In case you missed the acronym, the bipartisan message is loud and clear: NO RUSSIA. Russia’s influence will be expelled from the U.S. uranium market.

Almost 30 years to the day that the Russian US HEU agreement was inked in Washington DC, Senator Joe Manchin introduced Bill S.452 on February 2, 2023.

If passed in Senate, it would require the Secretary of Energy to establish a Nuclear Fuel Security Program.

The bill passed the House and is expected to pass the Senate then requires president’s signature.

The U.S. government has officially reset the domestic uranium industry. And with that, power 91 nuclear power reactors that in total require over 50 million pounds of uranium to run rain or shine, day or night and supply its military nuclear fuel needs.

We have found a “value investors dream”.

This company we are highlighting in the report below has in the past valued the portfolio at almost a $1 Billion valuation.

Today, the company enterprise value (Market price minus cash and equitable securities) can be obtained for less than $30 Million.

Yet, just one of its assets, a uranium asset in the highest grade producing region in the world would be valued at $75 Million using a comparable peer valuation based on the $600 per hectare valuation the bankers just valued a large three way merger in the same mining district.

This is rare, unique and how one goes about value investing in the Energy Transition by finding discount to current value with considerable value in low risk jurisdictions that will benefit from Americas Nuclear Renaissance and Energy Transition.

Click here for a full report on the company.

Never bet against America, but rather benefit from America’s greatness.

Regards,

The www.carboncredits.com Team

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/breaking-the-us-house-passed-a-bill-that-just-repatriated-the-nuclear-cycle-from-russias-control/